Oligopoly is a market structure in which a few firms dominate the industry; it is an industry with a five firm concentration ratio of greater than 50%.

In Oligopoly, firms are interdependent; this means their decisions (price and output) depend upon how the other firms behave:

- Barriers to entry are likely to be a feature of Oligopoly

- There are different models to explain how firms may behave

The kinked demand curve model suggests firms will be profit maximisers.

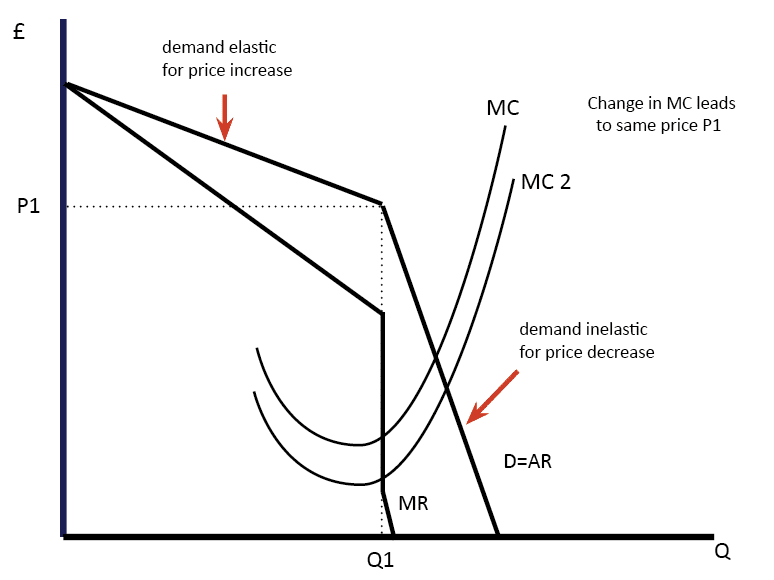

Kinked Demand Curve Diagram

At p1 if firms increased their price, consumers would buy from the other firms. Therefore, they would lose a large share of the market and demand will be elastic. Therefore, firms will lose revenue by increasing the price.

If firms cut price then they would gain a big increase in market share. However, it is unlikely that firms will allow this. Therefore, other firms follow suit and cut-price as well. Therefore demand will only increase by a small amount: Demand is inelastic for a price cut and revenue would fall.

This model suggests price will be rigid because there is no incentive for firms to change the price

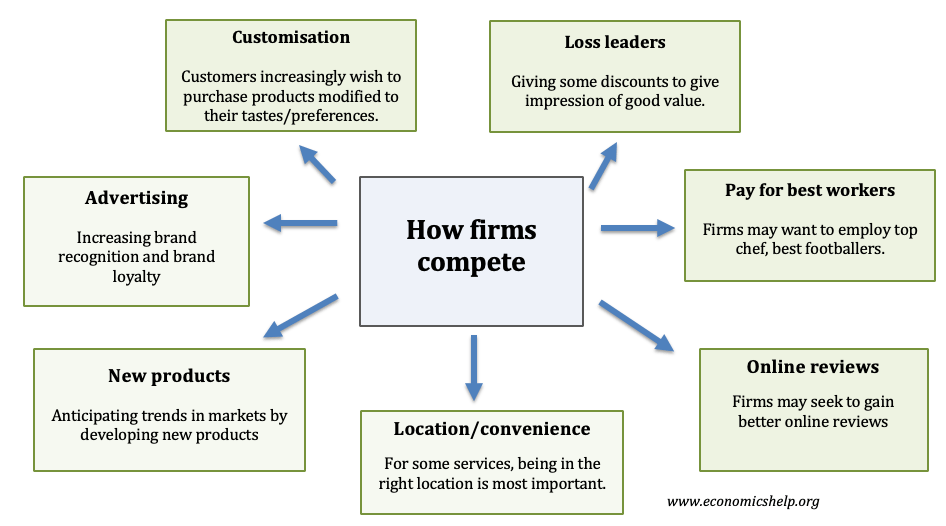

If prices are rigid and firms have little incentive to change prices they will concentrate on non-price competition. This occurs when firms seek to increase revenue and sales by various methods other than price.

For example, a firm could spend money on advertising to raise the profile of their product and try and increase brand loyalty, if successful this will increase market sales. Advertising is a big feature of many oligopolies such as soft drinks and cars. Alternatively, they could introduce loyalty cards or improve the quality of their after sales service. When buying a plane ticket price is not the only factor consumers look at, they may prefer airlines with more leg room, air miles e.t.c.

Non-price competition depends upon the nature of the product. For example, advertising is very important for soft drinks but less important for petrol.

However, in reality, this model doesn’t always occur. Often the objectives of firms are not to maximise profit. For example, they may wish to increase the size of their firm and maximise sales. If this is the case, they may be willing to take part in a price war, even if this does lead to lower profits. Price wars involve firms selling goods at very low prices to try and gain market share. For example, newspapers such as the Times and the Sun have recently been sold very cheaply. Price wars are more likely if:

- 1. Large firms are able to cross subsidise one market from profits elsewhere

- 2. In a recession, markets are more competitive as firms seek to retain customers

However, price wars may only be short-term

A firm may engage in predatory pricing; this occurs when the incumbent firm seeks to force a new firm out of business by selling at a very low price so that it cannot remain profitable.

Using game theory

Game theory looks at different possible outcomes of oligopoly – depending on how firms react to different decisions.

If the firms in oligopoly seek to increase market share the most likely outcome is that they both set low prices and make a low profit (£3m each) However if the firms could come to some agreement either formal or tacit collusion – they could both agree to raise prices. This will require the firms to reduce output and stick to the more limited supply. If they set high prices, then they will both be able to make monopoly profits (£8m each)

However, when prices are high, there is a temptation to undercut your rival and benefit from both high market prices and high output. This enables higher profit – £10m, but if firms start to cheat – then rivals are likely to retaliate by cutting prices too.

Collusion is possible in oligopoly, but it depends on several factors. Collusion is more likely if

1. There are a small number of firms, who are well known to each other – this makes it easier to stick to output quotas

2. A dominant firm, who is able to have a lot of influence in setting the price.

3. Barriers to entry, this is important to stop other firms entering to take advantage of the high profits

4. Effective communication and monitoring of output and costs

5. Similar production costs and therefore will want to raise prices at the same rate

6. Effective punishment strategies for firms who cheat

7. No effective government legislation, e.g. collusion is illegal in the UK.

Conclusion:

There is no certainty in how firms will compete in Oligopoly; it depends upon the objectives of the firms, the contestability of the market and the nature of the product. Some oligopolies compete on price; others compete on the quality of the product.

Examples of Competition in oligopoly

Petrol is a homogenous product and so is likely to be quite stable in prices. Firms often move petrol prices in response to changes in the oil price. However, the introduction of the supermarket own brand petrol has changed the market. Tesco and Sainsbury’s are more willing to sell cheaper petrol to attract customers to shop at their supermarket.

Coffee market

This takeaway coffee at 99p is quite cheap – suggesting a competitive oligopoly. However, for many customers, the price of coffee is secondary to the quality and environment of the coffee shop. Traditional coffee shops like Costa and Starbucks use more non-price competition to attract customers – as much as offering cheap prices.

In fact, there is a danger selling cheap coffee – may indicate to consumers lower quality.

How firms compete in general

See more – How firms compete

See also: