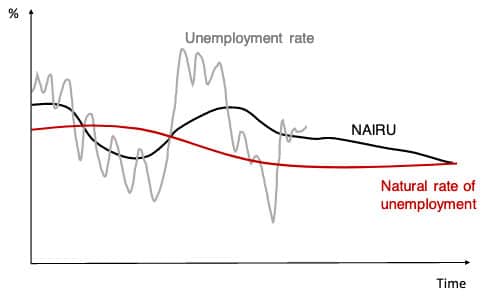

The NAIRU and Natural rate of unemployment are similar concepts – they both reflect the level of structural unemployment when the economy is close to full employment. However, they have different compositions and can vary in the short term.

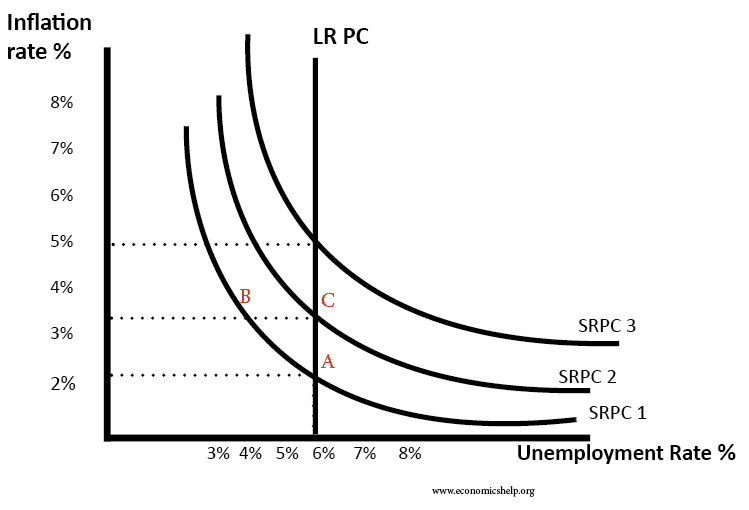

NAIRU – Non-accelerating Inflation rate of Unemployment. This is the level of unemployment that is consistent with no acceleration in the inflation rate. The NAIRU is related to the short-run Phillips Curve. If unemployment rises, inflation falls. If unemployment falls, there will come a point, where inflation starts to increase.

In this case, the NAIRU is at 6%. If the economy experiences a rise in demand, then we get a movement from A to B. The rise in demand causes unemployment to fall, as it gets close to full capacity. But, this, in turn, causes inflation. Eventually, the economy returns to the NAIRU of 6%.

Natural Rate of Unemployment (NR)

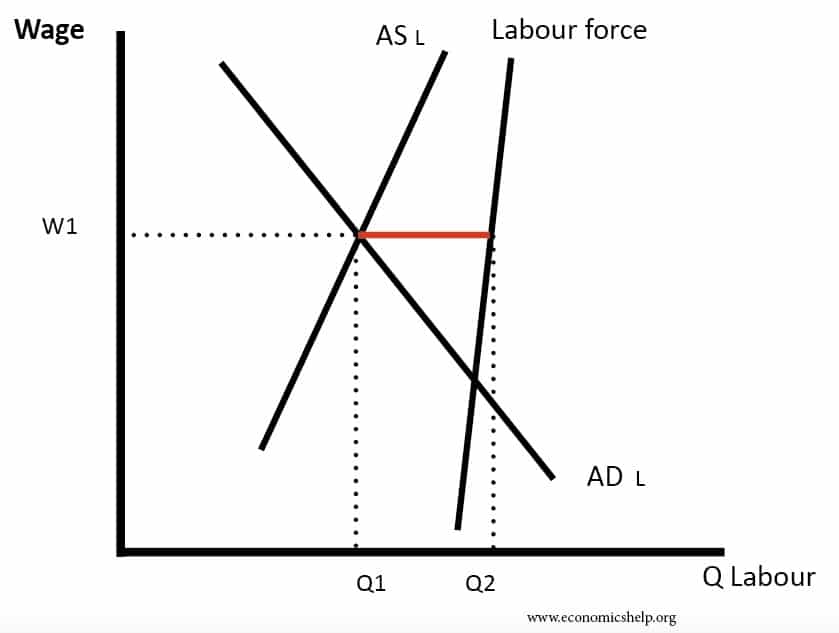

The natural rate of unemployment was developed by Phelps (1967) and Friedman (1968). They stated the natural rate of unemployment is that unemployment consistent with a steady rate of unemployment. The argument of this new monetarist theory is that the natural rate of unemployment is independent of the rate of inflation. The natural rate of unemployment is determined by structural unemployment, e.g. mismatch of skills, frictional unemployment and geographical immobilities.

Like the NAIRU, the Natural rate of unemployment is shown by the vertical Phillips Curve.

Variances between Natural Rate and NAIRU

Both the NR and the NAIRU will tend to converge to the same level. They are much more steady than the headline unemployment rate – which can vary due to fluctuations in the economic cycle.

However, in the short-term the NAIRU is likely to be more volatile, this is because the non-accelerating inflation rate of unemployment can change due to short-term factors, such as wage inflation, changes in wage expectations. For example, in a recession, when unemployment rises, inflation expectations may be slow to adjust, so a rise in demand can enable lower unemployment with no effect on inflation.

Hysteresis effects. An important consideration for the NR and NAIRU is hysteresis effects. When unemployment rises, it may cause more structural unemployment and frictional unemployment. If firms close down, there is more likely to be disruption to the labour market. In boom times, when unemployment is falling, there may be a greater motivation for the long-term unemployed to gain new skills and take part in buoyant labour markets.

Similarities between NR and NAIRU

Although there are differences between the NR and NAIRU in the short-term, in the long-term, they reflect very similar ideas – that there is a certain level of unemployment which is due to supply-side factors – structural and frictional unemployment. Therefore, using demand-side management will have no effect in the long-term in reducing this natural rate of unemployment.

A key question is working out what the natural rate of unemployment is. For example, it was always assumed the US had a natural rate of unemployment of around 6%. However, in the 2010s, unemployment has fallen to 4% without any noticeable increase in inflation. This reflects the fact the natural rate of unemployment can change and fall if there is increased labour market flexibility.

Related