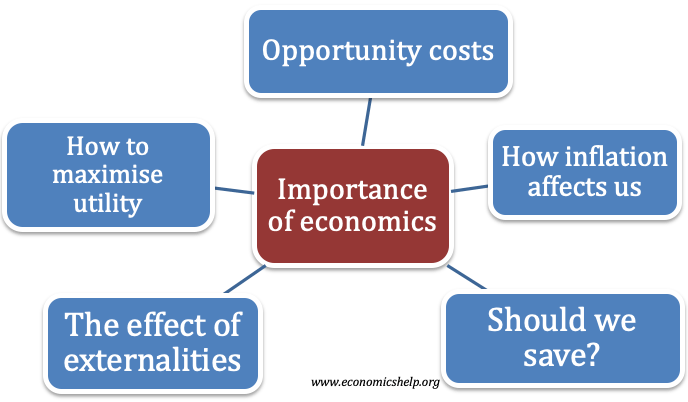

Importance of economics in our daily lives

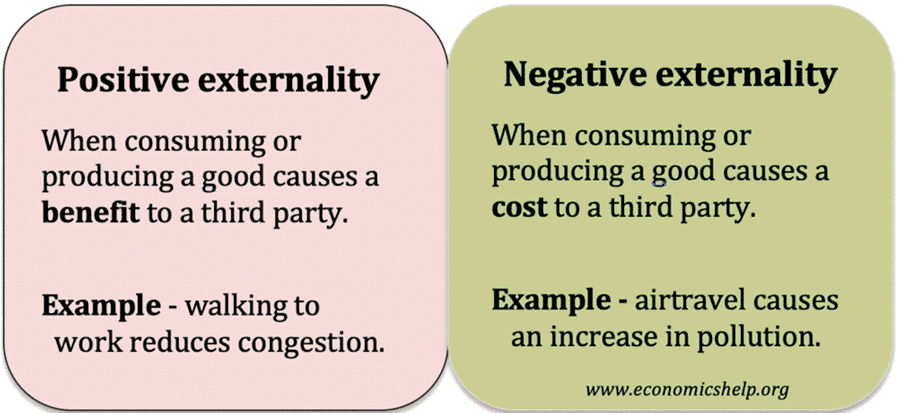

Economics affects our daily lives in both obvious and subtle ways. From an individual perspective, economics frames many choices we have to make about work, leisure, consumption and how much to save. Our lives are also influenced by macro-economic trends, such as inflation, interest rates and economic growth. Summary – why economics is important The …