In the UK, there is a strong desire for people to own their own house. This deep seated desire is one of the factors behind the extraordinary rise in UK house prices. However, the cost of houses means that it is becoming increasingly difficult for people to get on the property ladder. To be able to buy a house, bigger and more risky mortgages are often being taken out.

What is a Mortgage?

Mortgages are a particular type of loan, useful for the purchase of a house. The loan is secured against the value of the house.

Average house prices in the UK are close to £200,000. Average incomes are, by comparison, £23,000 a year. Clearly, the average worker would be unable to buy a house without the help of a mortgage.

Banks and building societies are able to offer high mortgage loans because they can maintain the house as security. Basically, if you default on your mortgage payments the building society can repossess your house. We say this type of loan is a secured loan. Without the security of the asset, mortgage loans would not be possible.

Repayment of a mortgage

A building society profits from giving mortgages because it can charge interest over the term of the mortgage payment. Suppose you borrow a £140,000 mortgage to buy a house. If the term is fixed at 30 years, and interest rates average at 6%. This is the amount of interest and capital you are likely to repay.

- Monthly repayments £839

- Total Repayment £302,174

- Total Interest £162,700

Therefore, over the course of the 30 years you end up paying more than double the initial mortgage term. This is how the bank makes profit. But, it also enable you to buy a house, you wouldn’t be able to through saving.

The importance of Interest Rates on Mortgages

Monthly repayments on a mortgage depend upon

- The amount that you owe

- The interest rate.

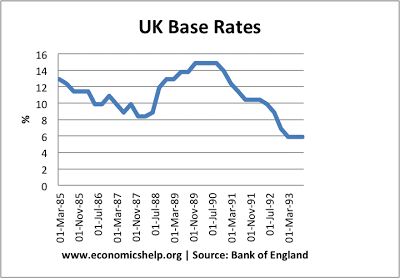

Interest rates are set by the Monetary Policy Committee and are used to control inflation. Therefore, the mortgage interest repayments can easily change from month to month. For example, in the past 12 months (July 2007) the MPC have increased interest rates 5 times. This is to combat rising inflation pressures in the economy.

Therefore, when you take out a mortgage, you have to be aware that the cost could increase significantly in the future, should interest rates rise.

For example, in 1992 UK interest rates reached 15% causing widespread mortgage defaults.

These are some of the pitfalls behind taking out a mortgage.

- Average house prices have increased faster than incomes.

- House Prices are not guaranteed to keep rising

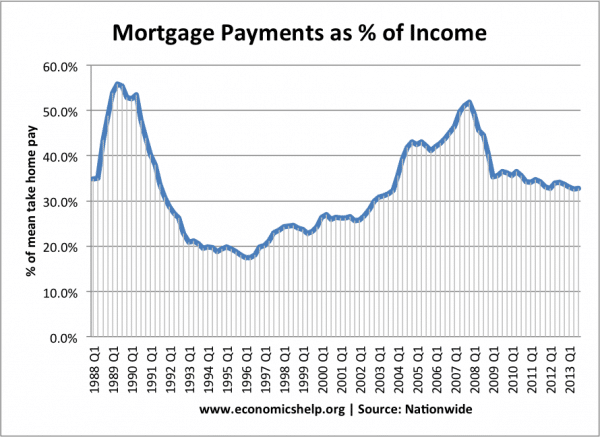

- Mortgage payments for first time buyers take a high % of income

- Variable interest rates in the UK. This means the cost of mortgage can change quite often. In the short term, interest rates are unlikely to increase; but, in the medium to long term it is difficult to predict

To get a mortgage students may have to consider an unconventional type of mortgage or ask for help from parents. These are some options for a student to get their first mortgage.

Types of mortgages

Interest only mortgage. This means that you don’t make any capital repayments, therefore you need to find an alternative investment scheme. Interest only mortgages may be an option, but, only for those who expect their income to increase in the near future – making it easier to switch to a repayment mortgage.

Joint Mortgage. This is becoming increasingly popular as a way to be able to afford a mortgage. A joint mortgage enables you to share your income with another person to be able to get a bigger mortgage.

Deposit from Parents. Unfortunately, this is often necessary to be able to get a mortgage. With a deposit from parents you have a better chance of getting a mortgage. Generally, the bigger the mortgage deposit, the more chance there is of getting lower interest rate on your mortgage.

Government Mortgage Scheme. In the UK, the government do offer some help to key public sector workers for buying a house. However, these tend to be restricted to a small number of people. If you are a public sector worker such as teacher, nurse or policeman it may be worth checking out.