Readers Question: The Oil Petroleum and Exporting Countries (OPEC) comprise the main oil procedures in the world. With the aid of diagrams show how OPEC is able to fix the price of oil on the world markets and comment on its recent activity in this area. Suggest what would happen if OPEC kept increasing prices rapidly over time.

OPEC comprise over 50% of the world’s oil suppliers. Therefore, if OPEC members agree to restrict the supply of oil it will have a significant impact on increasing price.

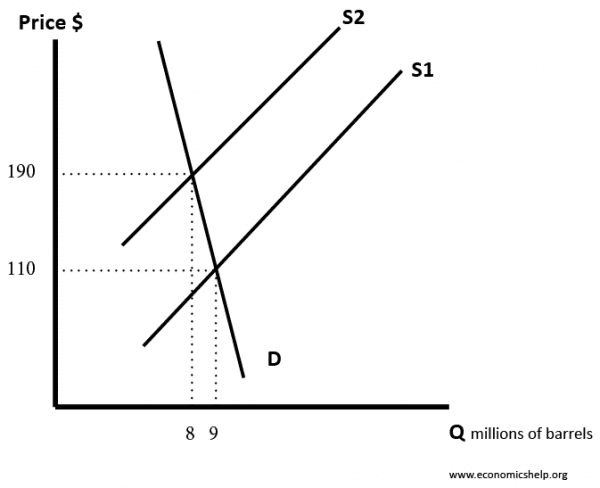

Graph of fall in Supply of Oil

To restrict supply, OPEC members will have to agree to stick to their output quotas. It relies particularly on Saudi Arabia – who are the world’s biggest producer of oil in the world. If Saudi Arabia cuts supply, it usually encourages smaller producers to follow suit.

However, the power of OPEC is less than in the 1970s.

If OPEC succeeds in raising the price, it makes oil production more profitable and so there is an incentive for other countries to increase supply to take advantage of the higher price.

Also, even OPEC members themselves have an incentive to ‘cheat’ on their output quotas. For example, Qatar might try to take advantage of the higher oil price by increasing output more than their quota.

Factors affecting oil prices

- Demand – growing demand from China is likely to see a rise in oil prices

- Geo-political events. For example, political turmoil in Iraq and Iran may lead to falls in the supply of oil.

- Speculation about oil prices. Speculation could be due to several factors, such as future demand or the future of Iran and the Middle East politics

- The value of the dollar. Oil is traditionally measured in the US dollar. If the dollar weakens, this can give the impression that oil prices are falling more than usual.

What happens if oil prices continue to rise?

- There is an increased incentive to increase supply in areas where it is more expensive to extract oil. E.g. the Antarctic. – could even cause friction as countries race for the right to extract from remote areas.

- Increases the attractiveness of alternative fuels such as biofuels and solar panels.

- Increases Demand for alternative forms of cycling (well maybe pretty insignificant)

- Depends on whether the rise is short term or long term.

- OPEC may not want the price to rise too much because it will lead to higher supply in non-OPEC countries.

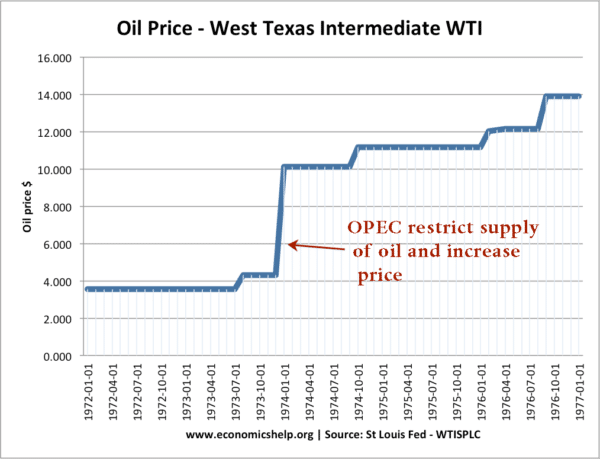

OPEC in the 1970s

In the 1970s, the oil price was much lower. As a result, fewer countries produced oil, giving the Middle-Eastern oil producers more market power. This enabled a few countries to form a cartel, restrict output and price nearly tripled overnight.

Related

1 thought on “How is OPEC able to fix the price of oil?”

Comments are closed.