The money supply is the amount of money in circulation measured by narrow money (MO) and broad money (M4).

The money supply can rise if

- Central Banks print more money.

- Banks choose to hold a lower liquidity ratio. This means banks will be willing to lend a larger proportion of their funds.

- An inflow of funds from abroad. If the B of E has to buy the surplus pounds on the foreign exchange markets to build up foreign reserves. This sterling will be used by foreigners to buy UK exporters this will then be deposited in banks by the exporters, credit will be created leading to a multiplied increase in the money supply. This will only occur when the B of E attempts to maintain an e.r below the equilibrium

- Government borrowing is financed by increasing the money supply

- If gov’t sells securities to the B of E, this will lead to an increase in the money supply, because bank’s deposits are seen as liquid assets

- Government sells securities to overseas purchasers; this will lead to an increase in the MS if the er doesn’t increase

- B of E sells Treasury bills to the banking sector. These are seen as liquid assets, and so they can be used as the liquidity base for additional loans to customers. Therefore there will be a multiplied increase in the Money supply

- Government sells bonds to the banking sector. Bonds are seen as illiquid, and therefore there will be not used as a base for lending money

- Government sells bonds or bills to the non-banking sector. If the public buys anything from the government they will reduce their deposits in banks; there will be no expansion in the money supply.

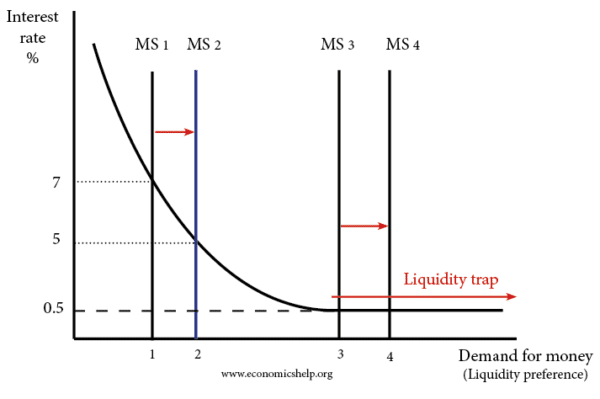

- Expansionary fiscal policy. In a liquidity trap, a lower liquidity ratio may not increase the money supply – because banks don’t want to lend and firms don’t want to borrow. There is often a ‘paradox of thrift’ business, and consumers want to increase savings – and this leads to a fall in spending and investment. If the government borrows from the private sector and spends on public work investment schemes, then this will start a multiplier effect where households gain wages to spend and encourage private sector investment.

Flow Of Funds Equation

- This shows the components of a change in money supply.

- A change in money supply is a flow into or decrease into the money stock.

- If we want to compare the size of the money stock at one point in time Mst with that of a previous point in time (Mst-1), then we have to look at the flow (change) of money between these two points (change Ms)

Mst= Mst-1 +change Ms

What does change Ms consist of? thus liquidity increases because

- Government borrowing financed by the banking sector

- The banking sector increasing lending to the private sector

- If the banking sector lowers its liquidity ratio in response to an increase in demand for loans

- If there is a currency flow surplus and hence a net inflow from abroad. Also included in item four is that part of the government borrowing that is funded by borrowing in foreign currency, this reduces the expansionary effect of the government borrowing.

The relationship between Money Supply and the rate of interest

Some monetary theory assumes the supply of money is totally independent of the interest rate. However Keynesian models assume that:

- higher demand for credit will push up interest rates, making it more attractive for banks to supply credit

- higher interest rates may attract deposits from overseas.

- Higher interest rates may encourage depositors to switch money from sight accounts to time accounts. Banks can then decrease liquidity ratio

- Lower interest rates cause an increase in the money supply

Key Terms

- Money Supply

- Narrow and broad money supply

- Maturity transformation

- Liabilities

- Sight deposits

- Time deposits

- Liquidity

- Liquidity ratio

- Lender of last resort

- Central bank

- Bank multiplier

- Money Multiplier

Examples of increasing the money supply

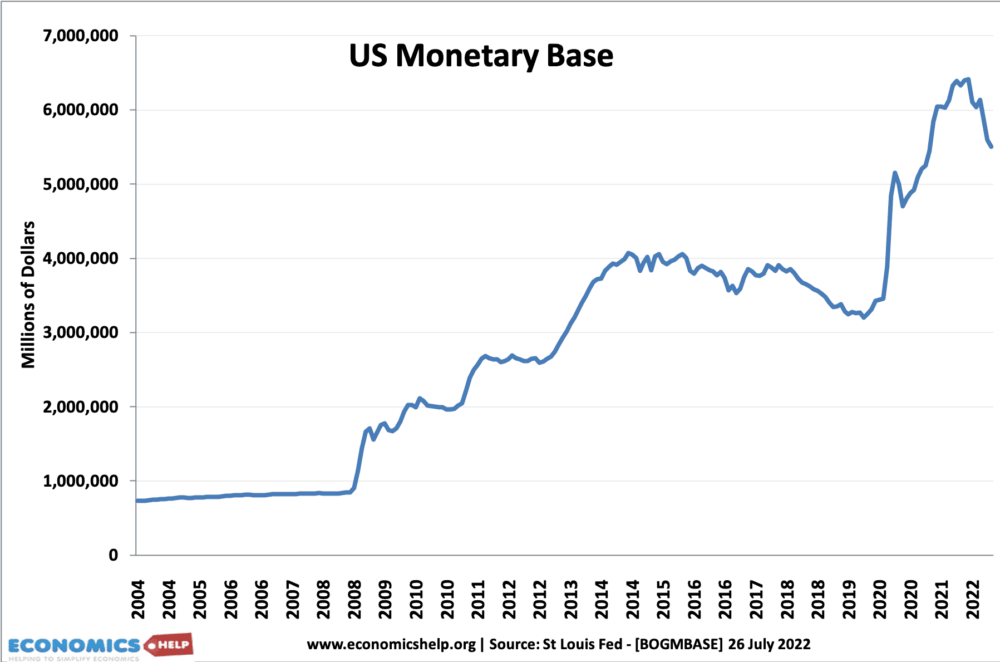

Between 2008 and 2020, the Federal Reserve created money to buy bonds from commercial banks. This led to a rise in the monetary base or ‘narrow’ definition of the money supply.

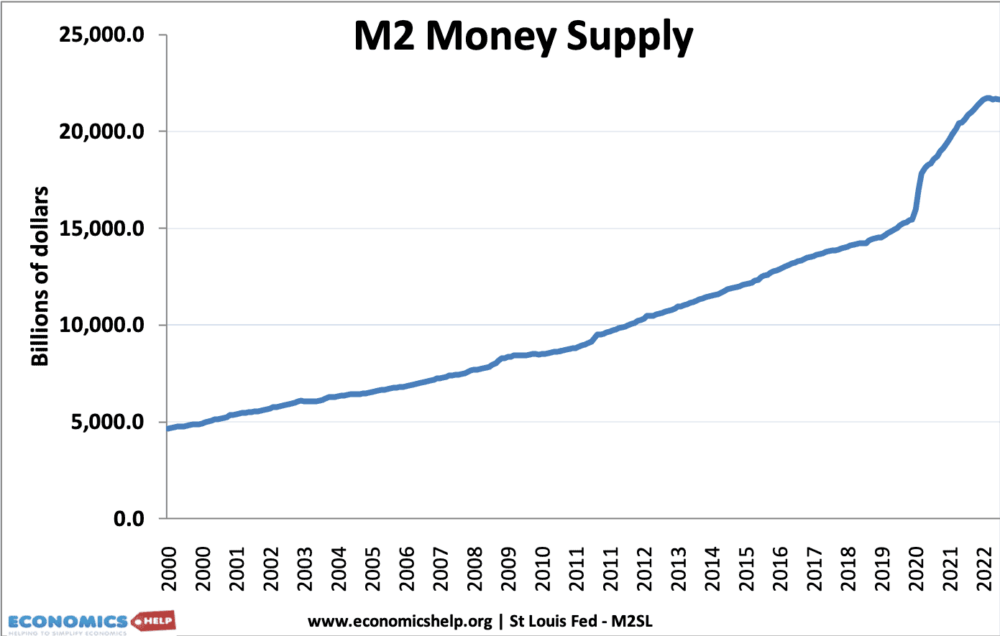

In 2009, the policy of quantitative easing increased the monetary base (M0) however, banks did not want to lend this money so M2 money supply growth didn’t change.

However, following the quantitative easing of 2020 (during Covid pandemic) there was a stronger economic recovery and the money supply jumped. This shows it is not just the monetary base, but how keen the economy is to use the extra money.

Related