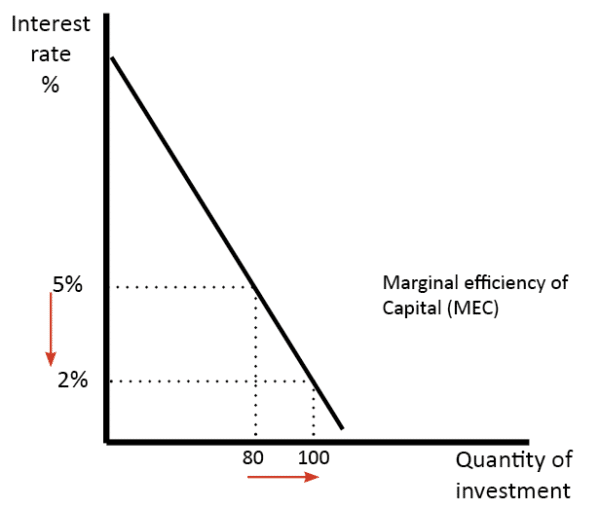

For manufacturing investment, the real interest rate is important for determining the viability of investment. Lower interest rates make it cheaper to borrow. Therefore lower interest rates tend to encourage business investment. High real interest rates discourage investment.

How interest rates affect the efficiency of investment

- At lower interest rates, the marginal efficiency of capital increases. This means when it is cheaper to borrow – more investment projects are likely to give a return greater than the cost of debt interest payments.

- Also, high interest rates may encourage firms to save cash rather than invest, as they can make a good return from just putting money in a bank. At lower interest rates, firms have less incentive to save.

- A fall in interest rates may also cause a depreciation in the exchange rate. A fall in the exchange rate will make exports more competitive and will boost demand for exporters.

- Interest rates also determine the level of economic activity in the economy. Higher rates discourage borrowing and encourage saving. Therefore, in countries with high-interest rates, consumption and investment tend to be lower. This could reduce domestic demand for your manufactured goods.

Evaluation of the importance of interest rates for business

A fall in interest rates may not necessarily be good for industry.

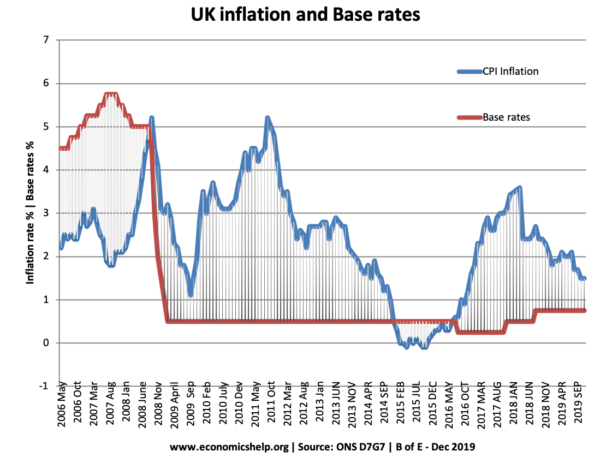

In 2008 Base rates cut to 0.5% but economic growth was very low

- If the economy is in recession. Demand will be low and firms may still go out of business

- If banks are short of funds so they will be reluctant to lend – even if base rates are low

The Real Interest Rate

The real interest rate is the Nominal Base rate – inflation. If the official Interest Rate is 7% and inflation is 5%. It means savings would increase in value by 2%. The real interest rate is important for many reasons.

- Reflects the cost of borrowing. A higher real interest rate increases the cost of borrowing and makes investment less profitable. (This is not an issue if the finance is raised in the UK) However, if it is necessary to borrow in a particular country the real interest rate is very important for determining the profitability of investment.

Negative Interest Rates

If a country has a negative real interest rate, I would see this as a warning signal. If inflation is higher than interest rates it will cause various problems.

- Depreciating exchange rate.

- Declining value of savings.

- Capital Flight. People will seek to invest abroad where the real value of their money/savings can be maintained.

- An economy with a negative real interest rate suggests that inflation is higher than the government can cope. Negative interest rates will only make inflation worse.

In the long term, negative interest rates will cause slower growth and therefore less demand for manufactured goods.

Related

1 thought on “Impact of Interest Rates on Industry”

Comments are closed.