Tight monetary policy implies the Central Bank (or authority in charge of Monetary Policy) is seeking to reduce the demand for money and limit the pace of economic expansion. Usually, this involves increasing interest rates.

The aim of tight monetary policy is usually to reduce inflation.

With higher interest rates there will be a slowdown in the rate of economic growth. This occurs due to the fact higher interest rates increase the cost of borrowing, and therefore reduce consumer spending and investment, leading to lower economic growth.

Tight monetary policy can also be termed – deflationary monetary policy.

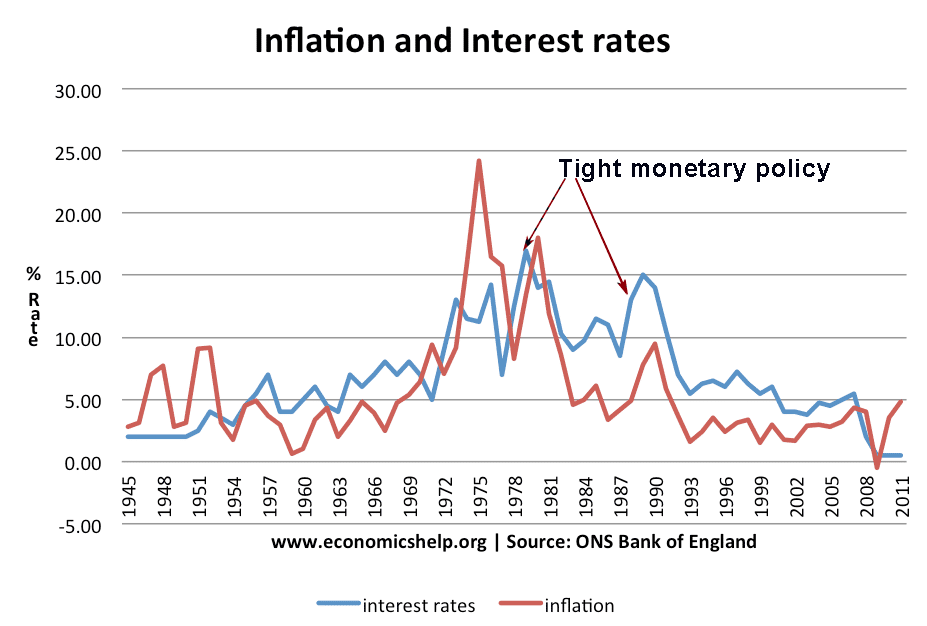

Tight monetary policy will typically be chosen when inflation is above the inflation target (of 2%) or policymakers fear inflation is likely to rise without a tightening of monetary policy. For example, in the early 1980s, the government increased interest rates in response to higher inflation. This caused inflation to peak in 1980 and then fall.

In the late 1980s, we also see a tightening of monetary policy. The economy was growing rapidly and inflation starting to rise. In response, the government increases interest rates.

Tight Monetary policy involves

- Raising Interest Rates

The Bank of England could raise the base interest rate. This base rate tends to affect all the other interest rates in the economy; this is because commercial banks have to borrow from Bank of England, so if the base rate rises, commercial banks tend to put up their own borrowing and saving rates.

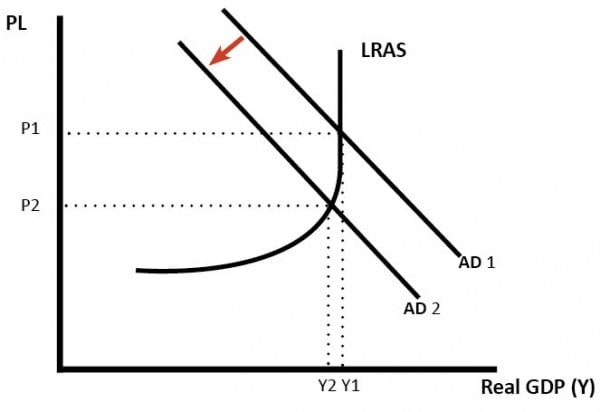

AD/AS Diagram showing impact of tight monetary policy

Higher interest rates tend to reduce aggregate demand (AD) because:

- Borrowing becomes more expensive. Therefore firms and consumers are discouraged from investing and spending.

- Saving becomes more attractive. Therefore firms and consumers are more likely to keep saving money in the bank rather than spend.

- Reduced disposable income. Consumers with a variable mortgage will see a rise in monthly mortgage interest payments. Therefore, they will have less income to spend.

- Exchange rate effect. By raising interest rates, the exchange rate tends to appreciate because of hot money flows taking advantage of better saving rates in that country. An appreciation of the exchange rate will also help reduce inflationary pressure. Imports will be cheaper. Also, there will be less demand for exports, leading to a decline in aggregate demand The decline in competitiveness may encourage firms to be more efficient and cut costs

2. Open Market Operations

The Central bank can also tighten monetary policy by restricting the supply of money. To do this, they can print less money or sell long-dated government bonds to the banking sector. By selling bonds, banks see a reduction in liquidity and therefore reduce lending.

A central bank could also raise the minimum reserve ratio. This forces banks to keep more liquidity in banks.

In practice, open market operations are not used very frequently.

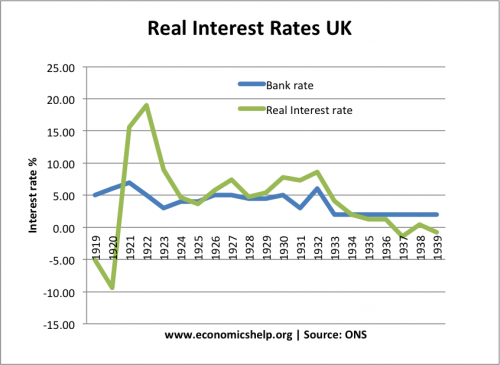

Tight monetary policy and real interest rates

When considering monetary policy it is important to look at real interest rates. This is interest rates – inflation. If inflation is 10% and nominal interest rates only 9%. Real interest rates are – 1%. However, if inflation is 0.5% and nominal interest rates 2%, then real interest rates are higher 1.5%

In the 1920s, the UK had a period of low inflation and deflation which caused very high real interest rates.

This meant during the 1920s the UK was running a tight monetary policy – which led to low economic growth, low inflation and high unemployment. See “Economy of the 1920s”

Effectiveness of tight monetary policy

Higher interest rates may not always bring inflation under control.

- There may be time lags, e.g. it can take up to 18 months for interest rates to influence the rest of the economy, e.g. homeowners may have mortgage rates fixed for a 2 or 5 year period.

- If confidence is very high, people may continue to borrow and spend, despite higher interest rates.

- If there is cost-push inflation (e.g. rising oil prices), tight monetary policy may lead to lower economic growth.

- Tight monetary policy also conflicts with other macro-economic objectives. The cost of higher interest rates is a fall in economic growth and possible unemployment.

- See: Effectiveness of Monetary Policy

Related