Definition of Concentration Ratios

The percentage of market share taken up by the largest firms. It could be a 3 firm concentration ratio (market share of 3 biggest) or a 5 firm concentration ratio.

Concentration ratios are used to determine the market structure and competitiveness of the market. For example, an oligopoly is defined when there is a 5-firm concentration ratio of greater than 50%

Importance of concentration ratios

The degree of competition. If the five-firm concentration ratio rises from 40% to 60%, this is an indication of a fall in competitive pressures. It could lead to higher prices for consumers

Indicate monopoly power. In the UK, the legal definition of a monopoly is a firm with more than 25% market share. Any firm over this threshold has an important market position.

Regulatory oversight. If there is a three-firm concentration ratio of over 80%, then there is greater scope for collusion and abuse of monopoly power. In this kind of industries, the government may need to use a regulator to check monopoly power isn’t being abused. For example, the government has a regulator for railways, electricity and gas – where the market is dominated by a few small firms.

Concentration ratios and contestability

One feature of concentration ratios is that they do not indicate the level of contestability. A contestable market has freedom of entry and exit. The threat of competition is sufficient to keep prices low – even if the concentration ratio is quite high.

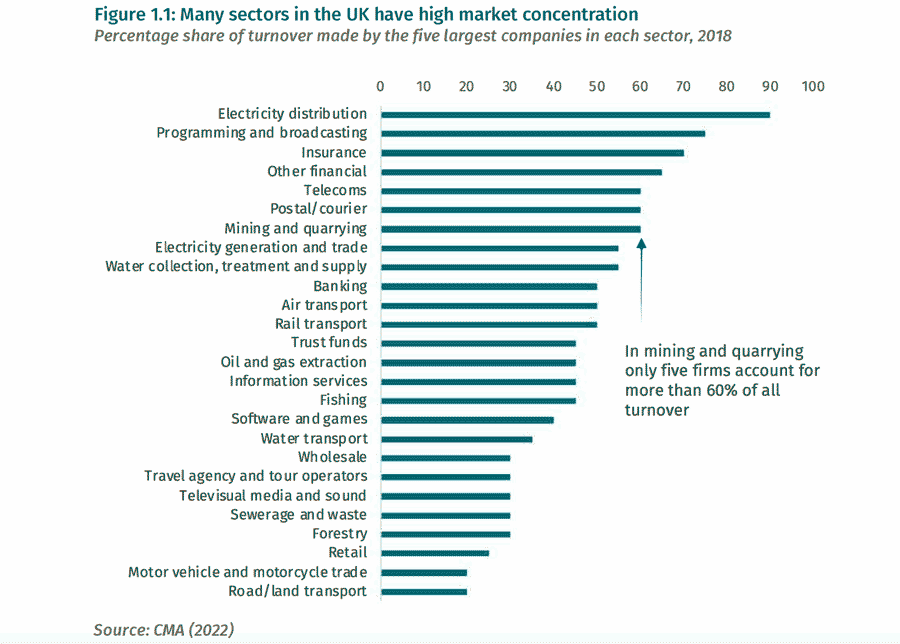

Examples of market concentration in the UK

This is from a study by the Competition and markets authority into the market share of UK industries. It shows that in electricity distribution the five largest firms controlled nearly 90% of market share. The most competitive markets were retail, motor vehicle trade and road/land transport.

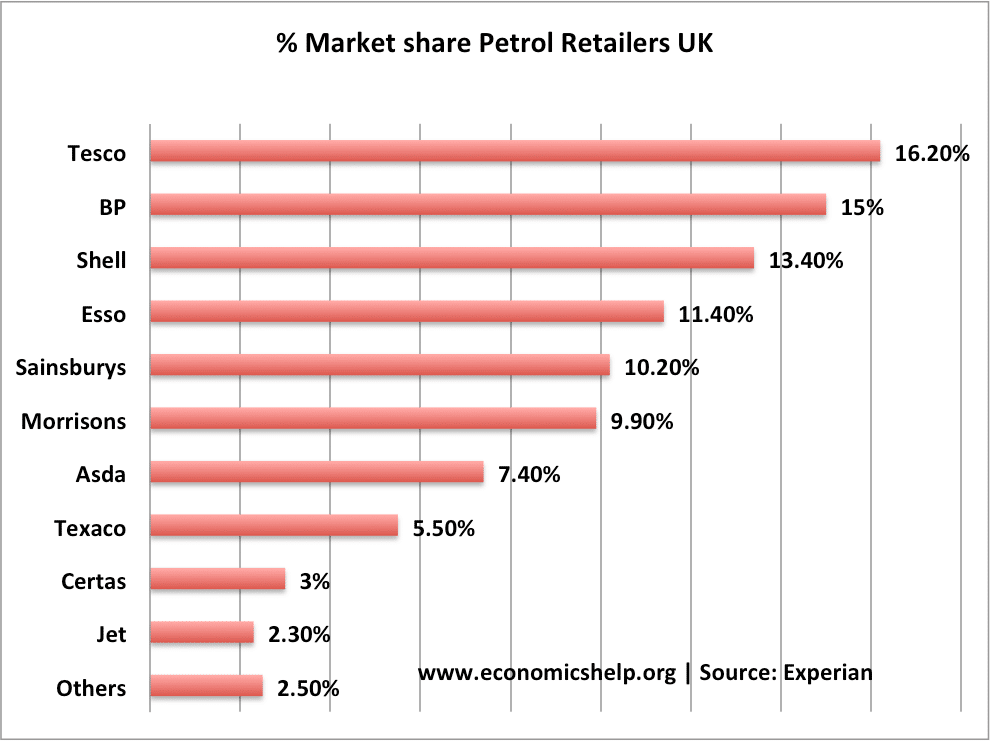

Market share of UK petrol stations

- In the UK retail petrol industry, there is five-firm concentration ratio of 66%

- There is a three-firm concentration ratio of 44%

- The growth of supermarkets selling petrol has made the market more competitive – especially because supermarkets are willing to sell petrol at a competitive pressure to attract customers to shop at the supermarket.

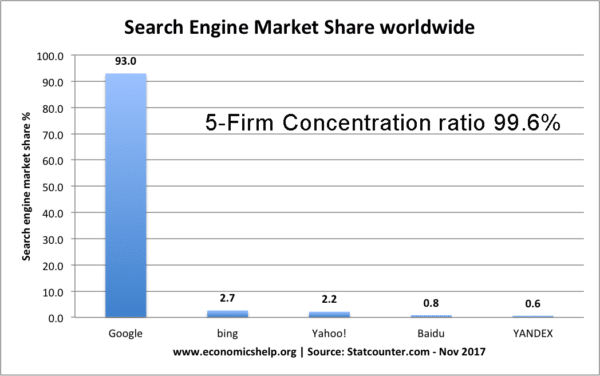

Search Engine market share

Note: I have seen other measures which put Google on closer to 80% of market share. This is from Statcounter.com own aggregate statistics.

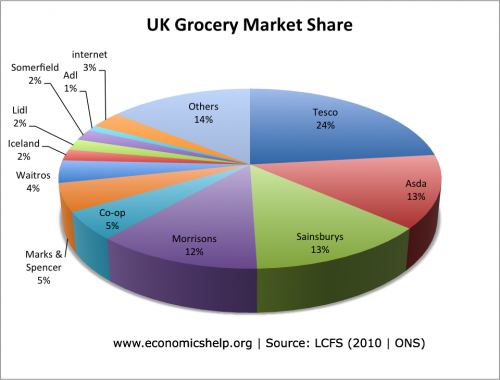

UK Supermarket industry

The five firm concentration ratio for the industry is 66% – a case of an oligopoly.

- Tesco – 23%

- Asda 13%

- Sainsbury’s 13%

- Morrisons 12%

- Co-op 5%

- Marks & Spencers – 5%

- Waitrose – 4%

- Iceland – 2%

- Lidl – 2%

- Somerfield – 2%

- Aidl – 1%

- internet – 3%

- Others – 14%

Related