An adverse supply-side shock is an event that causes an unexpected increase in costs or disruption to production. This will cause the short-run aggregate supply curve to shift to the left, leading to higher inflation and lower output.

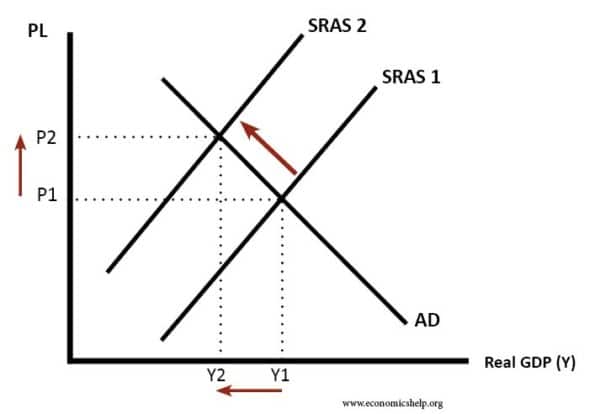

Diagram showing supply-side shock

SRAS shifting to the left causes a higher price level and lower real GDP.

Causes of adverse supply side shocks

1970s

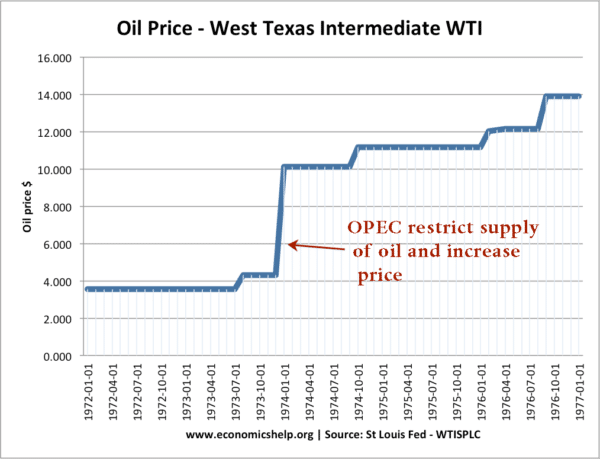

- Rising oil prices e.g. cartel activity by OPEC restricting supply and pushing up prices.

- Bad weather – Hurricane Katrina disrupted supply in the US.

- Declining productivity, e.g. general strikes

- Wage-push inflation. The 1970s were generally a period of rising wages, leading to cost-push inflationary pressures.

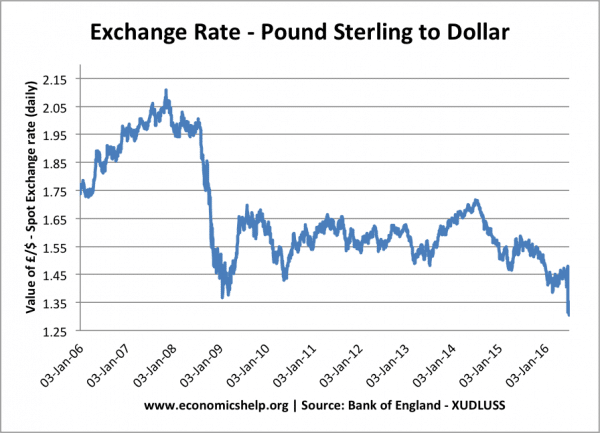

- Devaluation/depreciation in the exchange rate. A depreciation in the exchange rate causes import prices to rise and this can lead to inflation. A rapid devaluation can cause a significant increase in inflation.

- Poor harvest disrupting supply of food. A big issue for developing economies where food purchases are a higher % of GDP.

Pound depreciated in 2008/09 and after Brexit vote June 2016,

Cost-push inflation

A consequence of a supply-side shock is cost-push inflation. This causes higher inflation due to AS shifting to left.

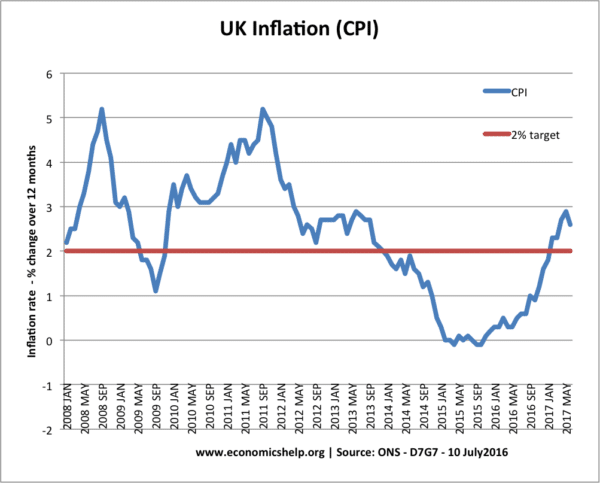

Cost-push inflation in the UK. In 2008, rising oil prices contributed to higher inflation. In 2012, cost-push inflation was due to effects of depreciation in the exchange rate, higher taxes and

More on cost-push inflation

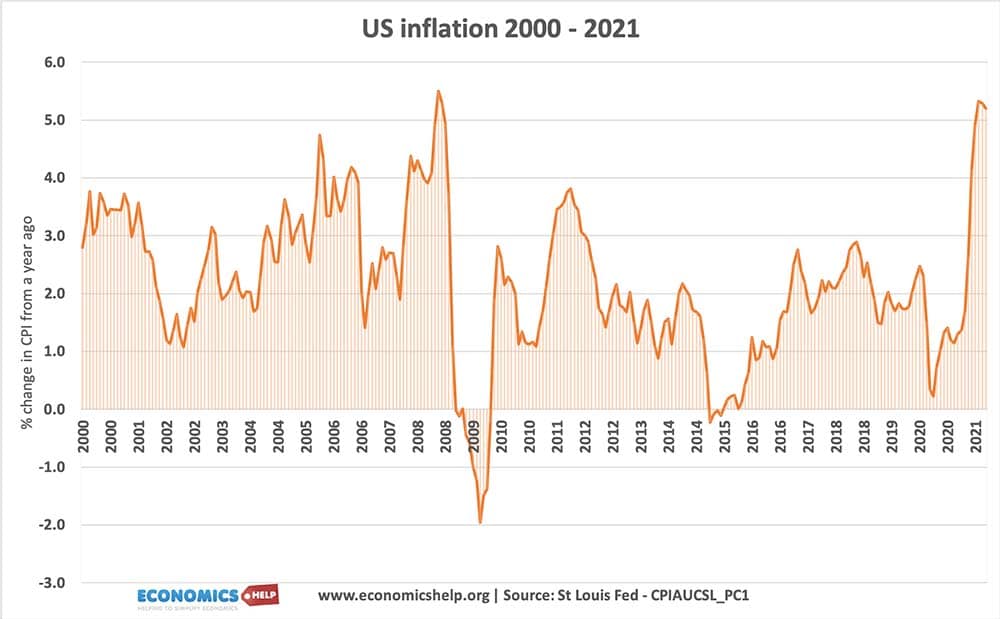

Covid Supply side shock 2020-21

In 2020, there was an unusual supply-side shock due to Corona pandemic. The pandemic led to long lockdowns with normal economic activity shut down. This particularly affected shipping because ships were often in the wrong location and not able to meet demand. This led to prolonged delays in the delivery of goods.

- These supply side shocks were also exacerbated by rising oil prices, which pushed up the cost of transport.

- In the US, covid encouraged a ‘great resignation’ with many workers quitting their jobs. This led to a shortage of workers and upward pressure on wages.

Response to supply-side shock

The difficulty of a supply-side shock is that conventional monetary policy cannot deal with both higher inflation and lower real GDP at the same time.

For example, in 2009 and 2012, with cost-push inflation, the Bank of England kept interest rates very low at 0.5% – because they were more worried about fall in GDP than the rise in inflation.

In the 1970s, the rise in oil prices was not something that could be dealt with in the short-term. However, in the long-term, countries did respond by – developing new sources of oil supplies, diversifying energy needs away from oil. This made western economies less vulnerable to future oil price shocks.

Related