Monetarists argue that if the Money Supply rises faster than the rate of growth of national income, then there will be inflation.

If the money supply increases in line with real output then there will be no inflation.

M.Friedman stated:

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.

Friedman (1970) The Counter-Revolution in Monetary Theory.

Quantity Theory of Money

Fischer Version MV=PT,

- M = Money Supply

- V= Velocity of circulation

- P= Price Level and

- T = Transactions.

T is difficult to measure so it is often substituted for Y = National Income

MV = PY where Y =national output

The above equation must hold the value of expenditure on goods and services must equal the value of output.

Explanation of why money supply leads to inflation

Monetarists believe that in the short-term velocity (V) is fixed This is because the rate at which money circulates is determined by institutional factors, e.g. how often workers are paid does not change very much. Milton Friedman admitted it might vary a little but not very much so it can be treated as fixed

Monetarists also believe output Y is fixed. They state it may vary in the short run but not in the long run (because LRAS is inelastic and determined by supply-side factors.)

Therefore an increase in the Money Supply will lead to an increase in inflation

Example 1

- If the total money supply is initially £1000 and the velocity of circulation is 5.

- The level of output (Y) is 5000 units.

- £1000×5 = P (5000)

- Therefore P = 1

- If the money supply now doubles the equation =

- 2000×5 =P×5000

- Therefore P = 2

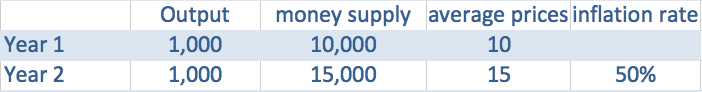

Example 2

- If the output is 1,000 units, and there is a money supply of £10,000. The average price of good will be £10.

- In year 2, if the output stays at 1,000 units, but money supply increases to 15,000. Consumers have more money to buy the same amount of goods. Therefore, firms put up prices to reflect this increase in money supply. Ceteris paribus, average prices will rise from £10 to £15.

Other points

- Milton Friedman predicted an increase in the money supply would take about 9-12 months to lead to higher output.

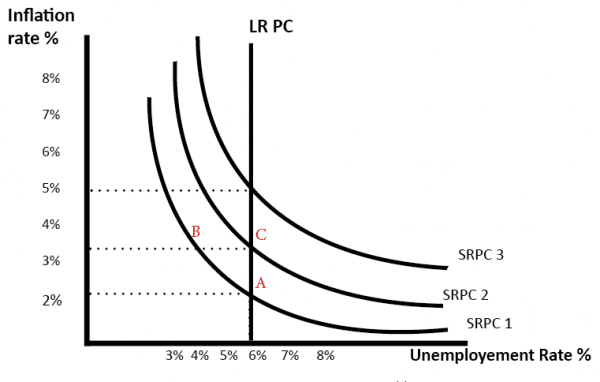

- Friedman placed great emphasis on the role of price expectations. If there are expectations of higher inflation, it becomes self-fulfilling – workers demand higher wages to meet rising living costs. Firms put up prices to meet rising costs. Strict monetarist policies would help reduce expectations.

- After another year output will return to its initial equilibrium causing prices to rise to accommodate the rise in money supply

- Cambridge Version of quantity theory states P= f(M)

- Monetarism became more popular in the 1970s due to rising inflation. (partly caused by rising oil prices).

- In the early 1980s, the UK and US adopted monetarist policies with mixed results.

Friedman’s k-percent rule

- Milton Friedman argued that the money supply should rise by a fixed k-percent each year. This rate of increase should depend on institutional factors and be determined independently of policymakers.

- Friedman believed this rule would avoid the extremes of deflation (Falling money supply, e.g. Great Depression) and inflation due to rising money supply.

- It would give business strong expectations of what would happen to money supply and inflation.

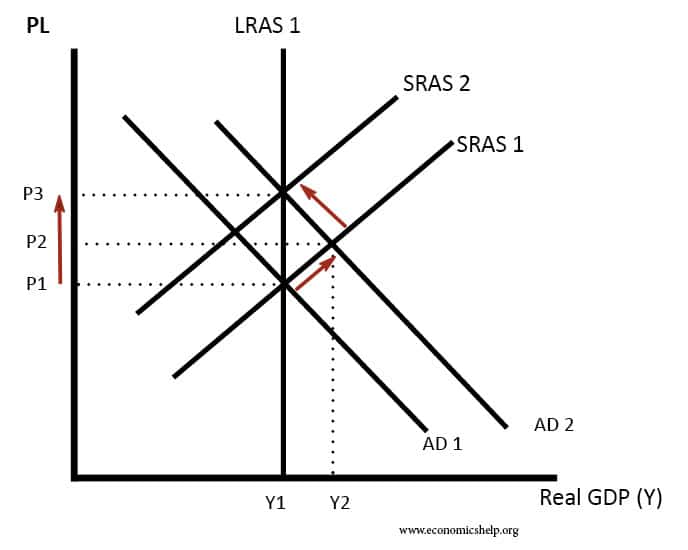

- Monetarist inflation in the AD and AS model

- Following a rise in the Money Supply, consumers have more money and therefore spend more money on goods; this shifts AD to the right. AD1 to AD 2.

- Firms respond by increasing output along SRAS. Real output increases from Y1 to Y2.

- National output now exceeds the equilibrium level of output. Therefore there is an inflationary gap.

- Firms need to hire more workers, so wages rise leading to an increase in costs and hence prices. Initially, workers agree to work more hours because they see an increase in nominal wages.

- As prices rise money can buy less, therefore, there is a movement to the left along the new AD

- Also, workers realise the increase in nominal wage is not a real wage increase. Therefore, workers also demand higher nominal wages to produce more output and to compensate them for rising prices, therefore SRAS shifts to the left.

- The economy has returned to the equilibrium level of output (Y1), but at a higher price level (P3).

- Therefore the rise in the Money Supply cause a rise in AD, But because the LRAS is inelastic there is no increase in real output, but inflation rises. It is a form of demand-pull inflation.

Monetarist view of Phillips curve

Criticisms of monetarism

- The link between the money supply and inflation is often very weak in practice.

- The velocity of circulation (V) is not stable but can vary significantly due to confidence, changes in the use of credit cards, decline in use of cash. e.t.c

- Targetting arbitrary money supply targets can cause a severe recession and high unemployment. For example, UK targetted money supply growth in the early 1980s, but this caused the recession of 1981 with many economists arguing it was deeper than necessary.

- The large increase in the monetary base following the 2009 recession did not cause any inflationary pressures.

- Why not target inflation directly? If you want to control inflation, it makes more sense to target inflation directly rather than through the intermediary of the money supply.

- Monetarists say that income can vary in the short run, but the short run could be a long time and therefore make monetary policy ineffective, Keynesians argue that the LRAS is not necessarily inelastic they argue that the economy can be below full capacity for a long time.

Related