Seigniorage is the profit created by issuing currency, where the face value is higher than the intrinsic value. (production costs)

Seigniorage income can also relate to the interest a Central Bank charges from lending commercial banks money.

Seigniorage explained

- Early forms of money had a face value equal to the production costs – e.g. gold coins where valuable because they were made with gold. In this case, there is no seigniorage.

- However, if a Central Bank produces a £10 note which only costs £0.20 to produce, then the seigniorage is £9.80.

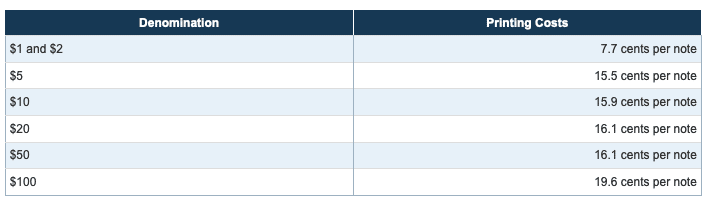

Cost of producing US notes vs value

These are the printing costs of producing US notes.

This shows the seigniorage of producing a $100 bill is $99.804

Positive revenue

If a government creates money and it can buy more goods and services, then this is the positive revenue from creating currency.

Central Banks can create money electronically, so there is practically no cost. In this case, the creation of money leads to an equivalent profit.

Negative seigniorage

The production of some coins could cost more than the face value. For example, it is estimated that the cost of producing a one-cent US coin is around ¢1.5 to ¢1.9 depending on the price of nickel. In 2019, the cost of a five-cent nickel is estimated at 7.62 cents.

Seigniorage income

Commercial banks borrow money from the Central Bank at a rate of interest (repo rate or base rate). The Central Bank, therefore, makes a profit on giving notes to commercial banks. This is seigniorage income from increasing the money supply.

Central Banks can manage the money supply to make commercial banks short of liquidity. Then they turn to the Central Bank to borrow money.

In Europe, 8% of Euros in circulation are considered to be issued by the European Central Bank. Therefore, the ECB earns seigniorage income on the 8% of notes in circulation.

Seigniorage income will depend on interest rates. Lower base rates will reduce seigniorage income. For example, between 2008 and 2020, interest rates fell causing Central Banks, such as the ECB made lower income.

How seigniorage can cause inflation

The temptation of positive revenue from printing more money is that it becomes an easy way for the government to create a profit. However, if the government keeps printing money it will cause inflation and reduce the real value of the currency.

For example, if the government create an extra £200bn of currency, but output stays the same, firms will respond to the extra money and extra demand by putting up prices. Therefore, although there is more money in the economy, there is no increase in real output. The government appears to make a profit from printing money – but it later turns out to be a money illusion. (Income goes up 10%, but if prices go up 10% individuals are not better off.)

Therefore, the ability of Central Banks to earn seigniorage will be constrained by their role of keeping inflation under control.

Seigniorage in time of Liquidity trap

In a deep recession with interest rates close to zero, the ability of Central Bank to earn seigniorage by increasing the money supply is higher than usual. This is because in deep recession a Central Bank can print money without causing inflation. If the economy is below full employment seigniorage financing of fiscal deficits is effectively a free lunch ‘no opportunity cost’ – at least while the economy remains with low inflation.

Seigniorage and inflation tax

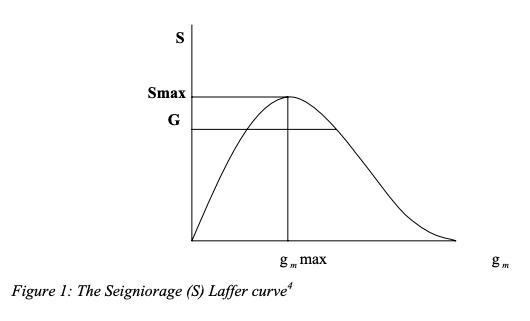

Seigniorage Laffer Curve

The Seigniorage Laffer Curve states that there is an optimal rate of money supply growth.

- Increasing the money supply enables more seigniorage

- Increasing the money supply causes inflation which decreases demand for money.

There will be some point where the rate of money supply growth will maximise revenue. This point is g m max

Origin of the term Seigniorage

The right to mint coins used to be given to the “Seigneur” or Lord

Related pages

External link

- Seigniorage at European Central Bank