A look at the arguments for and against privatisation.

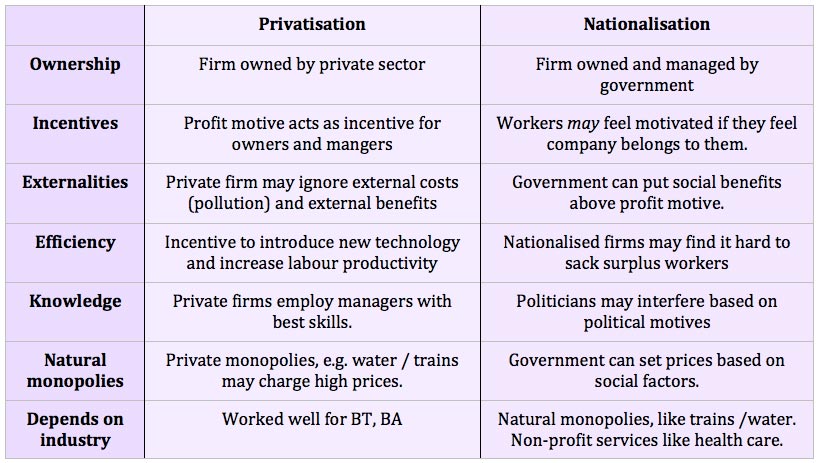

Privatisation involves selling state-owned assets to the private sector. It is argued the private sector tends to run a business more efficiently because of the profit motive. However, critics argue private firms can exploit their monopoly power and ignore wider social costs. Privatisation is often achieved through listing the new private company on the stock market. In the 1980s and 1990s, the UK privatised many previously state-owned industries such as BP, BT, British Airways, electricity companies, gas companies and rail network.

Arguments for and against privatisation

Potential benefits of privatisation

1. Improved efficiency

The main argument for privatisation is that private companies have a profit incentive to cut costs and be more efficient. If you work for a government run industry managers do not usually share in any profits. However, a private firm is interested in making a profit, and so it is more likely to cut costs and be efficient. Since privatisation, companies such as BT, and British Airways have shown degrees of improved efficiency and higher profitability.

2. Lack of political interference

It is argued governments make poor economic managers. They are motivated by political pressures rather than sound economic and business sense. For example, a state enterprise may employ surplus workers which is inefficient. The government may be reluctant to get rid of the workers because of the negative publicity involved in job losses. Therefore, state-owned enterprises often employ too many workers increasing inefficiency.

3. Short term view

A government many think only in terms of the next election. Therefore, they may be unwilling to invest in infrastructure improvements which will benefit the firm in the long term because they are more concerned about projects that give a benefit before the election. It is easier to cut public sector investment than frontline services like healthcare.

4. Shareholders

It is argued that a private firm has pressure from shareholders to perform efficiently. If the firm is inefficient then the firm could be subject to a takeover. A state-owned firm doesn’t have this pressure and so it is easier for them to be inefficient.

5. Increased competition

Often privatisation of state-owned monopolies occurs alongside deregulation – i.e. policies to allow more firms to enter the industry and increase the competitiveness of the market. It is this increase in competition that can be the greatest spur to improvements in efficiency. For example, there is now more competition in telecoms and the distribution of gas and electricity.

- However, privatisation doesn’t necessarily increase competition; it depends on the nature of the market. E.g. there is no competition in tap water because it is a natural monopoly. There is also very little competition within the rail industry.

6. Government will raise revenue from the sale

Selling state-owned assets to the private sector raised significant sums for the UK government in the 1980s. However, this is a one-off benefit. It also means we lose out on future dividends from the profits of public companies.

Disadvantages of privatisation

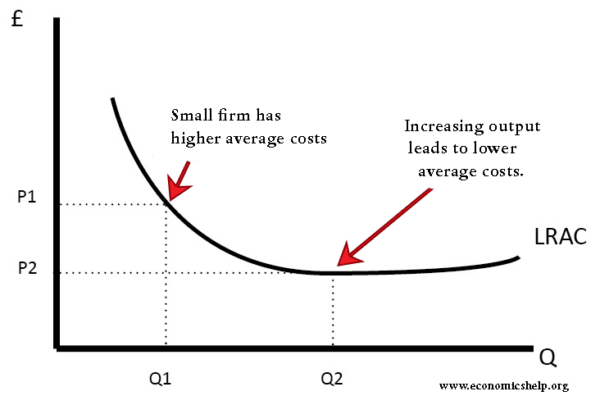

1. Natural monopoly

A natural monopoly occurs when the most efficient number of firms in an industry is one. For example, tap water has very high fixed costs. Therefore there is no scope for having competition among several firms. Therefore, in this case, privatisation would just create a private monopoly which might seek to set higher prices which exploit consumers. Therefore it is better to have a public monopoly rather than a private monopoly which can exploit the consumer.

2. Public interest

There are many industries which perform an important public service, e.g., health care, education and public transport. In these industries, the profit motive shouldn’t be the primary objective of firms and the industry. For example, in the case of health care, it is feared privatising health care would mean a greater priority is given to profit rather than patient care. Also, in an industry like health care, arguably we don’t need a profit motive to improve standards. When doctors treat patients, they are unlikely to try harder if they get a bonus.

3. Government loses out on potential dividends.

Many of the privatised companies in the UK are quite profitable. This means the government misses out on their dividends, instead going to wealthy shareholders.

4. Problem of regulating private monopolies.

Privatisation creates private monopolies, such as water companies and rail companies. These need regulating to prevent abuse of monopoly power. Therefore, there is still a need for government regulation, similar to under state ownership.

5. Fragmentation of industries

In the UK, rail privatisation led to breaking up the rail network into infrastructure and train operating companies. This led to areas where it was unclear who had responsibility. For example, the Hatfield rail crash was blamed on no one taking responsibility for safety. Different rail companies have increased the complexity of rail tickets.

6. Short-termism of firms

As well as the government being motivated by short-term pressures, this is something private firms may do as well. To please shareholders they may seek to increase short-term profits and avoid investing in long-term projects. For example, the UK is suffering from a lack of investment in new energy sources; the privatised companies are trying to make use of existing plants rather than invest in new ones.

Evaluation of privatisation

- It depends on the industry in question. An industry like telecoms is a typical industry where the incentive of profit can help increase efficiency. However, if you apply it to industries like health care or public transport the profit motive is less important.

- It depends on the quality of regulation. Do regulators make the privatised firms meet certain standards of service and keep prices low?

- Is the market contestable and competitive? Creating a private monopoly may harm consumer interests, but if the market is highly competitive, there is greater scope for efficiency savings.

- Can you create incentives in a nationalised firm? For example, performance-related pay could replace the profit incentive.

Video summary

Studies of UK Privatisation

Collected by David Parker “The UK’s Privatisation Experiment: The passage of time permits a sober assessment.” (Econstor CESifo working paper, no. 1126)

- British Airports Authority (Privatised July 1987). Study Parker (1999) – “No evidence that privatisation had a significant effect on performance. Performance improvements were a continuation of a longer-term trend.”

- Water and sewerage industry in England and Wales (privatised 1989). Study: Saal and Parker (2000, 2001) – “Privatisation led to no obvious rise in productivity or lower costs of production. Higher productivity and lower unit costs came when the regulatory price caps were tightened in 1995.”

- Regional electricity companies in England and Wales. Study Pollitt and Domah (2001) “Privatisation did yield significant net social benefits, but these were unevenly distributed across time and groups in society. Government gained £56m in sales proceeds and taxes, but consumers did not begin to gain until 2000. Producers benefited from large increase in after-tax profits.”

- UK Privatisations in total Study Florio 2002 – “Privatisation has had no noticeable effects in terms of trends in productivity, employment and price levels at the firm or sector levels after allowing for changes in technology and input prices, nor on GDP growth and productivity at the national level.” – Our overall result…..[is]… that taxpayers suffered a loss of £14bn, but this was cancelled out by the equivalent transfer to shareholders. …. Apparently, far from being a “revolution”, the great divestiture was a reshuffling of relative positions of various agents, probably a regressive one, with a rather modest impact on aggregate economic efficiency’ (p.41).

- British Telecom (Privatised 1984) – Florio (2003) “The rate of growth of output was higher before privatisation. Prices fell with business users and international calls the biggest gainers. There was evidence of capital for labour substitution, while R&D expenditures fell as a percentage of turnover. Operating profits were stable before and after privatisation and privatisation had little discernible effect on productivity trends before 1991, when the introduction of more competition and new regulatory pressures led to large gains.”

- UK Steel (privatised 1988) – Parker and Wu (1998) Compared to other UK Steel producers – “A large improvement in relative performance occurred in the British steel industry before the privatisation. Privatisation was followed by a decline in relative performance.”

- Electricity Generation – Newbery and Pollitt (1997) – “Labour productivity has more than doubled since 1990, mainly due to shedding labour. Real unit costs have declined.”

Related

It’s a well simplified and understandable text. Thanks a lot.

Helpful indeed

A question rises here that if we want progress acountry we should give education to the whole public

Now a days poor can not get education due privatization so now a country has almost of their public poor

I don’t get why the profit motive is supposed to be less important in some industries than in others. What makes public transportation, education, and healthcare different from telecommunications, or food? Is it monopoly power? assymetric information? Do those industries just attract different kinds of people who are not as motivated by profit as other industries? What exactly is the argument here?

You forget an advantage of privateization is low corruption rate.

I think it’s hard to say when you have many situations when corporations interfere in the legislative process. Corporations are donating to politicians if they support a bill that benefits said company. It’s an indirect quid pro quo. You also have to consider the lack of regulation, which can take advantage of workers and customers- historically speaking. So I would disagree and ask, “What is your definition of corruption to lead you to such a conclusion?”

Yes, a very important point indeed.

Well maybe they tried to cover it indirectly in the point “less government interference.”

But it is better than when it is owned by the government which is more corrupt than public individuals the government seek to benefit the inside sector

It is full right detail about privatisation, it’s true that privatisation will be good for Economy and developing of India. But I appear that Some sector such as Health sector, Education sector, Railway sector should’nt privatised. because of this the monopoly will be grow fastly between them.

There can be nothing worse than privatisation. It discriminates between rich & poor, higher & lower class. There can be no security for the persons working for their own country. They can be sacked anytime anywhere. The power goes directly to the hands of corrupted capitalists. There wouldn’t be anything called free (still we have to pay high taxes).

Tnx it was helpful

thank you,it helped a lot

What are the challenges of privatization and liberalization in developing nation’s like Tanzania

God bless you and thank you so much, your website helped me a lot for writing my essays!!

Thanks. This really helps with my debate on Why or why not Eskom should be privatized.

Yes