Readers Question: why should nominal GDP be corrected for the effects of inflation?

Suppose your annual salary went from £20,000 a year to £40,000 a year. Does that mean you are better off? Can you buy twice as many goods?

If there is zero inflation, if prices stay the same, then the answer is yes. With a doubling of income you can buy twice as many goods.

However, suppose the inflation rate was 40%. That means goods and services would be rising in price by 40%. Therefore, even though your nominal income has increased by 100%, it doesn’t mean you can buy 100% more goods. Your effective purchasing power has increased by 100 – 40 = You are effectively 60% better off.

If prices doubled and your income doubled. Your real income (effective purchasing power) would be exactly the same.

This same principle can be applied to National Income.

In the case of Zimbabwe, inflation has reached 100,000%.

Therefore the nominal value of output is rising very fast because the prices of goods are increasing. From a statistical point of view, it looks like nominal GDP is rising very fast. But, the reality is that living standards are falling because inflation is greater than the increase in nominal GDP.

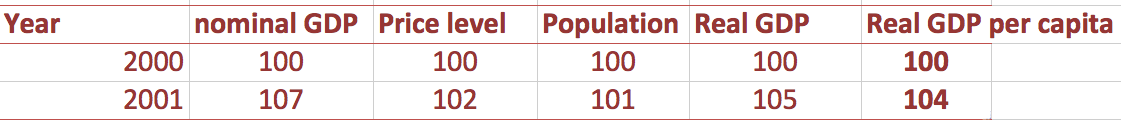

Example of nominal GDP and inflation

- In this case nominal GDP rises 7%, but inflation rises 2%.

- Therefore, the real increase in GDP is 5%

Further Reading