Perfect competition is a market structure

- Where there are many small firms

- There is freedom of entry and exit

- There is perfect information about price and supply

- Products are homogenous.

- Definition of Perfect Competition

Outcome of perfect competition

- Firms are price takers

- Firms will make normal profit (where AR=AC). If firms made supernormal profits – more firms would enter causing price to fall.

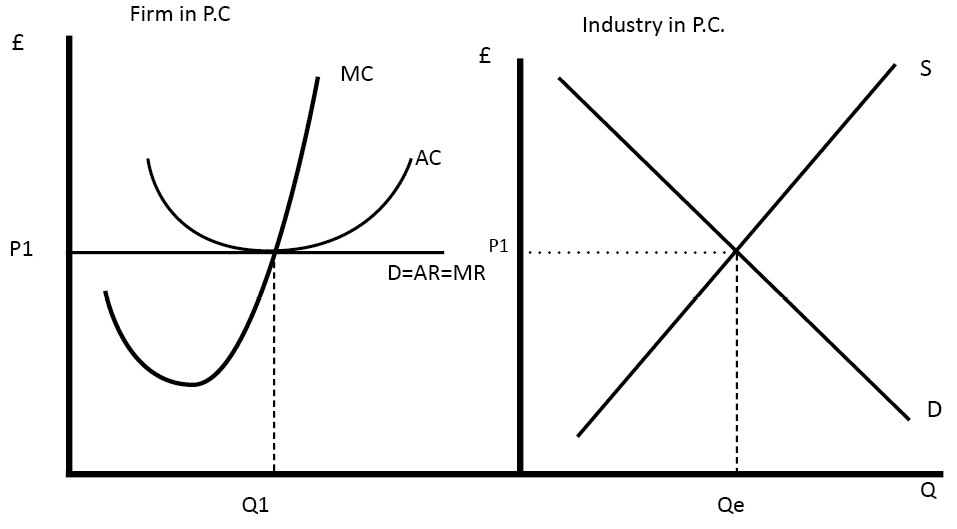

Diagram of Perfect Competition in long run

An individual firm will product at Q1, where MR=MC. At this equilibrium, we can examine the efficiency of the market.

1. Allocative efficiency occurs where P = MC. In this case, the firm will be allocatively efficient because at Q1 P=MC

2. Productive Efficiency. This occurs on the lowest point of the AC curve. This happens at Q1. This is because firms produce at the lowest point on the AC

3. X efficiency. Competition between firms will act as a spur to increase efficiency. In perfect competition, this is likely to occur.

4. Resources will not be wasted through advertising because products are homogenous

5. Normal profit means consumers are getting the lowest price. This also leads to greater equality in society

Inefficiency of Perfect Competition

- No scope for economies of scale. This is because there are many small firms producing relatively small amounts. Industries with high fixed costs would be particularly unsuitable to perfect competition. This is one reason why perfect competition. is unlikely in the real world. It means firms cannot benefit from efficiencies of scale.

- Dynamic efficiency? Lack of supernormal profit may make investment in R&D unlikely. This is important in an industry such as pharmaceuticals which require significant investment. Because there is a lack of investment, the firms may become static – there is no improvement in productivity and no reduction in costs over time; this makes them dynamically inefficient.

Other potential problems of perfect competition.

- With perfect knowledge, there is no incentive to develop new technology because it would be shared with other companies.

- If there are externalities in production or consumption there is likely to be market failure without government intervention.

- Undifferentiated products are boring giving little choice to consumers. Differentiated products are very important in industries such as clothing and cars

Reality of perfect competition

In the real world, perfect competition is very rare and the model is more theoretical than practical.

However in general economists often talk about competitive markets which do not require the strict criteria of perfect competition.

A competitive market is one where no one firm has a dominant position but the consumer has plenty of choices when buying goods or services. Therefore in competitive markets, we would expect:

- Firms to have a small share of the market

- Few barriers to entry

- Low prices for consumers

- Allocative efficiency

- Incentives for firms to cut costs and develop new products

- Profits will be lower than in markets with Monopoly power

This is linked closely to the idea of Contestable markets which is concerned with low barriers to entry and freedom of entry.

see also: