Deflation Definition

Deflation is defined as a decrease in the general price level.

- It is a negative inflation rate.

- Deflation means the value of money will increase.

- Deflation is often associated with periods of negative or stagnant economic growth (Great Depression, Japanese economy in the 1990s, early 2000s). In fact, deflation is often used to express a declining economy.

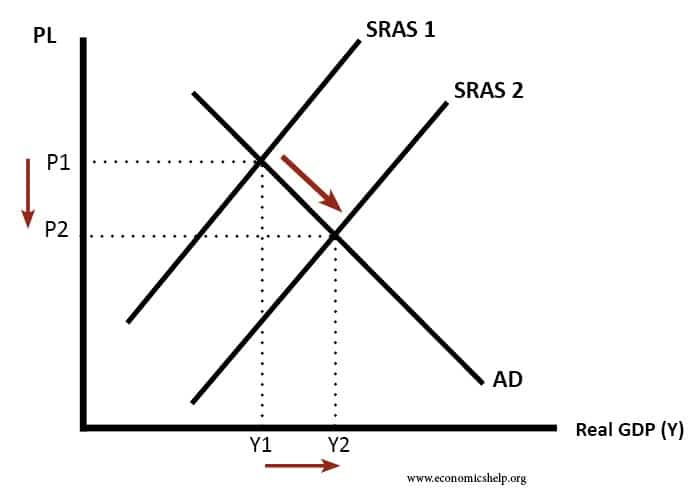

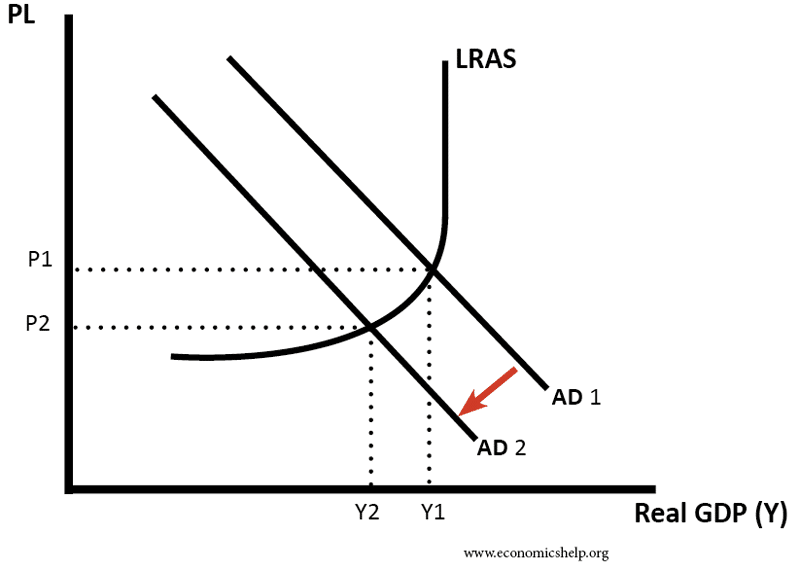

AD-AS Diagram Showing Deflation

Deflation is considered harmful to economy because

- People delay spending; hoping prices will be lower next year; this causes further falls in aggregate demand and rate of economic growth.

- Workers resist nominal wage cuts. Therefore, real wages rise causing real wage unemployment.

- Real interest rates become too high. Even interest rates of 0% cannot induce people to spend creating a liquidity trap.

- Deflation increases the burden of debt and reduces the disposable income of indebted people.

- Deflation can become entrenched in the economy – causing sluggish rates of economic growth.

Deflation caused by rising AS

However, if deflation is caused by rising productivity, improved technology and lower costs, the deflation may not be harmful but beneficial.

This shows how a shift in SRAS to the right causes lower price level.

Examples of deflation

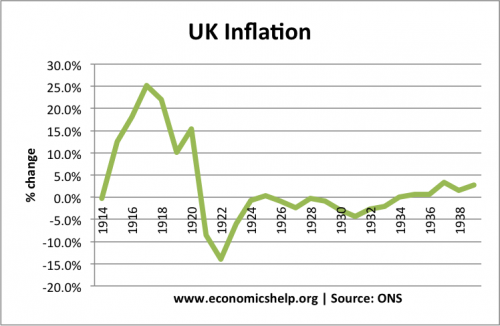

UK 1920s/30s deflation

Between 1920 and 1936, the UK had a prolonged period of deflation, with the inflation rate rarely rising above zero.

This deflation was caused by:

- High real interest rates depressing demand

- Overvalued exchange rate – In 1925 UK joined Gold Standard at pre-war level, but this caused deflationary pressures as UK exporters became uncompetitive

This caused problems of low growth high national debt to GDP and high unemployment. See UK economy in the 1920s

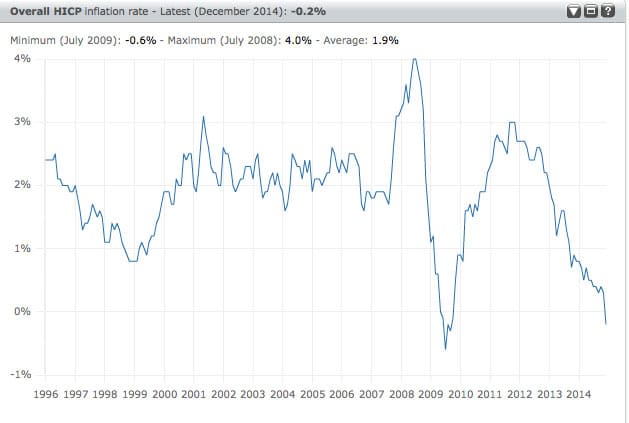

EU 2009/2015

Two periods of deflation in the EU – 2009 and 2015 – both caused by very weak demand

Related