Readers Question: when I read the EU spends 50% of their GDP, what does that actually mean? That half of Europe’s taxes are spent on government projects like welfare and entitlements, like taking money from the left hand pocket and putting money in the right hand pocket? I’m lost. Could you please use credit cards or something else as an example to help me understand the principles involved in these two problems?

This is a list of government spending as a % of GDP

Some EU Examples

| France | 52.8 |

| Sweden | 52.5 |

| Denmark | 51.8 |

| United Kingdom | 47.3 |

| Greece | 46.8 |

| Portugal | 46.1 |

| The Netherlands | 45.9 |

| Germany | 43.7 |

| Poland | 43.3

|

| China | 20.8 |

| Gabon | 20.1 |

| El Salvador | 20 |

You can see there is a big variance. Countries in the EU tend to have a higher rate of government spending, e.g. France 53% of GDP, UK 47%. US is 38%.

To simplify this. We could assume the average citizen for a country. Let us assume the average citizen receives 20,000 Euros. In France, the citizen would pay to the government 10,000 Euros (assume 50% tax rate).

That same ‘average citizen’ would receive 10,000 Euros of government spending. Free health care, free education, pensions, the benefits of military defense.

In the US, the ‘average citizen who earns $20,000 would pay $7,600 in taxes to the government. In return the US would receive $7,600 in government spending (education, military defense, roads e.t.c).

I put the ‘average citizen’ in brackets to simplify. Of course, people pay different tax rates. Some receive more government spending than others. But, it helps to understand.

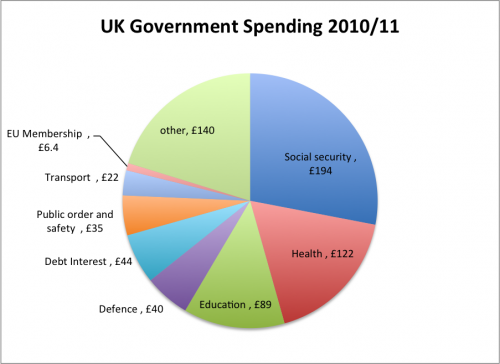

What do Governments Spend Their Money on?

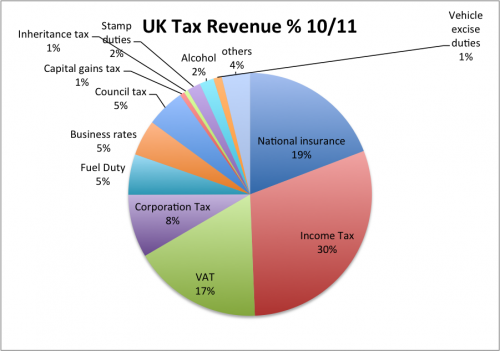

Where does Government Get its tax Revenue From?

Is it Good Or bad to have High Levels of Government Spending as a % of GDP.

We could reduce the amount of government spending as a % of GDP by privatising health care. We could say, the government will collect less tax and spend nothing on health care. However, then you have the additional cost of paying for private health care insurance (or you don’t get insurance and then you don’t have access to health care)

The US have a lower tax rate (only 38%) but, in the US both employers and employees have to pay significant amount of their income in private health care insurance. It may feel better to have lower tax rates, but your disposable income is affected by having the additional cost of private health insurance.

You could argue the US actually pay more for health care (they spend twice as much on health care as other countries) because private companies also charge for a profit margin, you don’t get with public sector provision in the EU. On the other hand, you might argue private health care in the US gives a better service.

The biggest bill is social security – pensions, child benefit, income support, unemployment benefit. You could reduce this spending, but the trade off is an increase in inequality. If you are unemployed, you may end up at the soup kitchen, and wish the government had a higher tax rate.

Related

I think it is extremely misleading to suggest that governments can only spend what they receive in taxes (an often used household analogy) In a country with it’s own currency, such as the UK, the government is, via the central bank, the monopoly issuer of money. It can spend what it wants and look for receipts at a later date. In this respect the taxes the government levies mainly serve to influence aggregate demand. Any perceived fiscal restriction is purely political.