Explain the role of the main economic groups: consumers, producers and the government.

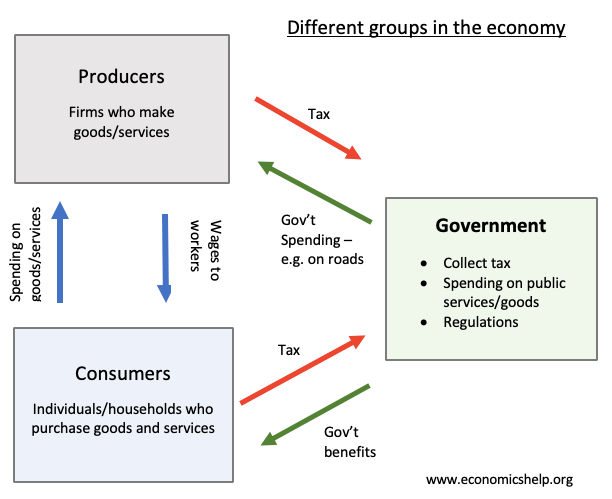

Within an economy, there are three main groups of agents.

- Producers

- Consumers

- Government

1. Consumers

- Individuals and households who provide labour to firms and purchase goods and services.

- Consumers pay income tax on wages and pay indirect taxes on purchases, for example, VAT on goods and services.

- Consumers can afford to purchase goods and services by providing labour to firms and receiving a salary in return.

- Consumers may also receive benefits from the government, such as income support, pensions and unemployment benefits

2. Producers

- Firms who produce goods and services.

- They may be individual entrepreneurs (self-employed) or large multinational companies

- They employ factors of production – labour and capital. Labour are the people working in a company. Capital is machines and factories that are also part of the production process.

3. Government

Governments regulate the economy. This includes

- Taxing consumers (income tax, VAT)

- Spend money on public infrastructure. Some of this spending helps firms to produce goods. For example, the government pays for public goods, such as education, Law and order, and public infrastructure such as roads, railways and communication

- Government spending may also be targetted at households. For example, the government provide education up to the age of 16, health care and welfare benefits. These include benefits for the unemployed and low-income workers.

- The government also impose regulations on consumers and firms.

- For example, a minimum wage which regulates the lowest wage a firm can pay to workers.

- The government limit the power of monopoly firms (firms with extensive market power like Google and Microsoft.

- The government also places a tax on producers, such as indirect taxes on fuel, alcohol and cigarettes.

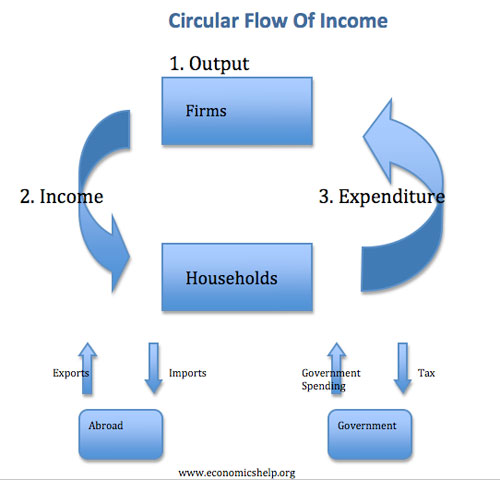

4. Foreign economies

The first three groups imply a ‘closed economy’, but in practise, most economies are open economies with trade forming a significant proportion of economic activity.

Different sub-groups

- The self-employed – workers who are part producers and also part consumers

- Outsiders People who fall out of the standard flow of economic activity. These could include the homeless and those living by self-sufficiency.

- Entrepreneurs. Individuals who set up new business and help to innovate and create new business

- International bodies such as the IMF and World Bank. The IMF and World Bank may offer temporary loans to governments but may require structural changes in the economy such as privatisation and devaluation

- Charitable bodies. Like producers, they differ in having different motives and are non-profit making but serving a particular purpose.

- Trading blocks. Trading blocks like the EU or NAFTA may have different rules which complement or supercede government regulations.

Interdependence of groups

- Producers need consumers to provide labour. They also require consumers to purchase goods and services. There can be tension between workers and firms with workers trying to bargain for higher wages and a bigger share of the profit and firms not wanting to pay workers. However, rising real wages can provide increased demand for goods and services and be beneficial for firms in the long-term.

- Consumers need producers to provide employment and a salary. They also need producers to have a range of goods and services to be able to purchase.

- The role of governments. In economics there is an on going debate about the extent to which governments should be involved in an economy. FIrms may feel that government regulation imposes costs and increases inefficiency. However, workers may feel labour market regulation and minimum wages give a greater incentive to work hard. Firms and consumers may dislike paying tax, but there are some non-profit making services that only the government can adequantely provide – Public services, such as flood defences, universal primary education and universal health care services.

Related concepts