A duopoly is a market structure dominated by two firms.

A pure duopoly is a market where there are just two firms. But, in reality, most duopolies are markets where the two biggest firms control over 70% of the market share.

Characteristics of duopoly

- Strong barriers to entry in the market, e.g. brand loyalty (Coca-cola and Pepsi).

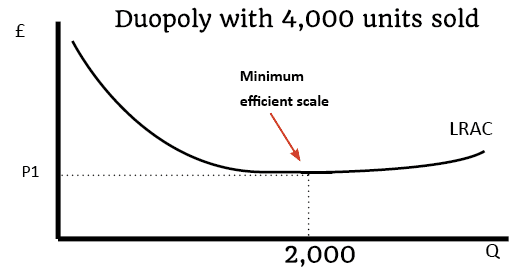

- Significant economies of scale which suit a small number of firms (e.g. Airbus and Boeing – airline manufacture)

- Firms may compete on price or they could seek to collude – either tactically or formal agreement. This will depend on the nature of the industry. For example, Coca-cola and Pepsi compete on brand image and spend a high share of revenue on advertising. Price competition is relatively muted. The creation of Airbus in 1970 helped to make airline manufacture more competitive, airlines could now choose a different company to Boeing forcing more price competition and greater choice of goods.

- Duopolies are usually quite profitable industries and are likely to have an outcome similar to monopoly – with price above marginal cost and a degree of allocative inefficiency. The drawbacks of higher prices may be offset by economies of scale and lower average costs.

Duopoly relation to monopoly

A duopoly is close to a monopoly (one firm dominating market). One definition of a monopoly is a firm with more than 25% market share. If an industry has two firms (duopoly), then they will both have significant monopoly power.

Duopoly relation to oligopoly

A duopoly is a concentrated form of oligopoly (where several firms dominate the market). If two firms have a market share of over 70%, then the industry will definitely meet the criteria of an oligopoly (five firm concentration ratio of greater than 50%)

Examples of duopoly

Visa and Mastercard – two companies which process credit card payments take around 80-90% of market share, gaining highly profitable commission on the processing of payments. According to Reuters, Visa has 60% market share, Mastercard 30% and American Express (8.5%) (Reuters) The market share of Visa and Mastercard have led to the EU commission investigating for monopoly power. The EU forced the two companies to cut fees for tourists paying in different country.

Mobile phone operating systems. Apple and Android operating systems account for 97.3% of mobile operating systems, with other rivals accounting for only 2.7% (Macworld)

Aeroplane manufacturers. Boeing and Airbus are a classic duopoly with the two companies dominating the market for airline production with the two companies owning 99% of the market for commercial production. Boeing used to enjoy a monopoly until 1970 when Airbus was founded. By the 1990s, Airbus had become a major rival. The industry for airline manufacturer has very high fixed costs and substantial economies of scale, which means that it would be impractical for the industry to have several competitors.

Some particular airline routes. On routes from London to Edinburgh, there are two aeroplane companies offering direct flights on this route – Easyjet and British Airways. This is a pure duopoly in the particular market for direct air flights.

Coca-cola and Pepsi. For the cola market, the two brand names of Coca-cola and Pepsi dominate. In 2018, Coca-cola had 43%, Pepsi had 29%, giving a two-firm concentration ratio of 68%. (Statista)

Two formal models of Duopoly

- Cournot Model

- Bertrand Competition

Cournot Model

The Cournot model was based on the economist Antoine Augustin Cournot’s investigation of the duopoly in French spring water. In his model he assumes firms produce a homogenous product, they do not co-operate, firms act rationally and they have market power. The main form of competition is in choosing optimal output.

Cournot concluded that firms would effectively act like a monopolist setting a profit maximising output and price which gives no incentive to start a price war. He argued the equilibrium in a duopoly is stable.

Bertrand Competition

Bertrand Competition. In the Bertrand model, Bertrand came to a different conclusion – that in an oligopoly with a homogenous product the most likely outcome would be the two firms setting price equal to marginal cost.

If a firm increased price above marginal cost, they would lose all market share to the cheaper firm and would be forced to cut price until p=mc.

The model assumes no co-operation, homogenous product and no market power. It also assumes firms can easily increase output and there are no capacity constraints.

Related

Published 2 June 2020, Tejvan Pettinger. www.economicshelp.org