Variable costs are costs which change with output.

As output increases the firm needs to use more raw materials and employ more workers. These costs vary with changes in the output. Variable costs exclude the fixed costs which are independent of output produced.

Examples of variable costs

- Raw materials. Aluminium, plastic, rubber, coffee beans. All the materials used in the productive process are variable costs

- Labour costs. If a firm increases output, it will need to employ more workers to produce more. If a taxi firm takes on more drivers to meet increased demand. (Some labour will be fixed cost – e.g. those workers needed to maintain safety, oversee factory e.t.c)

- I.T. fees. Some production will have variable costs, with firms charging a percentage for each transaction. For example, Paypal or credit card companies may charge 2% of final sale.

- Shipping fees. The cost of delivery for items.

- Tax. Some firms are responsible for paying VAT, excise duty or sales tax – related to the number of goods sold.

Total variable cost

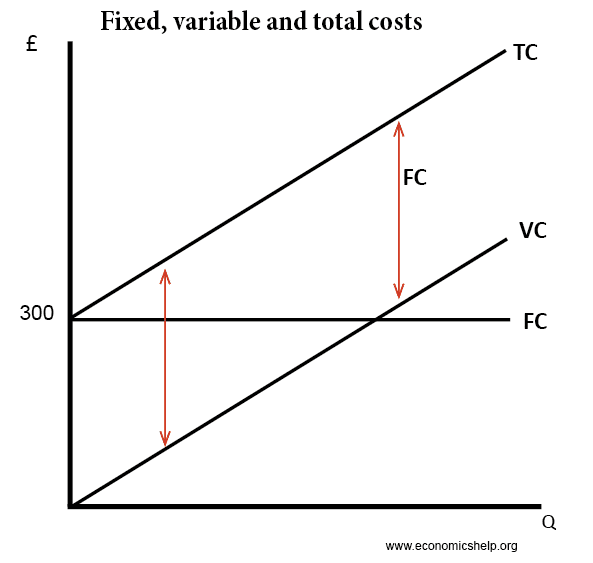

Variable costs and fixed costs make up total costs.

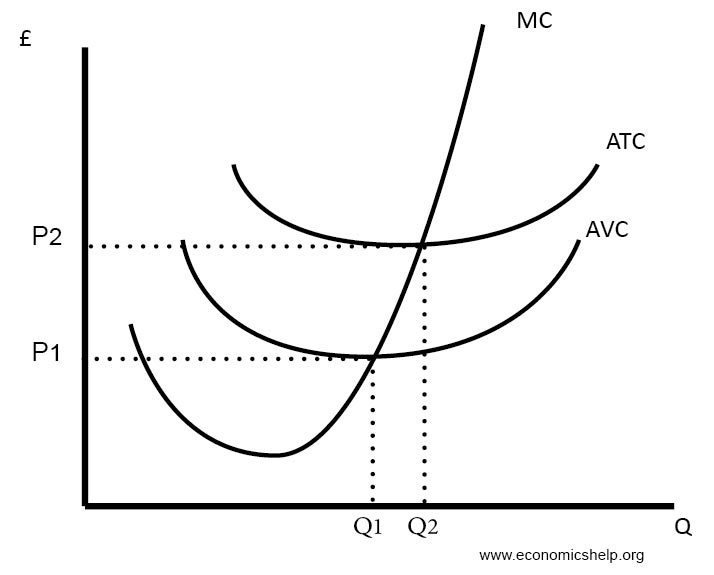

Average Variable costs

Average variable costs = total costs/quantity

In the short-term, average variable costs may be u-shaped due to the law of diminishing marginal returns.

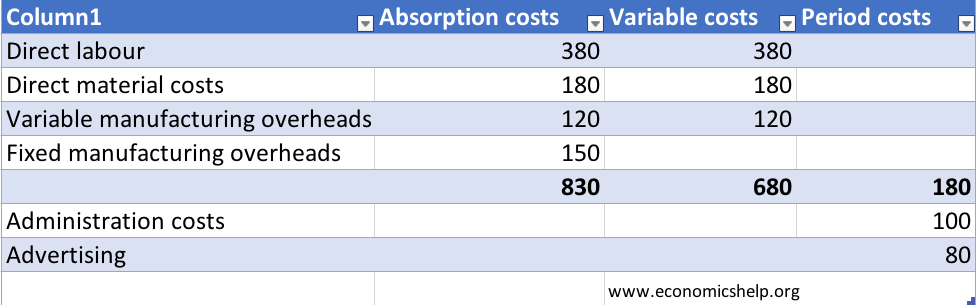

Variable costs

In this example, variable costs include – direct labour, direct material costs and variable manufacturing overheads (e.g. raw materials)

Absorption costs would include also the fixed manufacturing overheads (e.g. rent/ fixed labour)

Related