A list and definition of different types of economic costs.

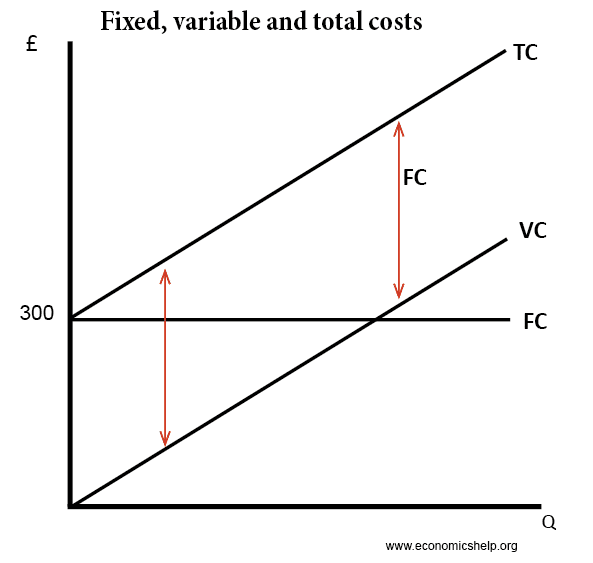

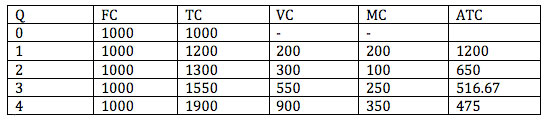

Fixed Costs (FC) The costs which don’t vary with changing output. Fixed costs might include the cost of building a factory, insurance and legal bills. Even if your output changes or you don’t produce anything, your fixed costs stay the same. In the above example, fixed costs are always £1,000.

Variable Costs (VC) Costs which depend on the output produced. For example, if you produce more cars, you have to use more raw materials such as metal. This is a variable cost.

Semi-Variable Cost. Labour might be a semi-variable cost. If you produce more cars, you need to employ more workers; this is a variable cost. However, even if you didn’t produce any cars, you may still need some workers to look after an empty factory.

Total Costs (TC) = Fixed + Variable Costs

Marginal Costs – Marginal cost is the cost of producing an extra unit. If the total cost of 3 units is 1550, and the total cost of 4 units is 1900. The marginal cost of the 4th unit is 350.

Opportunity Cost – Opportunity cost is the next best alternative foregone. If you invest £1million in developing a cure for pancreatic cancer, the opportunity cost is that you can’t use that money to invest in developing a cure for skin cancer.

Economic Cost. Economic cost includes both the actual direct costs (accounting costs) plus the opportunity cost. For example, if you take time off work to a training scheme. You may lose a weeks pay of £350, plus also have to pay the direct cost of £200. Thus the total economic cost = £550.

Accounting Costs – this is the monetary outlay for producing a certain good. Accounting costs will include your variable and fixed costs you have to pay.

Sunk Costs. These are costs that have been incurred and cannot be recouped. If you left the industry, you could not reclaim sunk costs. For example, if you spend money on advertising to enter an industry, you can never claim these costs back. If you buy a machine, you might be able to sell if you leave the industry. See: Sunk cost fallacy

Avoidable Costs. Costs that can be avoided. If you stop producing cars, you don’t have to pay for extra raw materials and electricity. Sometimes known as an escapable cost.

Explicit costs – these are costs that a firm directly pays for and can be seen on the accounting sheet. Explicit costs can be variable or fixed, just a clear amount.

Implicit costs – these are opportunity costs, which do not necessarily appear on its balance sheet but affect the firm. For example, if a firm used its assets, like a printing press to print leaflets for a charity, it means that it loses out on revenue from producing commercial leaflets.

Market Failure

- Social Costs. This is the total cost to society. It will include the private costs plus also the external cost (cost incurred by a third party). May also be referred to as ‘True costs’

- External Costs. This is the cost imposed on a third party. For example, if you smoke, some people may suffer from passive smoking. That is the external cost.

- Private Costs. The costs you pay. e.g. the private cost of a packet of cigarettes is £6.10

- Social Marginal Cost. The total cost to society of producing one extra unit. Social Marginal Cost (SMC) = Private marginal cost (PMC) + External marginal Cost (XMC)

Diagram of Costs

For full diagrams of costs see: Diagrams of cost curves

Average Cost Curves

- ATC (Average Total Cost) = Total Cost / quantity

- AVC (Average Variable Cost) = Variable cost / quantity

- MC = Marginal cost.

- AFC (Average Fixed Cost) = Fixed cost / quantity

Total costs

Related

- Marginal costs

- Social costs

- Diagram of cost curves

- Absorbed costs = variable + fixed manufacturing overhead costs

- Isocosts – a line showing all combinations of two factors that cost the same to employ.

Is this the same as the firms cost? My topic is on Firm Cost however there is not outline if there is difference the this type of costs.