The German Finance Minister Wolgang Schauble has been a strong advocate of austerity, supply side reforms and ‘sound money’ policies. (i.e. sticking rigidly to inflation targets). Generally, this has been the preferred approach of Europe to the ongoing debt crisis and recession of the past few years. Recently, he has claimed that the European economy is recovering well and this is vindication that the broad approach of fiscal discipline and structural reforms are laying a foundation for strong economic growth in the future.

Writing in the Financial Times, Schauble states:

While the crisis continues to reverberate, the eurozone is clearly on the mend both structurally and cyclically.

What is happening turns out to be pretty much what the proponents of Europe’s cool-headed crisis management predicted. The fiscal and structural repair work is paying off, laying the foundations for sustainable growth. This has taken critical observers aback. It should not have, because, in truth, we have seen it all before, many times and in many places. Despite what the critics of the European crisis management would have us believe, we live in the real world, not in a parallel universe where well-established economic principles no longer apply. (FT – Ignore the doomsayers)

Others are much more critical arguing that this view ignores the long-term damage being done to the EU economy by years of deflationary policies. Also, his view ignores the damage of self-defeating austerity which has caused mass unemployment across Europe and rising debt to GDP ratios.

Economic recovery in Europe

source: Eurostat

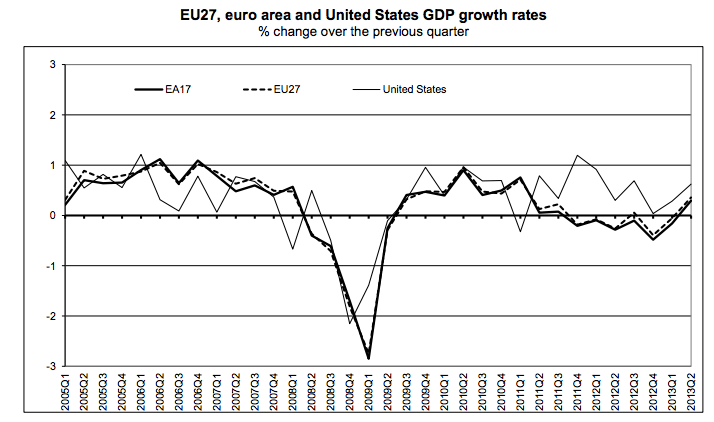

Firstly, the recovery is very timid. The Euro area did grow by 0.3% in the Q2 of 2013, but Eurozone real GDP is still -0.5% lower than 12 months ago. The important point is that since 2008, Europe has failed to reach a normal rate of economic growth – there has been no escape velocity. The recovery of 2010 petered out.

Reasons to hold back on the champagne and not celebrate the EU economy.

1. Quarterly growth figures are very limited in determining the success or otherwise of the economy. The European recession began in 2008. The fact you have one quarter of positive growth in 2013 Q2 doesn’t overcome the five years of recession. Real GDP growth has fallen drastically behind the trend rate of growth necessary to get anywhere close to full capacity.

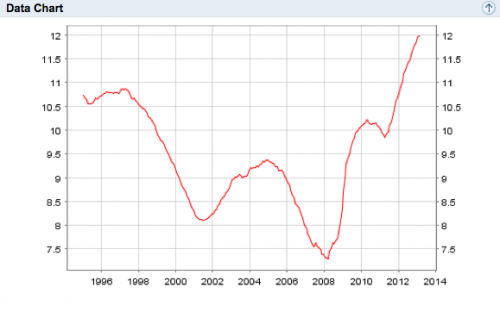

2. Unemployment. Unemployment is arguably the most useful statistic for understanding the degree of spare capacity and wasted resources in an economy. High unemployment has very high social costs in terms of lower incomes, declining morale, and wider social problems. On this metric, the Eurozone faces an unprecedented crisis. Yet, it tends to be brushed aside by European policy makers.

- The multiplier effect has been much greater than predicted (fiscal multiplier)

The myth of structural reforms

Well designed structural reforms can improve the supply side and increase productivity. There is no doubt that Europe has scope for reducing some structural unemployment through labour market reforms (e.g. increased flexibility). But, to portray the European crisis as predominantly structural is to miss the glaring obvious rapid rise in unemployment due to a deficiency of demand in the economy.

Competitiveness

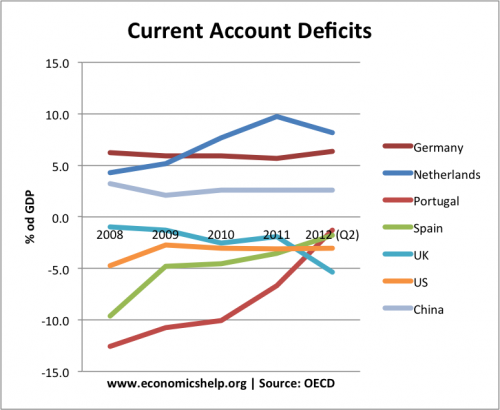

In recent months, the massive current account imbalances in the Eurozone have been reduced. Countries, such as Ireland and Spain have seen a fall in their current account deficit.

However, this narrowing of current account deficits is not a vindication of positive productivity gains and restored competitiveness. The current account deficit reduction has been driven by falling demand. (e.g. how Portugal reduced current account deficit) Massive unemployment in Spain has made productivity look slightly better, but there is guarantee that the fundamental imbalance between north and south has been resolved.

Conclusion

It is understandable if politicians try to put a positive spin on the economy. In one sense, it is good to try and encourage a positive outlook – hoping business and consumer confidence will improve. If there is always a cynical attitude of defeatism and looking on the bleak side of the economy – there is a danger it can be self-fulfilling.

However, in the case of Europe, it is hard to find suitable language to express how dismally the economy has performed over the past five years. Rates of unemployment are threatening the very fabric of European society. It is no co-incidence the rise of the neo-Nazi Golden Dawn party in Greece is occuring in a society with 60% + youth unemployment.

To declare the Eurzone economy has a success is to only show a dangerously distorted view of the economic situation. If you think the economic policies pursued by Europe in the past five years are the best foundation for the future, there is every danger that Europe will persist with it’s insistence on deflationary policies. If there is an awareness of the real problems in Europea and the causes, then there can be an opportunity to pursue lower unemployment and not live in a bubble celebrating every 0.1% quarterly growth figures.

Related

- Ambrose Pritchard Evans view at the Telegraph

Europe very poor leadership

As you rightly say, improving periphery competitiveness is crucial. So you’d think there’d be some central Euro authority keeping a keen eye on periphery competitiveness. But not a bit of it, so it seems.

It seems to be left to people like you to try to fathom out whether periphery austerity is having the competitiveness improving effects that are needed. Some else trying to fathom this out (in Australia) is Bill Mitchell. See:

http://bilbo.economicoutlook.net/blog/?p=25420

The fact that an Australian, eight thousand miles from Europe, thinks its necessary for him to diagnose Europe’s problems speaks volumes.

You really have to wonder what Eurocrats in Brussels and at the ECB do all day, don’t you? Instead of getting to grips with the problem, perhaps they just drink tea and attend union meetings.

EU leadership are living in a dreamland

The crisis is now still not yet over and the recent developments will also ensure that a rethinking must take place for the solution.

NIGEL LAWSON SAID THAT IF HE HAD KNOWN THEN WHAT HE KNOWS NOW WHEN HE SIGNED THE CHARTER TO JOIN THE EU.

HE WOULD NEVER HAVE CONTENPLATED JOINING EVER.

THAT FOR SAYS IT ALL.