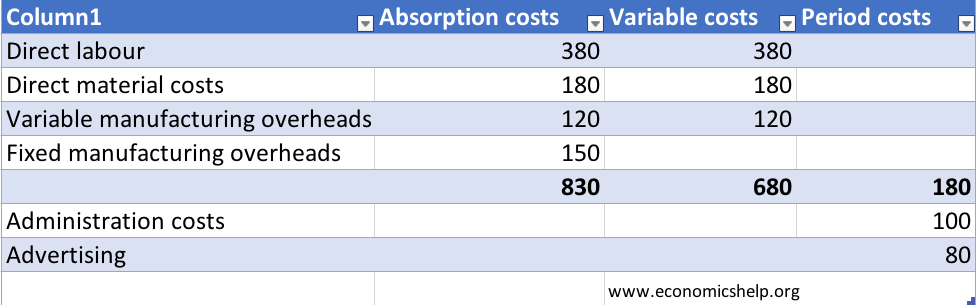

Absorbed costs involve including all the variable and fixed costs in producing a unit of output.

For example, in producing a motor car, the absorbed costs include the variable raw material costs and the associated fixed manufacturing costs, such as the factory, safety inspections and maintenance of machines.

Absorbed costs would not include general administration of a firm or expenditure on advertising.

Absorbed vs variable costs

Absorbed costs can be contrasted with the variable costs or the direct costs of producing a good. The direct costs are those specific to the good – labour, raw materials. However, this excludes those fixed costs which are part of the overall cost.

Which is better to use absorbed costs or variable costs?

For certain decisions, firms may prefer to use variable costs. Variable costs give a guide to operating profit – given that fixed costs have already been spent. For short-term decision making, a firm will look at marginal cost (which will be the extra variable costs associated with increasing output) and marginal revenue.

For external accounting and evaluation in the long-term, absorption costs are needed. They give a fuller picture of the long-term profitability of the firm and real costs associated with producing a good.

Evaluation of absorbed costs

- One issue with absorbed costs is deciding what will count as a fixed manufacturing overhead cost.

- The cost per unit will typically fall with increased output. Economies of scale will reduce the manufacturing average fixed costs.

Related

Published 12 November 2018, Tejvan Pettinger. www.economicshelp.org