Nationalisation occurs when the government take control of an industry previously owned by private firms.

For example, after 1945, the Labour government nationalised key industries, such as railways, steel and electricity. The argument was that the government would be able to run the industries in the best interests of society.

Arguments for Nationalisation include

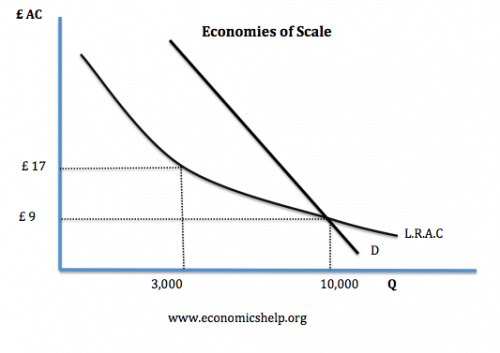

1. Natural Monopoly

Many key industries nationalised were natural monopolies. This means the most efficient number of firms in the industry is one. This is because fixed costs are so high in creating a network of water pipes, there is no sense in having any competition. A private natural monopoly could easily exploit its monopoly power and set higher prices to consumers. Government ownership of a natural monopoly prevents this exploitation of monopoly power.

If industry demand is 10,000 – then the most efficient number of firms is one.

See more at: Natural Monopoly

2. Profit shared with taxpayer

If Virgin Trains set high ticket prices, you know the profit margin will go to a small number of wealthy shareholders. If the same service was run by a nationalised British Rail, any profit from profitable train services would go to government revenues and enable lower tax rates.

2. Externalities

Some of the nationalised industries had significant positive externalities. For example, public transport plays a key role in reducing pollution and congestion. A private firm would ignore the positive externalities, but a government run public transport system could invest in public transport to help improve the economic infrastructure.

3. Welfare Issues

Some industries play a key role in the welfare of consumers and citizens. For example, gas and water could be considered necessities for basic living standards and not luxuries. Government provision means that needy groups can be looked after and provided with basic necessities.

4. Industrial Relations

Labour unions often favour nationalisation because they feel they may be better treated by the government – rather than a profit maximising monopoly.

5. Government Investment

Some industries require long-term investment to improve services over time. This long-term investment may not be profitable in the short-term, so without government intervention, they may suffer from lack of long-term investment.

6. Free market failure

WIth train franchises, two private train franchise of East Coast Mainline has failed, with the government having to step in. The third franchise Stagecoach/Virgin has also admitted difficulties, stating it overpaid for the franchise. [1] When the government managed the service, the company made a decent profit – showing that nationalised industries can be successful in running profitable services.

7. Saved banking system

Two large banks would have gone bankrupt (Lloyds, Royal Bank of Scotland) without government intervention. Since the crisis, the government has owned shares in these two banks – showing that government ownership can provide greater stability than free-market forces.

Evaluation of benefits of nationalisation

- Ownership is only one factor. Shifting ownership from the private sector to the public sector is only one factor in whether it will be successful. It also depends on how the nationalised firm is managed. For example, is it possible to give workers in nationalised industries effective incentives to work hard, increase productivity and increase efficiency? This would combine the best of both worlds

- Do workers feel a sense of ownership with nationalised industries? In the 1930s, workers in the Soviet Union were genuinely enthused by the “Soviet System’ (with high degrees of political repression) and output rose faster than capitalist economies. But, by 1960s and 70s, workers in the Communist Soviet Union were completely demoralised. The joke went amongst Soviet workers “They pretend to employ us, we pretend to work.

- Does nationalisation mean increased centralisation to committee’s in Westminster or can effective control be delegated to local bodies who have a closer relationship with industries?

- In the UK coal mining industry, the initial enthusiasm for nationalisation wore off because the industry faced serious challenges – declining demand, increased uncompetitiveness and desire for coal mines. Also, are the funds for investing in nationalised industries there?

- It depends on the industry

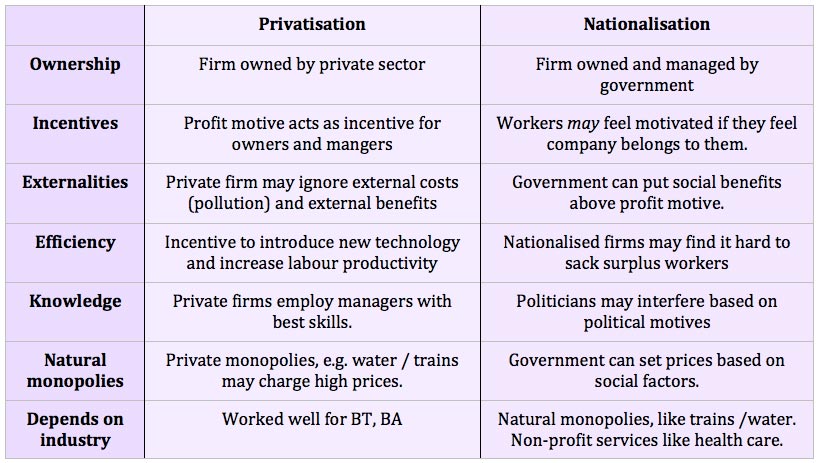

Nationalisation vs Privatisation

Related pages