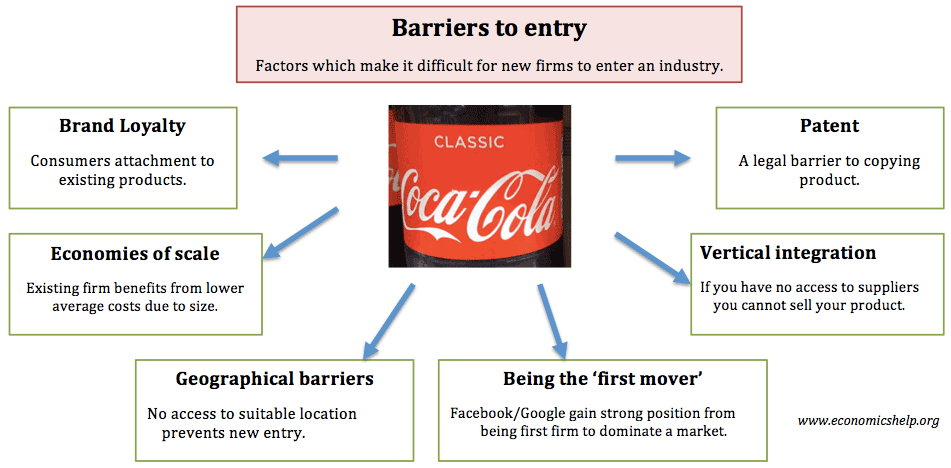

Barriers to entry are factors that prevent or make it difficult for new firms to enter a market.

The existence of barriers to entry make the market less contestable and less competitive. The greater the barriers to entry which exist, the less competitive the market will be. Barriers to entry are an essential aspect of monopoly markets.

Examples of barriers to entry

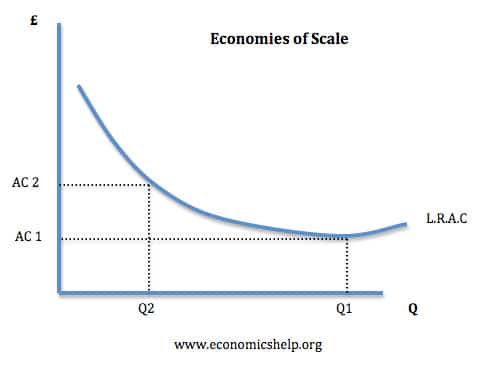

1. Economies of Scale. Economies of scale occur when increased output leads to lower average costs. Therefore new firms, with relatively low output, will find it difficult to compete because theirs average costs will be higher than the incumbent firms benefiting from economies of scale. The prospect of higher average costs may deter entry.

A firm producing at Q1 has lower average costs. If a new firm enters and produces Q2, its average costs will make it uncompetitive.

2. Natural / Geographical Barriers, e.g. Zimbabwe has 85% of the world supply of Chromium. If you don’t have oil in your country, you can’t enter the oil market. Geographical barriers could be more local, e.g. if you don’t have access to a good location for a theatre in say Covent Garden, it creates a barrier to entry.

4. Limit Pricing. This occurs when a firm sets price sufficiently low to deter entry. A monopoly may engage in limit pricing – even though it means fewer profits, it prefers to keep prices lower to prevent competition. It is related to economies of scale.

5. Predatory Pricing. This occurs when an incumbent firm responds to a new firm entering the market by starting a price war and trying to push the rival firm out of business. It is illegal so it may be difficult to implement in practice.

6. Vertical Integration. Vertical integration occurs when a firm has control over the supply and distribution of the good. For example, oil companies can keep the price of petrol very high to discourage new petrol retailers. If a new firm wants to enter the retail petrol market, it will have to buy petrol from one of the big oil companies, who can set a high price, thereby discouraging entry into the petrol market.

7. Legal Patents. A legal patent can provide a pure monopoly because other firms can’t use its patent (e.g. a pharmaceutical company can get a drug patent for seven years, meaning no one else can sell that particular drug.)

8. Knowledge and expertise gained from experience, e.g. Microsoft and Google are both established, technological giants. Many years of operating in the markets will give them knowledge and expertise. This may be difficult for new firms to catch up.

9. Being the first mover in the industry. In some industries, being the first firm to get established gives a big advantage. Google wasn’t the first search engine, but now it has dominated the market and is often pre-installed on browsers. Therefore, it is very difficult for any new firm to compete with the first mover privileges that Google has.

10. Network effects. In many industries, the success of the business requires a firm to have a critical mass of users. This is particularly the case with social media. People don’t choose necessarily the best technical, social media – but the ones their friends use. It can be difficult for a new firm to enter because people are reluctant to use a service that not many others do use.

Related