Readers Question: What are the factors that influence the fixing of a minimum wage?

- The UK’s first National Minimum wage was established in 1999 and was set at £3.60 for those over 21.

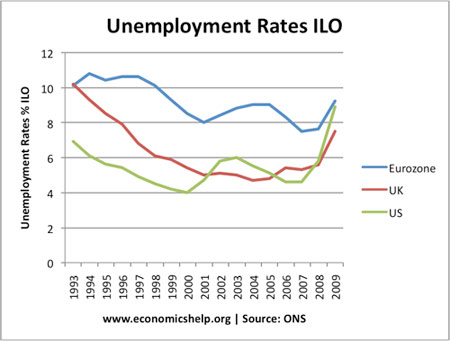

- It was feared by business that a minimum wage would cause unemployment.

- However, over the period between 1999 – 2007, in the UK unemployment fell from 6% to 5%, despite successive above inflationary increases in the minimum wage.

- Between 2007-11, unemployment increased because of the recession. Some economists argued the UK minimum wage was too high for the economic environment.

In 2011, the UK Minimum wage is set at:

- £5.93 – the main rate for workers aged 21 and over

- £4.92 – the 18-20 rate

- £3.64 – the 16-17 rate for workers above school leaving age but under 18

- £2.50 – the apprentice rate, for apprentices under 19 or 19 or over and in the first year of their apprenticeship.

Factors That Influence the Setting of the Minimum Wage

1. Equilibrium wages

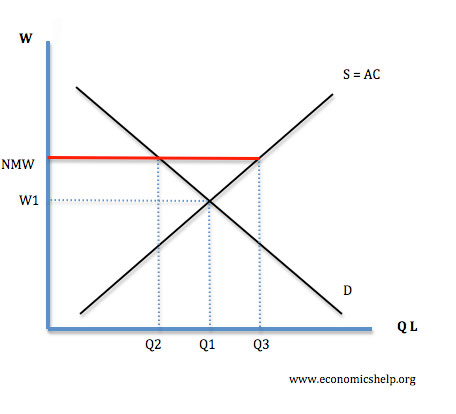

In theory, if the minimum wage is set above the equilibrium wage rate it will cause unemployment and demand for labour falls. Therefore, the government will seek to work out the equilibrium wage rate that firms will be willing to pay. If minimum wages are increased substantially above the competitive equilibrium it can cause ‘real wage unemployment’.

2. Economic Growth

Unemployment is cyclical in nature. During economic expansion, firms’ demand for labour increases and they will be willing to pay a higher wage. However, in a recession, there is often stagnant wage growth and firms are more reluctant to employ labour. Therefore, some argue, in a recession it is a mistake to increase the national minimum wage rate as this will add to the unemployment problem. However, when the economy is growing e.g. 97-07, increases in minimum wage don’t cause unemployment.

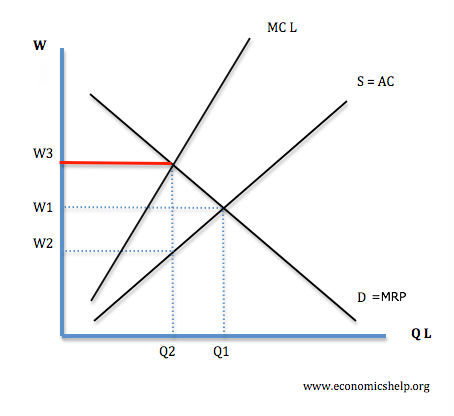

3. Are Firms Exploiting Workers?

The theory of monopsony suggests that firms with market power can pay wages below the equilibrium level. A minimum wage can counterbalance this monopsony power and therefore, wages can be increased without causing unemployment. If firms have significant market power in paying low wages, a minimum wage can be introduced without causing unemployment.

Diagram of Monopsony Power

Age Rates

The UK sets different minimum wages for different age groups. The idea is to reflect the different equilibrium wage rates that occur for different ages. The apprentice rate is to reflect the idea that firms incur greater costs for training apprentices. If the national minimum wage rate of £5.90 applied firms wouldn’t take them on.

Geographical Differences.

One argument is that the UK should have different minimum wage rates for different parts of the country. For example, average wages rates are much higher in London than in the north of England. Therefore, arguably there should be a higher minimum wage rate in London.

Other Factors Taken into Consideration

- Wage differentials. Will an increase in the minimum wage affect over pay scales, e.g. if the lowest get paid more, will middle-ranking workers demand higher wages to maintain a wage differential.

- Elasticity of demand. If the demand for labour is highly inelastic, then higher wages may not cause unemployment.

- Impact on incentives to get a job. Higher minimum wage may increase the incentive for unemployment to take a job or increase the incentive to increase labour market participation rates.

- Impact on wage equality. One aim of the minimum wage is to reduce wage inequality.

Related

- National Minimum wage – Direct Gov

Having worked for many years in the Department for Work and Pensions (UK), I am amazed that there is no evidence to determine how the minimum wage is determined as an affordable wage? When one considers rent, food, fuel, travel etc what wage rate would you arrive at? In short, what is the basic formula?

I am also amazed that the term ‘living wage’ is adopted while working tax credits still exist. By definition a living wage needs no supplement and the tax payer is subsidising the employer.