Bretton woods was a semi-fixed exchange rates set up in the post-war period. The Bretton Woods exchange rate system had a system of pegged exchange rates with currencies pegged to the dollar.

The dollar was fixed to the price of gold ($35 an ounce) – giving the US Dollar a fixed value.

The currencies in Bretton Woods were only to be revalued in the event of fundamental disequilibrium. The system ended in 1971.

The idea of the Bretton Woods was

- Provide stable exchange rates to encourage investment and economic growth

- Encourage countries to maintain low inflation / competitiveness – in order to maintain value of exchange rate.

- Try to prevent competitive devaluation – where countries seek to gain a short-term advantage by reducing value of the currency.

- Limit free movement of foreign exchange on the capital account of balance of payments

Policy Trilemma and Bretton Woods

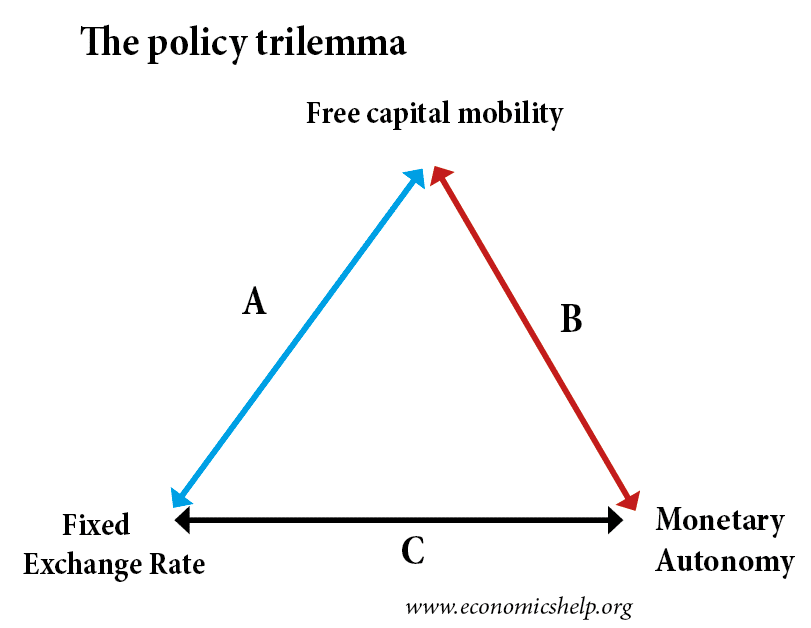

The Policy trilemma states that a government can only choose two monetary objectives out of three possible choices.

- Fixed exchange rates

- Capital mobility

- Independent monetary policy

Under Bretton Woods, the government was effectively choosing to prioritise, semi-fixed exchange rates and independent monetary policy. This meant the necessity of capital controls.

- (Breton Woods) C = Fixed Exchange rate + monetary autonomy

Capital controls under Bretton Woods

- Limits on the amount of foreign currency that could be exchanged. In the 1960s, UK citizens were limited to taking £50 of foreign currency on a foreign holiday.

- Limits on the sale and purchase of financial assets, such as government bonds.

- Taxes on dealings with financial assets.

Collapse of the Bretton Woods System

In the late 1960s, there was a run on the Pound Sterling and later the dollar. It was partly caused by a booming US trade deficit. With the US unwilling to use protectionism as a measure to reduce imports – the link between the dollar and gold was broken in 1968. There was a short period of a floating Bretton woods exchange rate, but it was effectively ended by 1971. Some of the structural changes which undermined the Bretton Woods system included:

- Rise of global trade

- Growth of international currency markets with hedging and speculation causing fluctuations in the exchange rate

- Decline of US economic and monetary hegemony. After the Second World War the US economy was dominant but it declined in relative importance by 1970s.

- Long-term Decline of the Dollar

- Increase in free market ideology and belief that capital controls are either harmful or difficult to implement.

- Oil price shocks of 1970s saw cost-push inflation and greater economic instability.

- 1973-74 US, Canada and Germany removed capital controls.

Bretton Woods Conference 1944

Bretton Woods is a ski resort chosen as a location for a conference in 1944 to decide on the new international monetary arrangements for after the end of the Second World War. It was attended by over 700 delegates from 44 allied countries. The conference led to the creation of

- International Monetary Fund IMF

- International Bank for Reconstruction and Development IBRD – this was later to be known as the World Bank

The aim of the Bretton Woods conference was to provide greater global financial stability and enable the movement of capital to struggling economies.

Related

Published: 17th November 2019. Last updated 18 May 2020. Tejvan Pettinger, www.economicshelp.org, Oxford, UK