Readers Question: How does an increase in imports cause inflation in the economy?

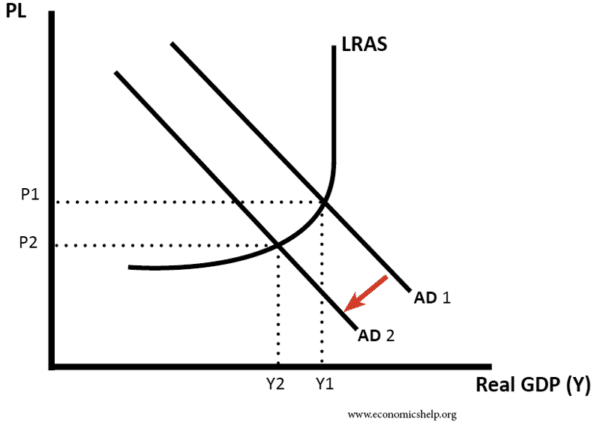

If the quantity of imports increases, this should reduce domestic demand-pull inflation

(AD = C+I+G+X-M). Therefore if consumers spend more on imports it will, ceteris paribus, reduce domestic demand. Therefore, we get lower growth of AD and lower inflation.

Suppose there is an increase in the marginal propensity to import. Rather than 20% of consumer spending going on imports, this rises to 30% – then this implies less spending on domestic goods.

If higher imports cause lower domestic demand, we will see lower inflation.

Imports and an economic boom

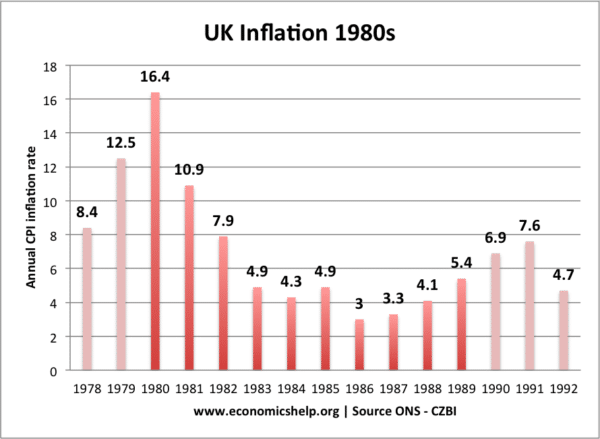

However, often a rise in imports occurs because there is a rise in general spending. For example, in the UK in the late 1980s, there was rapid growth in real incomes – this caused both domestic demand-pull inflation and also a rise in imports. (causing trade deficit)

In this case, the rise in spending on imports occurred alongside an increase in the inflation rate.

Imports and exchange rate

The other effect is that a rise in imports will, ceteris paribus, cause a depreciation in the exchange rate. This is because to buy imports, we have to supply more pounds to be able to buy foreign imports. This rise in the supply of sterling causes a depreciation in the pound.

A depreciation in the exchange rate tends to increase inflationary pressure because:

- Imports become more expensive

- Exports and AD increase causing demand-pull inflation

- With more competitive exports, firms have less incentive to cut costs

It is one of those issues where it is impossible to say with certainty exactly what will happen. It depends on which effect is bigger – the reduction in AD or depreciation in the exchange rate. Overall, I would imagine the impact on inflation of higher imports to be negligible.

It’s a bit like saying how do higher interest rates effect current account deficit?

- Higher interest rates increase exchange rate worsening current account

- But, on the other hand, higher interest rates reduce consumer spending, reduce imports and improve the current account.

How inflation may affect import spending

Suppose the UK saw a rise in inflation and this caused UK inflation rate to be higher than its main competitors. In this case, UK goods would become less competitive – leading to lower demand for domestically produced goods. Instead, consumers would look to buy more imports because they will be more competitive.

Related

very useful, cleared up an ambiguous area in my textbook!

why increase the supply of sterling to buy foreign imports?

it is ceterus parabus, assuming that everything else is the same. That would mean that the money supply in the economy would stay the same so an increase in imports would force the government to increase supply of sterling.