- A contestable market occurs when there is freedom of entry and exit into the market.

- In a contestable market, there will be low sunk costs. (Costs which can’t be recovered when leaving the market)

- Due to freedom of entry and exit – existing firms always face the threat of new firms entering the market.

- This threat of entry is sufficient to keep prices close to a competitive equilibrium and profits low – otherwise, new firms enter.

- In a contestable market, it is not the number of firms that is important, but the ease by which new firms can enter the market.

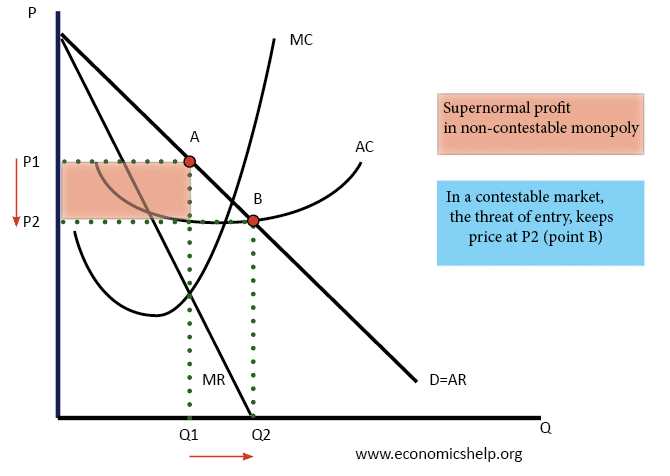

Diagram of a contestable market

- If the market was a monopoly with high barriers to entry, the firm would maximise profits at P1, Q1 (point A)

- If the market became perfectly contestable – with freedom of entry and exit, then the existing firm would have an incentive to cut prices to P2 (point B) – Otherwise, new firms would enter the market until normal profits are made.

- Therefore, contestable markets will have lower profits than monopoly.

Contestable markets and the public interest

Contestable markets can bring the benefits of competitive markets such as:

- Lower prices (allocative efficiency)

- Increased incentives for firms to cut costs (x-efficiency)

- Increased incentives for firms to respond to consumer preferences (allocative efficiency)

However, there could also be significant economies of scale because the theory of contestable markets doesn’t require there to be 1000s of firms

- Therefore policymakers should not just look at the degree of concentration, but also the degree of contestability and how easy it is to enter the market.

- Regulators in the privatised industries have often focused on removing barriers to entry, rather than breaking up big firms.

Factors which determine the contestability of a market

When considering the contestability of markets, it is important to consider the different barriers to entry a new firm may face

- Sunk Costs If sunk costs are high this makes it difficult for new firms to enter and leave the market. Therefore it will be less contestable. For example, if a new firm had to purchase raw materials, that it wouldn’t be able to resell on leaving the market, this may act as a deterrent.

- Levels of advertising and brand loyalty. If an established firm has significant brand loyalty such as Coca-Cola, then it will be difficult for a new firm to enter the market. This is because they would have to spend a lot of money on advertising which is a sunk cost. Even if they spend money on advertising it may not be sufficient to change customer loyalty to very strong brands. It depends on the industry; customer loyalty would be fairly low for a product like petrol because it is quite homogenous. But, for soft drinks, people have greater attachment to their ‘brand’

- Vertical Integration If a firm does not have access to the supply of a good then the market will be less contestable. E.g. Oil firms could restrict the supply of petrol to petrol stations, making it difficult for new firms to enter. If you wish to sell electricity to domestic customers, a big issue is whether you can gain access to the electricity grid. The national electric grid is a natural monopoly, but government regulation can make sure firms have a fair access to the grid. Giving access to different stages of production can make the market more contestable. (How vertical barriers can restrict competition)

- Access to technology and skilled labour For some industries like car production it is difficult for new firms to have the right technology. Nuclear power may require skilled labour that is difficult to get. This makes the market less contestable. If you wished to compete with Google, you may find it hard to employ the best software engineers because Google pays its employees a very good wage and is seen as an attractive company to work for.

See also: other barriers to entry

As well as looking at barriers to entry, there are other factors that might indicate the competitiveness of a market.

- The level of profit. If the market is highly profitable, this suggests the market is less contestable. In theory, if firms are making supernormal profit, it would attract new firms into the market. The persistence of supernormal profits suggests that hit and run competition is not possible and there are barriers to entry.

- The number of firms. A contestable market could have a low number of firms – as long as there is the threat and possibility of new firms entering. However, if there are only a few firms and it has been many years since any new firms have entered, then it is likely to be less contestable. If there are recent examples of firms entering the market, then it is likely to be more contestable.

It is important to remember that contestability is not a clear-cut issue, there are degrees of contestability, some markets having more capacity for new firms to enter. In practice, few industries are perfectly contestable.

Example of market becoming more contestable – UK Banking industry

- There are high sunk costs in getting a network of banks set up around the country..

- Brand loyalty to existing banks is high. Customers are not so willing to switch. Therefore a new firm may have to spend a lot on advertising to attract new customers, which is a sunk cost, therefore not contestable.

- Existing banks make very high profits, suggesting hit and run competition does not occur.

These issues suggest banking is not contestable. However, other factors may suggest greater contestability.

- The introduction of the internet has reduced set up costs and enabled new firms to enter the market for online banking e.g. EGG, Virgin business.

- The government is trying to introduce regulation to reduce the time and costs of switching to another current account.

Methods to Increase the Contestability of Markets

- Remove legal barriers to entry. Royal Mail used to be a legal monopoly but now firms are allowed to enter the market for sending letters and parcels.

- Force firms to allow competitors to use its network For example when BT was privatised, OFTEL forced BT to allow other companies to use its network. This has also occurred in the Gas and Electricity industries and has made them more contestable. A firm can now gain access to the national network of gas/electricity infrastructure

- Legislation against Predatory Pricing If a firm can engage in predatory pricing it can force new firms out of business and make it less contestable.

- OFT can legislate against abuse of Monopoly power. If a firm abuses its monopoly power by restricting supply to certain firms the OFT can intervene to overcome this restriction on contestability.

- A government firm. In the banking industry, the government has even toyed with creating its own company to help increase competition and increase bank lending to small firms. This could be a last resort where private firms face insurmountable barriers to entry.

Note, there are many barriers to entry that the government can’t solve. The government can’t alter the economies of scale in an industry.

Related

1 thought on “Contestable markets”

Comments are closed.