What do we mean by balanced economic growth? Also, is it important for an economy to promote a balanced approach to growth?

A balanced economy suggests that economic growth is sustainable in the long-term, and the economy is also growing across different sectors – and not focused on one particular industry or area.

A balanced economy has several key features.

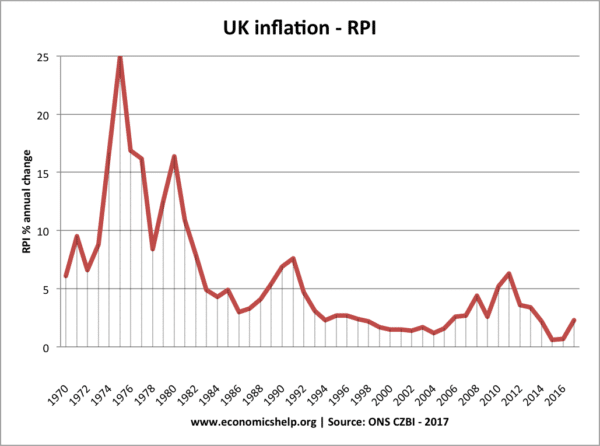

- Low inflation – avoiding an unsustainable boom and bust period of economic growth.

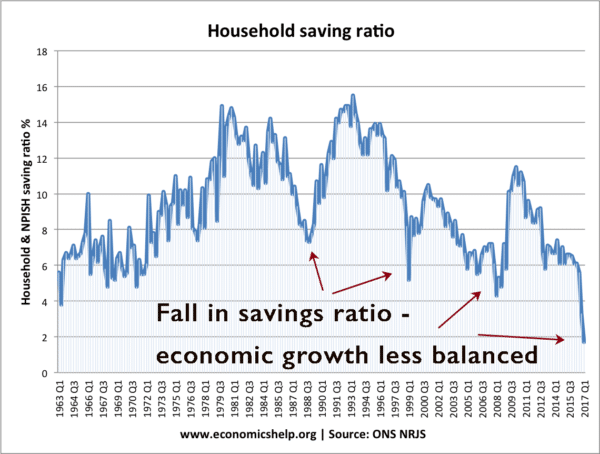

- A balance between saving and consumption. An unbalanced economy would consume a high % of income. A more balanced economy would be saving a significant percentage of income to finance investment and future productive capacity. Without sufficient savings and investment, long-term growth will be constrained.

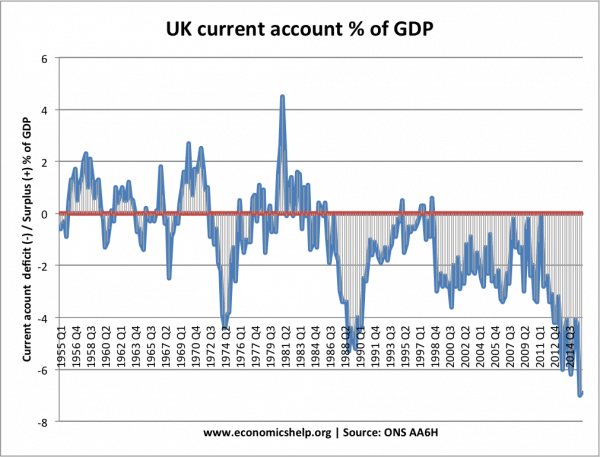

- Trade balance. A balanced economy would have a balance between exports and imports – a low (or at least sustainable) current account deficit. If the economy is relying on imports and running a current account deficit, this is a sign of imbalance. A large current account deficit would need to be financed by capital inflows.

- Housing market which is stable. A stable housing market helps to balance the economy. A rapid rise in house prices could cause a positive wealth effect and a temporary rise in spending – which later proves unsustainable. A booming housing market raises fear prices could fall in future.

- Sustainable bank lending. A balanced economy needs a strong and stable finance sector. Firms need access to credit, but unlike the credit crunch, the bank lending needs to be sustainable and not dependent on other bank loans.

- Growth across different sectors. An economy relying on the primary sector for growth is more at risk of fluctuating commodity prices. An economy reliant on growth in only services may struggle to gain sufficient export revenues.

- Equality of distribution. Growth evenly distributed across income spectrums and across different geographical regions.

- Sustainable levels of debt (Government, private and corporate). If economic growth is financed by debt, then this growth may prove unsustainable, and it may only prove temporary.

Warning signs of an unbalanced economy

- Large current account deficit – especially if financed by borrowing or volatile short-term capital flows. In the late 1980s, the UK had a large current account deficit during the unsustainable Lawson Boom.

- Inflationary growth causing demand-pull inflation. UK inflation was high in 1974 and 1990 – due to an economic boom which was unsustainable.

- Low savings – economic growth caused by higher consumer spending, which in turn is financed by higher credit and a falling saving ratio. In 2008, the UK saving ratio had fallen to less than 5% – it was a sign household spending was being financed by credit and lower savings. In the subsequent recession, savings rose.

- Inequality Rapid income growth amongst some sectors and income groups and falling income amongst lower income groups. This growth is unbalanced because some groups are not benefiting from economic growth. Since 2010, the UK has seen a rise in real GDP – but median wages have stagnated.

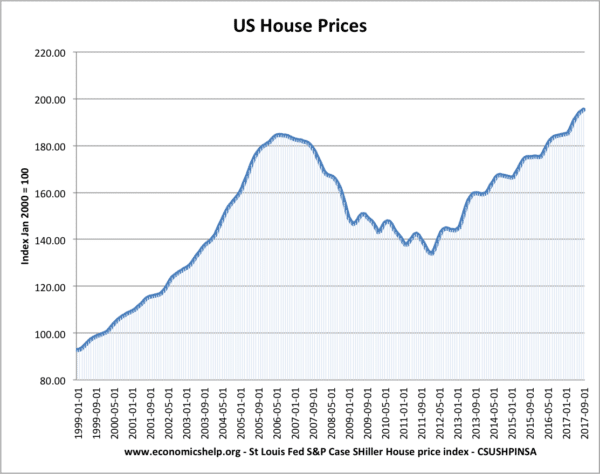

- Unsustainable rise in asset prices, such as houses, which could fall in the future – causing economic hardship for banks and homeowners

- Unsustainable rises in credit and debt levels both private and government.

- Reliance on government spending and decline in the private sector.

- Lack of public sector investment to provide necessary public goods.

- Falling productivity and decline in investment.

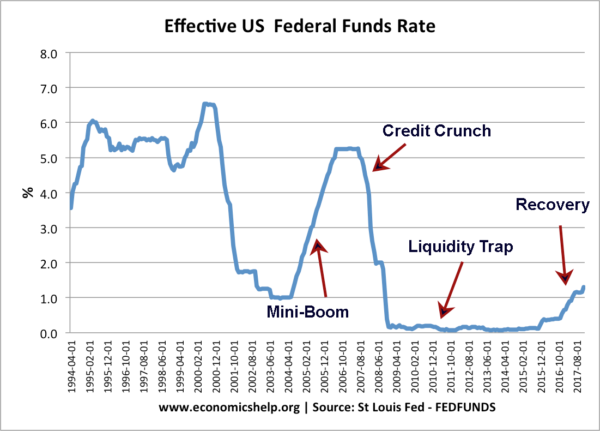

- Reliance on extreme monetary/fiscal stimulus.

In 2009-15, interest rates remained very low. Some economists argued the economy was in effect being ‘propped up’ by artificially low-interest rates – which in turn were distorting the economy by making borrowing very cheap and encouraging another asset bubble. A rise in interest rates is a sign the economy is healthier and less reliant on unorthodox monetary policy.

Is the UK a balanced economy?

There have often been fears expressed that UK economic growth in recent decades tends to be unbalanced. It is weighted towards services – consumer spending and financed by low saving and low investment rates. This has implications for the UK’s long-run trend rate of growth – without sufficient investment, UK productivity is more likely to fall behind our competitors.

Theory of unbalanced growth

We tend to think ‘unbalanced’ growth is harmful to the long-term prospects of the economy. However, one theory of unbalanced growth suggests – it is not harmful but actually a necessary part of economic development.

The theory of unbalanced growth is associated with Albert O. Hirschman. [Albert O. Hirschman. The Strategy of Economic Development. Yale University Press, 1958]

Hirschman notes it is not possible to always have broad growth across different sectors. He argues that as long as there is growth in some sector, it will create a dynamic pressure to grow other sectors at a later stage. Hirschman even argues that unbalanced growth and the dynamic tensions it creates helps to speed up economic development.

For example, if there is growth in primary product sector, this creates a complementary investment in transport to get the goods to the export market.

Secondly, if there is growth in one sector, there will be a multiplier effect, and this will cause induced investment in related industries. For example, if mining jobs are created, miners will demand more retail services.

Thirdly, if the mining industry develops and creates more infrastructure, this will later benefit different industries which can make use of the same infrastructure. For example, we built railways to transport coal, but now these railways are used by commuters to get into the city and work in the service sector.

Evaluation

Nevertheless, this theory of unbalanced growth is debated.

Dutch disease – the problem of being resource rich

Dutch Disease is a model goes to the other extreme and says that an economy which focuses on producing primary products will not get this induced investment, but can crowd out other sectors of the economy. An economy which becomes resource-rich creates problems, such as:

- Appreciation in exchange rate making exports uncompetitive

- Resource attracts investment and labour away from other manufacturing sectors

- Over time, manufacturing sector shrinks as it is crowded out by more profitable resource industry.

But, the price of raw materials can be volatile. Economies like Russia and Venezuela which become dependent on producing oil can have serious economic problems – when the price of oil falls. Arguably, it is desirable for oil rich countries to use proceeds to diversify and invest for the future. Norway is seen as one example.

Related

sir very nice your debate

great explanation, thanks for the diagram on this economic growth an development.

Please reply.

For the past thirty years, the distribution of revenue in the U.S. has shifted from the Manufacturing Industry to the Healthcare Industry, the change in percentage of GDP for each industry has been 11.2%, minus and plus. The cause has been the creation of an Oligopoly in the healthcare industry, supported by the federal government not enforcing antitrust laws and tax laws. The belief is the health care providers and insurance companies would not violate these laws.

There are 35 countries that are members of Organization and Economic Developing Countries (OEDC), 34 of the members have a government-sponsored single-payer health care system. The U.S. is the only nation that does not and its medical costs are four times the average cost of other members. Because of this the U.S. now has a tremendous trade deficit and a National Debt of 20 trillion dollars.