The Neo-classical synthesis (also referred to as the neo-Keynesian theory) refers to the post-war macroeconomic development which combined elements of Keynesian macroeconomics with more classical microeconomic theory. (This is not relevant for A-Level economics, you may be relieved to know)

Up until the 1930s, economics had been dominated by classical economists who argued that markets were self-regulating, markets would clear and markets were the most efficient method of distributing resources.

Keynesian theory, however, suggested markets weren’t self-regulating and could be below full employment for a considerable time.

The neo-classical synthesis suggests that Keynes was right in the short term, and classical economists were correct in the long-term. Markets may be subject to short-term shocks which put them out of equilibrium. But, in the long-term, free markets were best for distributing resources. The neo-classical synthesis suggests government intervention should primarily be concentrated on the short-term, stimulating demand in a recession, and dealing with rigidities in labour markets, such as monopolies, minimum wages and monopsonies.

Key people in the Neo-Classical Synthesis

- John Hicks. Hicks developed the IS/LM model in 1937, which is based on Keynesian macroeconomic insights.

- Paul Samuelson. In the post-war period, Samuelson was one of the first economists to popularise Keynesian theory with his amendments. His textbook, Economics: An Introductory Analysis, first published in 1948 was instrumental in sharing Keynesian macroeconomic principles, alongside more classical microeconomic theory.

Politics of the Neo-Classical Synthesis

There was a belief Keynesian economics was partly inspired by ‘Communist’ ideas. This was in the ‘McCarthyite era’ with great suspicion of any ‘left wing’ ideas. Samuelson’s synthesis helped to dilute Keynesian economics to give it more market-based approach and this became the more widespread version of Keynesian economics.

Key Elements of the Neoclassical Synthesis

Full Employment is possible. Government intervention could help the economy be maintained close to full employment. For example, in an economic downturn, the government could pursue expansionary fiscal policy to boost demand. In the 1950s and 1960s, these ideas received widespread support as most major economies experienced two decades of economic expansion and close to full employment. Richard Nixon said in the early 1970s ‘we’re all Keynesians now‘

Monetary and Fiscal Policy. Keynes had concentrated on the role of fiscal policy in managing the economy. However, the neo-Keynesians became more accepting that Monetary policy could also be used to manage demand and the rate of economic growth. By the late 1990s, the neo-classical synthesis had embraced the role of monetary policy in achieving inflation targets. (neoclassical synthesis and monetary policy)

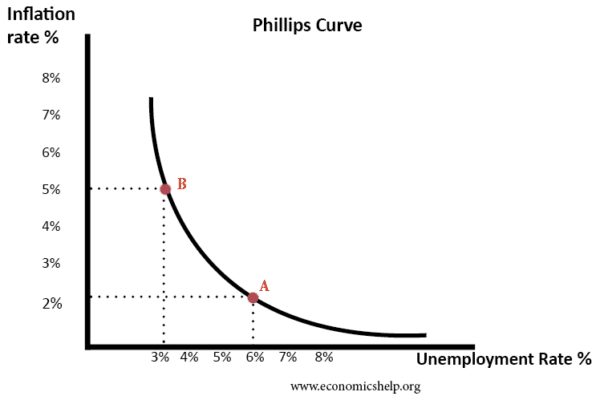

Phillips Curve

In the post-war period, the Phillips curve was considered a significant aspect of economic policy. It appeared there was a trade-off between inflation and unemployment and the government could decide which to prioritise.

Neo-Keynesian acceptance of Neo-classical micro ideas

Keynes had rejected many of the classical microeconomic theories, such as ergodic axion, neutral money and gross substitution. The Neo-classical synthesis reverted to the classical view of these microeconomic foundations.

- Ergodic axiom. Keynes argued the future wasn’t pre-determined, there were many unknown variables. The neo-classical synthesis rejected this and supported the ergodic axiom of neo-classical economics. What this means is the neo-classical synthesis argued the future could be determined by market fundamentals (a kind of efficient market hypothesis). Keynes said it couldn’t, Keynes placed a greater role in people’s behaviour, ‘animal spirits’ and actions influencing the future.

- Neutral Money. Neo-Keynesians believed money was neutral (money supply didn’t affect real output). Keynes rejected neutrality of money in the short and long-term.

- Gross substitution. Classical economics argues money is a close substitute for less liquid assets. Keynes argued they are not close substitutes. If people save more money in liquid assets, there will be a fall in demand for physical goods. Therefore, Say’s law is broken (supply = demand). The lack of substitution explains why markets often fail to clear. The neo-classical synthesis accepted the classical version of gross substitution.

Bastard Keynesianism

English economist Joan Robinson labelled these ‘neo-Keynesian ideas’ as Keynesianism because they rejected many key elements of Keynes’ theory.

Breakdown of Neo-Classical Synthesis.

In the early 1970s, stagflation caused neo-Keynesian ideas to fall out of place. The theory struggled to explain rising inflation and unemployment at the same time.

This led to a resurgence of neo-classical economics/monetarism and a ‘New Keynesian’

Related

External Links

Published 25 Feb 2017, Tejvan Pettinger. www.economicshelp.org