A merger will lead to a bigger firm and a greater market concentration. This can have both advantages and disadvantages for the public interest.

A merger is likely to reduce competition and give the new firm more market power. Therefore, it will be able to increase prices leading to a decline in consumer surplus and could cause allocative inefficiency. This occurs when goods are not distributed optimally according to consumer preferences; If Price > MC then there will be allocative inefficiency.

However, it depends upon the market share of the new firm. If 2 small supermarkets merged such as NETTO and ALDI the new firm would only have about 5% of market share, this is unlikely to reduce competition significantly.

The Competition Commission defines a monopoly, as a firm with more than 25%. If Tescos and Sainsburys merged the new firm would have over 40%. This is likely to lead to a significant reduction in competition and lead to higher prices. Therefore it would be beneficial to block this particular merger.

The Competition Commission should also look at local competition, for example, a firm may have 12% of the national market share, but in some regions it could have monopoly power; therefore it may be necessary to block this as well.

Another problems of a merger is that with an increase in monopoly power, the firm may have less incentives to cut costs and be efficient. This is known as X inefficiency. Also, if there are less firms in the market it may be easier to collude and increase prices. This will lead to allocative inefficiency because prices will be greater than MC (see Monopoly diagram) Other possible disadvantages include:

- If firms make more supernormal profits they may be able to use this for predatory pricing and force new firms out of business.

- Also if firms get too big they may suffer from diseconomies of scale leading to more inefficiency.

- The new firm may be able to use its monopoly power to pay suppliers less and therefore make more profits, E.g. supermarkets with monopoly power have been able to reduce profit margins for producers such as farmers.

- A merger may lead to job losses, the govt may consider this factor. However, if the job losses lead to greater efficiency then the economy will benefit in the long run

All these suggest mergers have disadvantages and should be blocked, however, the govt must look at the possible advantage of mergers as well.

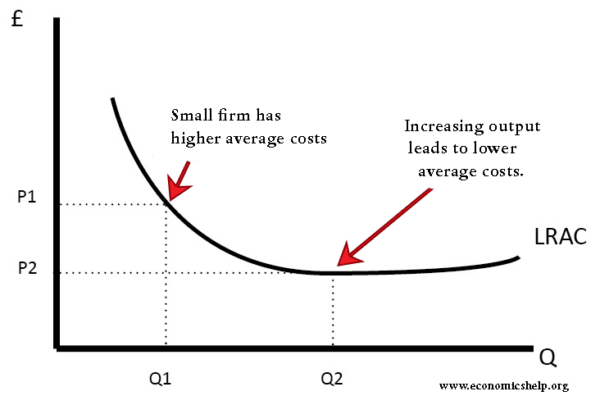

For example, the new bigger firm may benefit from more economies of scale and have lower average costs, this can then lead to lower prices. This is important in industries such as cars where there are high fixed costs and scope for technical economies.

A bigger firm may also be in a better position to invest in research and development. This can lead to better products in the long term, this is important for industries such as planes where investment is needed, but is less important in industries like cafes.

A firm may have a domestic monopoly, but this may be necessary to compete in the global market, e.g. cars or steel. Therefore a merger between 2 domestic firms may be beneficial.

Conclusion: There are certain cases when a merger can be against the public interest and the govt should block it. This usually occurs when the new firms has a significant Market share (>25%), but without any benefits such as economies of scale and more investment.

See also: