Definition: The announcement effect refers to the fact that behaviour can be changed merely by announcing a future policy change.

For example, if the government say that petrol tax will increase in 6 months time, people may start spending less money now; they may also look for alternatives to the car.

Announcement effects will be important for exchange rates. If the government announced a rise in the inflation rate, this can cause a rise in the exchange rate because the markets assume that this data will cause the monetary authorities to increase interest rates and therefore hot money flows will occur.

The importance of the announcement effect may depend on the credibility of the financial institute. For example, if the MPC announces they will tackle inflation; this may be sufficient to reduce inflation expectations. However, if a government with a poor track record of inflation made the same announcement, markets may not take any notice.

Market investors may even try to predict government announcements.

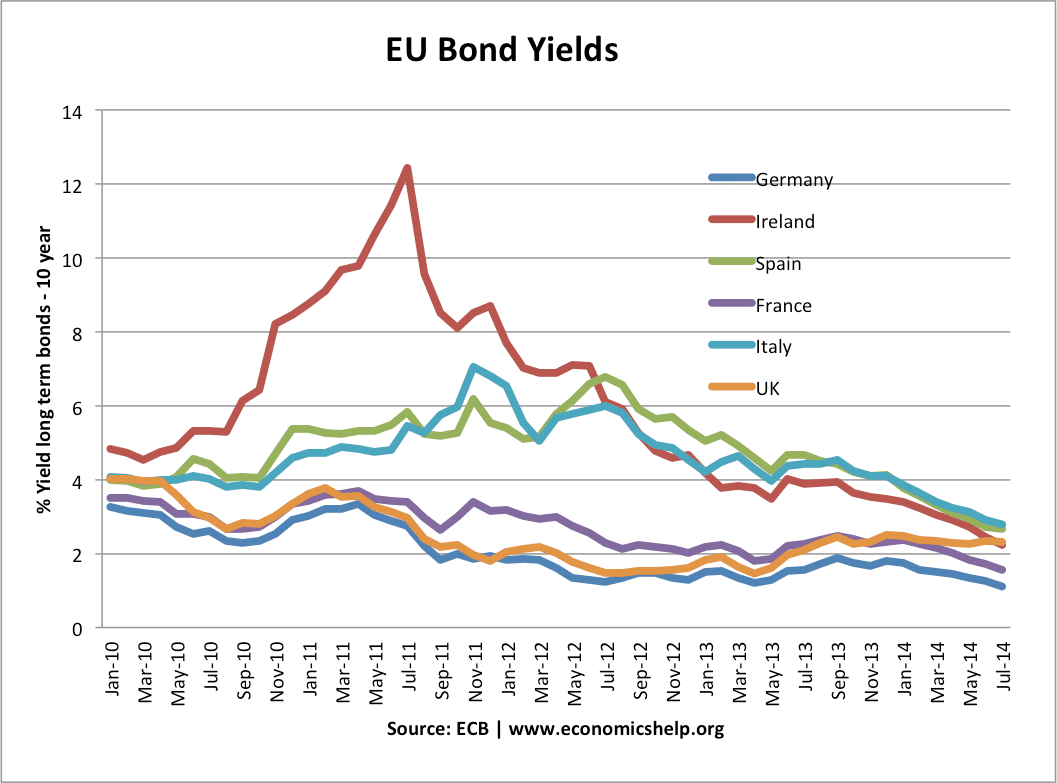

Announcement effects on bond yields

In 2011, the ECB’s decision to increase interest rates sent a clear signal that they were going to be rigid in targeting low inflation even at the cost of economic growth. This led to concerns in the bond market about future growth prospects.

Similarly, in 2013, when Mario Draghi announced he would take whatever steps necessary to provide liquidity – bond yields in the Eurozone fell sharply because investors were reassured liquidity would be maintained.