A budget deficit is the annual shortfall between government spending and tax revenue. The deficit is the annual amount the government need to borrow. The deficit is primarily funded by selling government bonds (gilts) to the private sector.

Summary of effects of a budget deficit

- Rise in national debt

- Higher debt interest payments

- Increase in Aggregate Demand (AD)

- Possible increase in public sector investment

- May cause crowding out and higher bond yields – if close to full capacity

Economic effects of a budget deficit

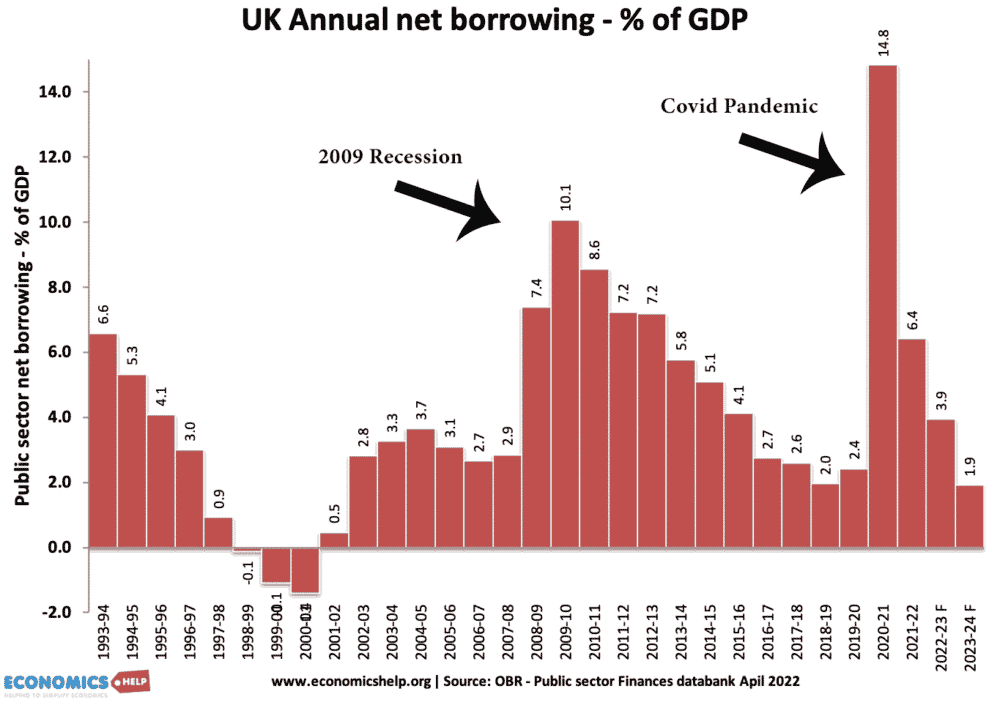

UK budget deficit significantly increased in 2009, due to the recession and expansionary fiscal policy.

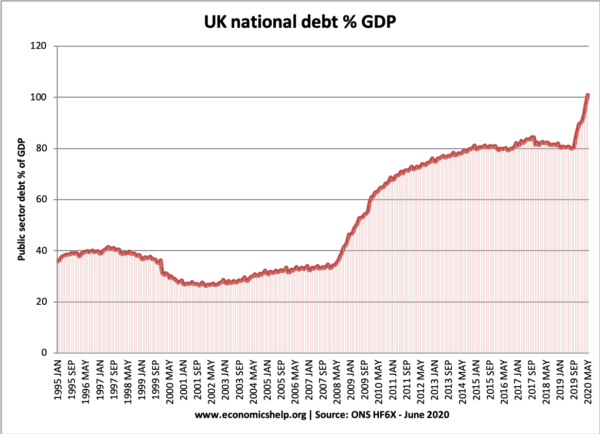

Increase in public sector debt

UK national debt increased since high deficits of 1999The government will have to borrow from the private sector. In the UK, the Debt Management Office (DMO) sells bonds and gilts to the private sector. The public sector debt is the total amount of debt owed by the government.

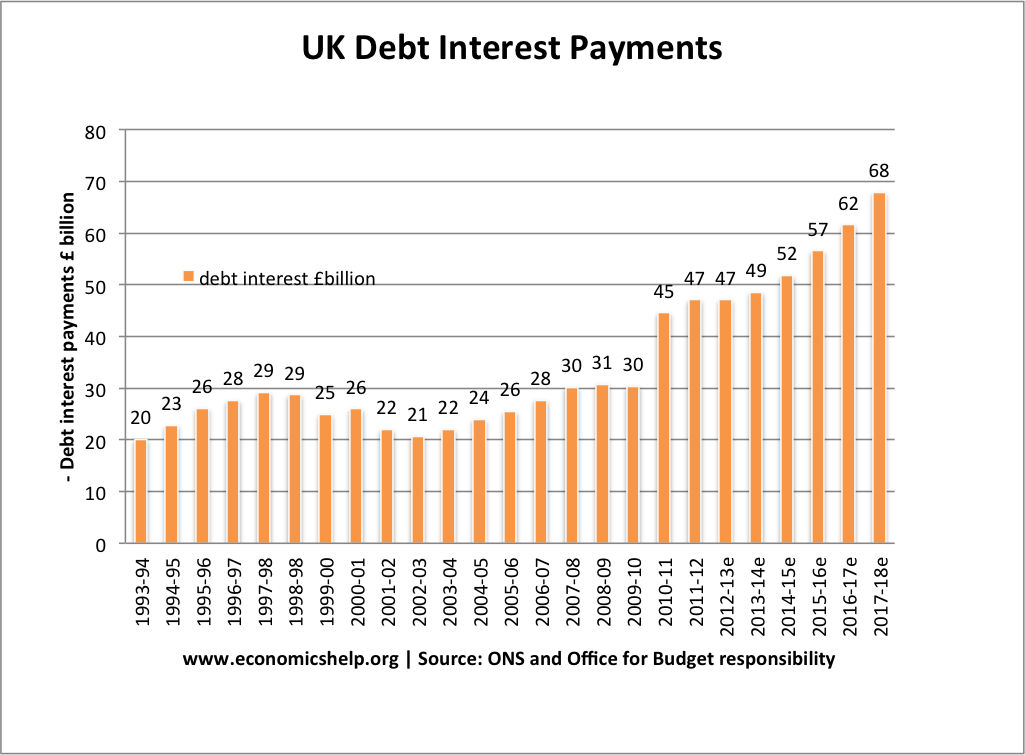

Higher debt interest payments

When the government borrows, it offers to pay an interest payment to those who buy the bonds. The interest rate attracts investors to lend the government money.

In 2009/10, the cost of debt interest payments on UK government debt was £30bn. By 2010/11 this interest cost had increased to £45bn.

Increased aggregate demand (AD)

A budget deficit implies lower taxes and increased Government spending (G), this will increase AD and this may cause higher real GDP and inflation. For example, in 2009, the UK lowered VAT in an effort to boost consumer spending, hit by the great recession.

Fund public sector investment

A government may run a budget deficit to finance infrastructure investment. This could include building new roads, railways, more housing and improved telecommunications. This public sector investment can help increase long-run productive capacity and enable a higher rate of economic growth. If growth does improve, then the borrowing can pay for itself. For example, many public sector investment projects can have a rate of return higher than the cost of borrowing

Future – higher taxes and lower spending

In the future, the government may have to increase taxes or cut spending in order to reduce the deficit. After 2010, the coalition government implemented a period of austerity. This involved cutting public sector spending; in particular, areas such as local government, public sector pay saw cuts in government spending – affecting public services and public pay.

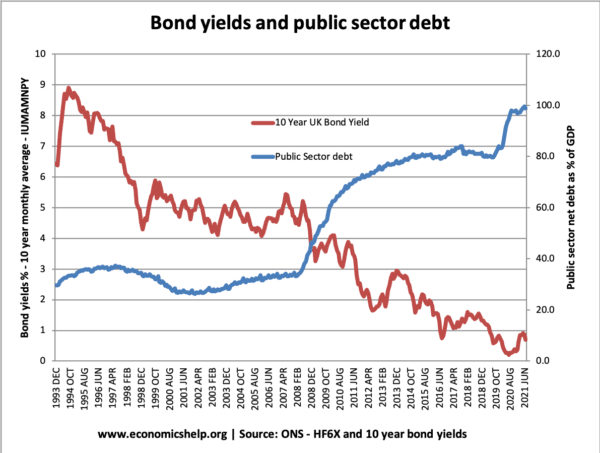

Increased interest rates/bond yields

If the government borrows more, this can cause interest rates to increase. This is because they will need to increase interest rates in order to attract investors to buy the extra debt. In 2012, countries in the Eurozone saw a rise in bond yields because there was a lack of confidence in Eurozone economies and the ability to finance the deficit.

Crowding Out

Increased government borrowing may cause a decrease in the size of the private sector. The government borrow by selling bonds to the private sector. Therefore, if the private sector (banks/private individuals) buy government bonds, they have less money to invest in private sector projects. If there is crowding out, government borrowing will not cause higher aggregate demand.

Inflation

- In extreme circumstances, the government may increase the money supply to pay the debt, and this will lead to inflation. This has occurred in countries such as Germany (1920s) and Zimbabwe (2000s). However, inflation from a budget deficit is rare in developed economies.

- If the government sells short-term gilts to the banking sector then there will be an increase in the money supply, this is because banks see gilts as near money, therefore, they can maintain there lending to customers.

Evaluation of the effects of a budget deficit

1. Depends on the situation of the economy

If the government increases borrowing in a recession, then there is unlikely to be crowding out. In a recession, we get a fall in private sector spending and investment – and a rise in private sector saving. In other words, in a recession, there is more surplus saving and therefore higher demand for the ‘relatively safe’ government bonds.

From 2009 to 2015, UK bond yields fell – despite high levels of borrowing. This was because there was high demand for buying government bonds.

However, if the government increase borrowing during a period of rapid economic growth – it is more likely to cause crowding out and rising bond yields.

2. Depends on why the government borrow

If the government borrow to finance infrastructure investment, it can help boost the supply side of the economy and enable higher economic growth. If growth improves, then there will be higher tax revenues to pay back the debt.

However, if the government is borrowing to pay pensions or welfare benefits, then there is no supply-side improvement, and it will be harder to pay back the debt.

3. Economic growth can influence future tax revenues

If the government borrow in a recession as part of expansionary fiscal policy then it can help accelerate an economic recovery and reduce unemployment. This will lead to improved public finances in the medium term and the budget deficit will prove more temporary. However, if the government borrow during a period of high growth, the crowding out will mean growth and cyclical tax revenues will be unchanged.

Related