Firstly, this post will help consider the impact of zero inflation on AD and economic growth – Is zero inflation a good thing?

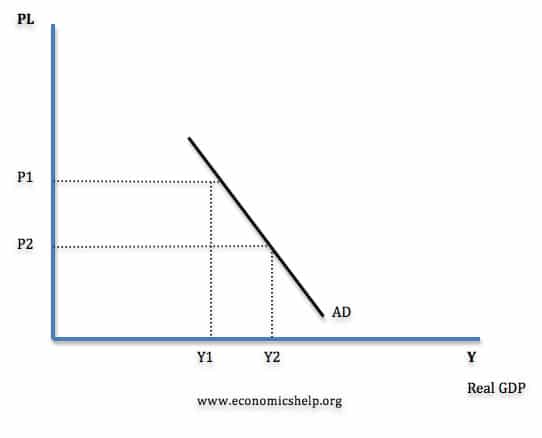

To add a few things to this. Let us look at an AD curve

Aggregate Demand Curve

If we look at an aggregate demand curve, we usually assume that a lower price level causes a movement along the AD curve (and higher AD).

Therefore, zero inflation should, in theory cause higher AD. The AD curve is sloped like this because:

- A lower price level, ceteris paribus, gives consumers more disposable income. Assuming constant nominal wage growth a fall in the inflation rate, will give consumers more income, and so they will be more willing to spend.

- A lower price level will, ceteris paribus, make UK goods more competitive and therefore encourage UK exports (X is a component of AD)

- At a lower price level, interest rates usually fall, encouraging more spending (see effect of lower interest rates.)

However

- This simple model of AD – plotting Price Level (PL) and National Income (Y) is an over-simplification. We talk about a lower price level, when often we mean just a fall in the inflation rate. I’m often uncomfortable with this model that slips in between price level / inflation rate. But, for A – Level economics at least, we don’t make the model more complicated.

- The UK has seen a fall in the inflation rate to zero, but this fall in the inflation rate has occurred in many other European countries (some EU countries have experienced outright deflation), therefore the UK has not seen a big boost to competitiveness, and we would not expect a big rise in export demand as a result of zero inflation. Furthermore, the European economy is sluggish, there is weak export demand – even if we were more competitive.

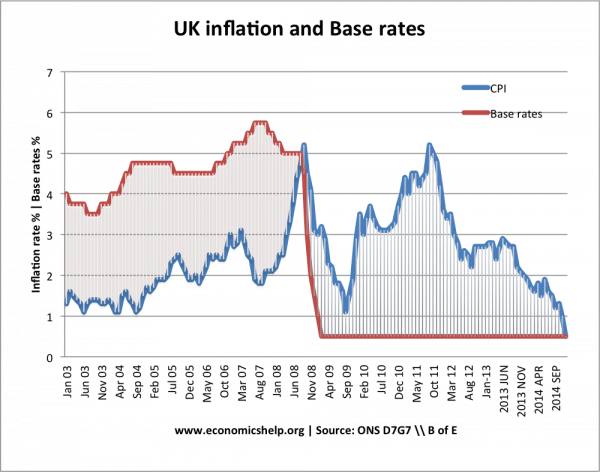

- Interest rates have been at 0.5% since March 2009, so with this fall in inflation to zero, monetary policy has effectively become tighter – real interest rates have increased.

The fall in inflation to zero, has led to positive real interest rates for the first time since 2008.

Wage growth has been limited. There are some signs of positive wage growth in the UK, but it has been quite limited; many householders have seen only very small growth in real wages.

Other impacts of zero inflation

As mentioned in other posts, zero inflation will affect aggregate demand in other ways.

- Falling inflation rate may encourage people to delay buying expensive goods – hoping they will continue to fall in price – therefore AD may fall.

- Real value of debt will increase. People may have expected moderate inflation of 2% to steadily erode value of their debt, but with zero inflation and limited wage growth, these debt burdens are becoming higher than expected.

- The impact of zero inflation may be different for different groups. Zero inflation will be welcomed more by people with fixed incomes and those living off savings. Pensioners may respond to zero inflation by spending more. Young people struggling with rising rents, high debt and limited wage growth, may not spend more.

Further reading