A fixed cost is a business cost that is unrelated to output. They can also be referred to as ‘indirect costs’

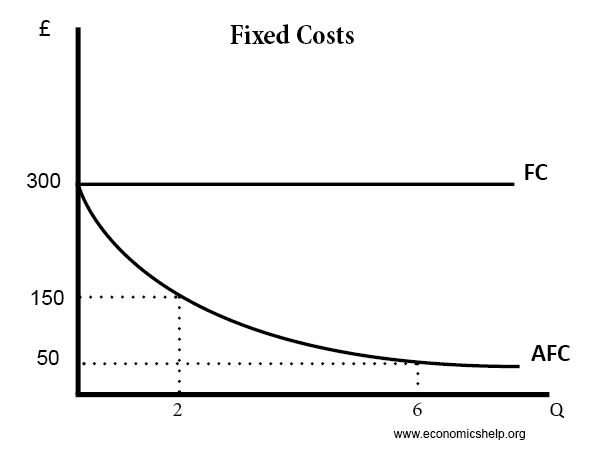

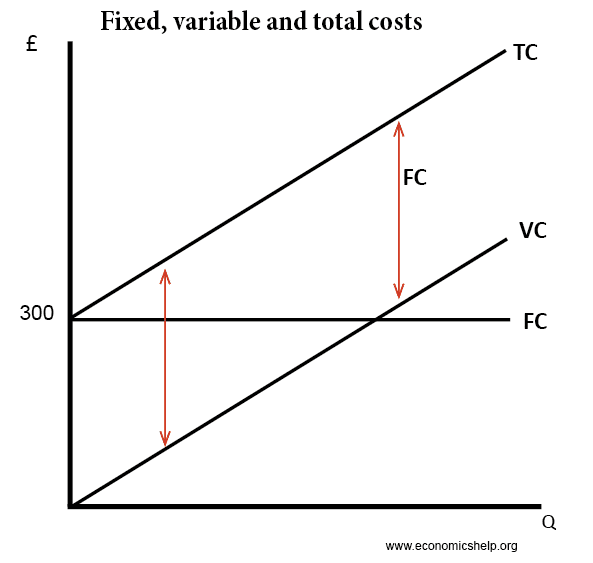

Whatever the output fixed costs (FC) remains constant at £300.

Average fixed cost (AFC) declines with increased output

Examples of fixed cost

- Rent on premise

- Cost of buying machines and factories.

- Salaries of managers and supervisors who are needed whatever the output.

- Spending on health and safety measures

- Filing of tax returns

- Training staff.

Comparison to variable costs

Some costs like raw materials are related to output. If a firm produces more cars, it will have to purchase more steel, plastic and tyres to make the cars. These costs are variable to the output produced.

Importance of fixed costs

Business with high fixed costs will experience economies of scale. This means that as output increases, long-run average costs fall and the firm is relatively more efficient.

Semi-fixed costs

In the short-term, some costs will be fixed and unrelated to output, but in the longer term, these can become variable. For example, if a firm has three managers on a contract, it will need to pay them their salary – whatever the output of the firm, but if the low output continues, they can terminate their contracts and reduce the outgoing salary.

Difference between fixed and sunk costs

A sunk cost is a cost that is irretrievable. If you spend money (£1m) on advertising, it counts as a fixed cost, because however many goods you sell, the fixed cost is the same £1m. However, this is also money you cannot get back. If you exit the industry, the expenditure on advertising is gone and cannot be recovered.

Some fixed costs, like the purchase of land, factories and capital can be resold. Therefore, they are not sunk costs because at least part of the cost can be recovered by selling.

Related