Readers Question I am confused by the statement that is written in my O level text book (Economics Author: Dan Moynihan; Brian Titley). It says that if the current account is in surplus the financial account will be in deficit. Is this true?

Yes, it is true

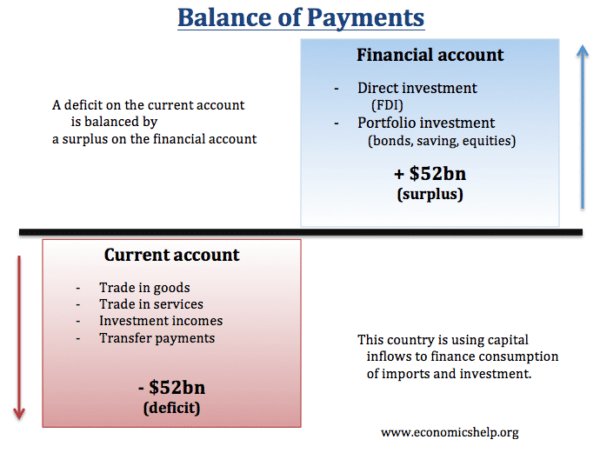

- Firstly, the current account on balance of payments measures trade in goods, services, investment incomes and current transfers

- The financial account measures capital flows / short term and long term. For example, long-term investment in building a factory or financial flows such as buying bonds or depositing money in bank accounts.

Current Account = (Financial + Capital Account)

Note: The (Financial + Capital Account) used to be just called the capital account.

Why does the Current Account and Financial account balance?

Basically, if we import goods and services, we need an inflow of capital (financial flows) to be able to pay for them.

If you take a simplistic model.

Suppose, we import £1m of clothes from China. We need to buy £1m of Chinese Yuan. To get this foreign currency, we need an inflow of foreign currency in the financial account.

For example, if the Chinese deposited £1m of Chinese Yuan in British Banks, the foreign currency comes into the UK, and this is how we can afford the goods. This bank deposit would be counted as a short-term capital flow and included in financial account as a credit item. This balances the debit on our trade in goods.

What would happen if we couldn’t attract capital flows?

Suppose the UK had a current account deficit because the UK was importing goods from China, but, China wasn’t sending capital flows to the UK. This would mean more money is flowing out of the UK than coming in.

This would mean the supply of pounds is greater than the demand and the Pound would fall in value. This would make our exports cheaper and imports more expensive. If exports are cheaper, the demand will increase. Conversely more expensive imports would reduce their quantity. Therefore depreciation would improve the current account deficit until it was in equilibrium.

Since the Credit Crunch, the UK has found it harder to attract capital flows. Because we have a current account deficit, we have seen the Pound fall in value. So a large current account deficit often causes a depreciation, especially, if the country struggles to attract a balancing item on the financial/capital account.

how depreciation in the value of pound which is going to make export cheaper and inport expensive, will evetually reduce current account deficit.

Depreciation in the value of pound means that the currency value of the pound is now relatively cheaper.

Domestic goods (exports) are now cheaper to foreign consumers and so they may increase demand, hence increasing quantity of export sold.

Since the domestic currency has depreciated against the foreign currency, the domestic country will find the import more expensive, hence may decrease demand for imports.

With increase in export, along with a decrease in import – this improves the current account (by definition, current account = inflow – outflow).