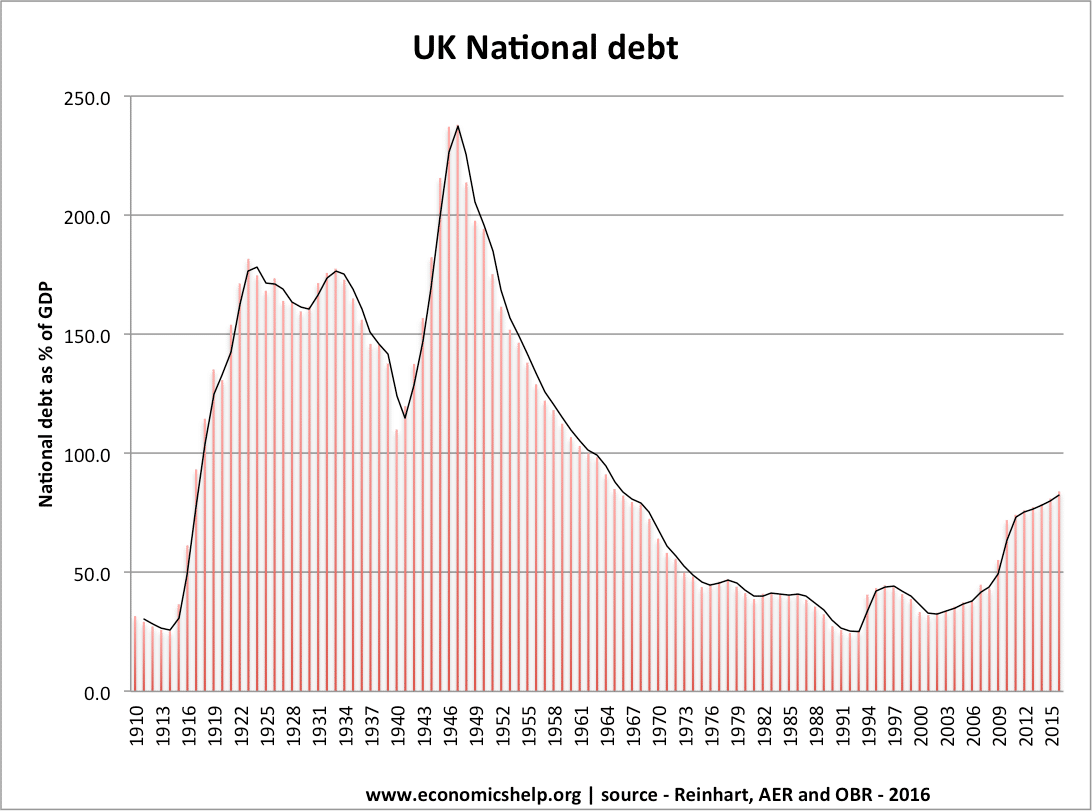

Readers Question: I thought your explanation about whether to worry or not about the National Debt was pellucid but I would like to know, from an economics perspective, why governments (and people) were not worried about the debt after World War 2 given that it was far higher for many years than the UK debt now about which there is so much concern. I understand, of course, that the post-War debt was the inevitable consequence of financing a war of survival but why did the post-War debt not lead to such consequences as a debt default, bail out by IMF and do on? Is it the context has changed – that the power of the markets and investors who finance sovereign debt has increased? Or some other reason? I think it’s important to answer this query from an economics viewpoint because I’ve read lots of political articles which imply the present debt should give no rise for worry when the post-War debt was so high for so many years. Your answer, while very good, does not answer this point. Thank you.

It is a very good question. In short, there are quite a few differences which mean the UK would definitely struggle to borrow similar amounts (240% of GDP compared to present value of 70%) in the present economic climate. In short, these reasons include

- Greater expectations of low inflation in the 1940s (meaning bond values don’t diminish) post deflation days of 1930s. This encouraged people to buy bonds at a relatively low interest rate. Today people may be more sceptical of future inflation

- Greater interest in buying bonds due to lack of alternatives and patriotic fervour.

- Strong post-war growth which helped reduce debt to GDP ratio.

- A loan from US (even in the 1960s, UK was reluctant to criticise Vietnam war because we still were reliant on US loan)

- Easier to cut military spending now the war was over.

Nevertheless, it does show that you can have national debt of over 200% without bankrupting the economy. It also shows that the panic to ‘slash government spending’ is overstated.

The great fear is that you have high debt combined with deflation and a fall in economic growth. This is what is happening in Ireland and Greece.

Ireland pursued austerity measures with such vigour they have caused a second fall in GDP. This fall in GDP means the debt to GDP ratio has shot up leading markets to lose confidence.

It also shows it is difficult to make comparisons between years. Circumstances are quite different now compared to the post-war period.

For more details on this question see:

This presupposes that the reported GDP isn’t fictitious.

Thanks for the good answer. I guess my question could be more succinctly put as ‘How much national debt is sustainable?’ You identify several factors post-WW2 which made that larger debt sustainable. In the current UK position it seems that the government is acting to reduce the debt transferred to the next/future generations (that seems to be political rhetoric based on the moral line that a generation should pay its own debts but the very nature of national debt is that it permits such transfer in time and generations overlap: the argument, I suppose, is that it’s ‘unfair’ unless the spending now improves life for later generations – that it is investment rather than consumption), that lenders (bond investors) worry if the trend is upwards, that the scope to grow GDP is limited (poor economic prospects, unfavourable demographics, too many retired people) and that a government can’t/won’t tackle growing debt for domestic political reasons.

Where is the limit? The IMF’s research ‘Primary Surpluses and Sustainable Debt Levels in Emerging Market Countries’ suggests about 30% GDP but that can’t readily apply to countries like the UK. Probably the only credible answer is when the market starts to jib at lending and rates go up quickly and high (the Ireland case) but that doesn’t tell us how close the UK is to the edge (and it assumes the market response is well-calibrated to circumstances (unlikely one suspects since people continue to lend to the USA).

Good comment, but, markets can be volatile and unpredictable. Also a lot of people are suggesting the bond market will put up interest rates in the future without austerity, but, that is not guaranteed.