No one doubts the commitment of many in the EU to seeking a way to prevent the Euro breaking up. The Euro project is deeply embedded in the European establishment. But, are they fighting a lost cause? Are the structural problems with the single currency so severe, they would be better off pursuing an orderly break-up? Or would the break-up of the Eurozone lead to an even worse period of instability and economic crisis?

Reasons Why the Eurozone is heading for a Break-up

1. There has been no Economic Harmonisation

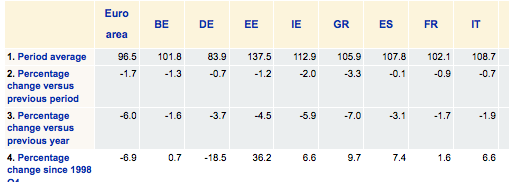

Harmonised competitive indicators in the EU (2011 Q1), source: ECB Stats based on unit labour costs indices for the total economy:

Since 1998, Germany (DE) has seen a reduction in labour costs of 18.5%. By contrast, Italy and Ireland have seen an increase of 6.6% and Greece of 9.7%.

The Eurozone is not an optimal currency area. There is a huge difference between northern European economies (Germany) and Southern European economies. This is not a difference in debt levels. It is a difference in productivity and relative wage costs.

In normal circumstances, this would not be a problem because the German currency would appreciate due to its hyper-competitiveness – and the exchange rate of Italy, Greece e.t.c. would devalue, but this has not happened because the Euro permanently locks in exchange rates. See also: (competitiveness in Europe) | Two Speed Europe

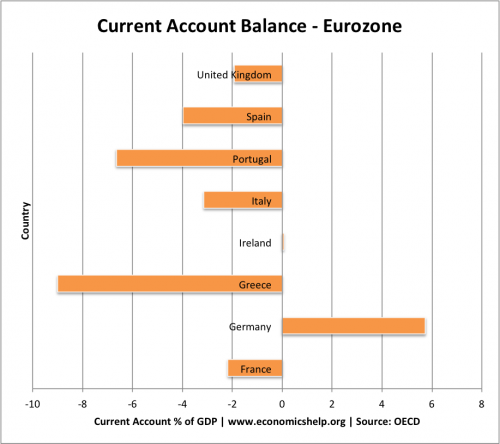

2. Current Account Deficit

- This divergence in labour costs, productivity and inflation is reflected in the current account statistics within the Eurozone. In particular, it shows that Germany has had a persistently large current account surplus, which is matched by a current account deficit in other Eurozone economies.

- With a fixed exchange rate, German goods have become more competitive in the Eurozone. Southern Eurozone goods have been uncompetitive. The exchange rate imbalance is a significant factor in the persistently low economic growth in Southern Europe.

- Without a mechanism for exchange rate adjustment within the Eurozone, the current account imbalances will persist.

- Furthermore, this issue rarely gets much attention. The EU and Germany frequently talk about the need for internal devaluation for countries to regain competitiveness. But, internal devaluation is causing economic misery of unemployment and falling GDP.

- Economic Imbalances in the Euro by Christian Schoder 2011

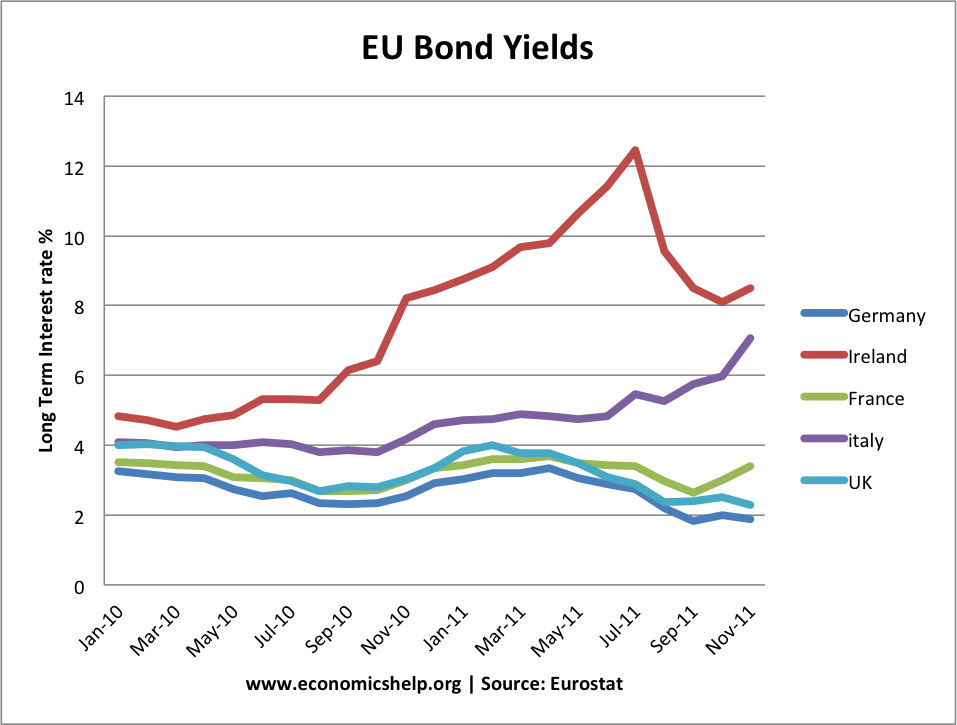

3. Vulnerability to Deficits

Countries like Spain, Italy and Ireland didn’t have large budget deficits at the start of the crisis. Spanish debt to GDP was low at the start of the crisis. However, because of fears over economic growth and lack of liquidity in the Eurozone, bond yields have rapidly risen. This has created great pressure on countries to pursue deflationary fiscal policy (austerity).

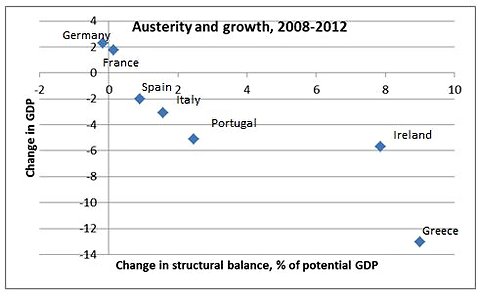

4. Austerity isn’t Working

Because of the structure of the Euro (e.g. rising bond yields because of no lender of last resort, countries have been forced into austerity measures. However, these austerity measures haven’t been successful in solving the crisis. Debt to GDP ratios have often continued to rise, but they have left economies with rising unemployment and falling GDP.

source: Krugman. The link between changes in austerity measures and GDP.

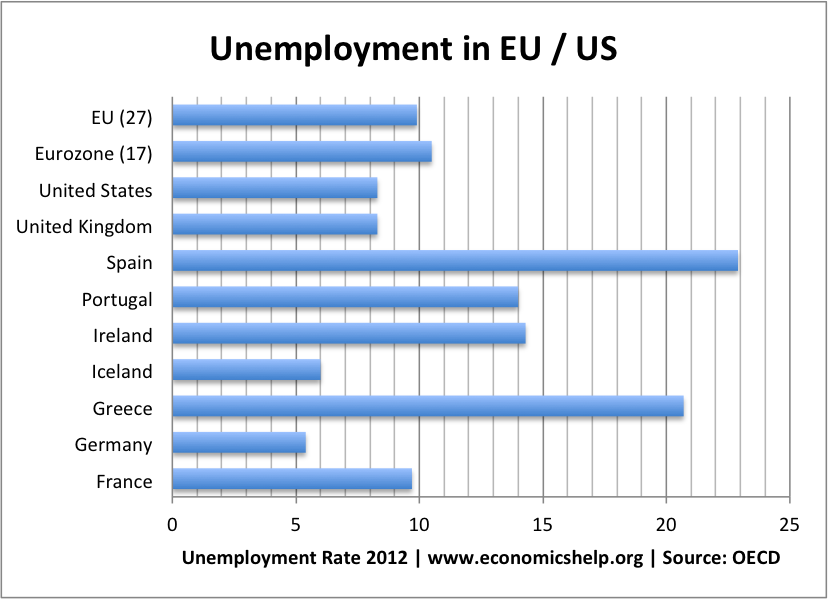

The main policy of Europe has been to try and implement radical budget targets which have caused unsustainable levels of unemployment.

Unemployment rates are often higher amongst young workers. These levels of unemployment combined with falling living standards are already having political consequences, with strikes and protests at levels of austerity.

5. No Fiscal Union

One way to make the Eurozone work is to pool debt, through common Euro bonds. This would enable southern countries to benefit from lower bond yields and give them a more reasonable time frame for reducing debt without compromising prospects for economic growth. See: Fiscal Union However, there is a great political reluctance to this as German taxpayers don’t like the idea of ‘bailing out’ their neighbours.

6. Political Support for Current Euro

The likely election of French Socialist candidate threatens to change the current German-French consensus of pursuing strict budget targets.

7. No Real Bailout Possible

The Level of bailout funds is inadequate should there be sovereign default in Italy or Spain. The IMF recently increased the level of its bailout fund to £1 trillion, but this would still be inadequate.

Reasons Why the Eurozone Will Not Break-up

1. To leave the Euro is very difficult. It would cause capital flight and a crisis of confidence. It would be easier for Germany to leave, causing their new currency to appreciate and existing Eurozone members to benefit from devaluation. But, Germany has no intention of doing that.

2. Internal devaluation does eventually work if you persist for long enough.. Supporters of the Eurozone policy will point to Ireland as evidence that countries pursuing deflationary policies can lead to improvements in competitiveness. Ireland’s current account deficit has been reduced in past few years, as they have embraced spending cuts and lower wage costs.

3. The Eurozone could be made stronger, if there was a real embrace of fiscal union and the ECB was able/willing to act as lender of last resort. A combination of these two policies would enable the Eurozone to have a better chance of pursuing economic growth rather than the current policy of austerity.

Related

2 thoughts on “Will the Eurozone Breakup?”

Comments are closed.