Readers Question: How Has China’s Economic Industrialisation affected the UK’s Economy? And What Policies Could The UK Government Implement To Rectify The Problems Created From China’s Growth?

The rapid growth of China’s economy has had various effects on the UK economy – some positive and some which have created challenges and problems for the UK.

1. Lower Goods Inflation. Chinese economic growth has been characterised by low priced manufactured goods. The price of items such as clothes and electronic goods has consistently fallen, helping to maintain low inflation in the UK. This downward pressure on prices is particularly helpful for consumers, who have experienced rising cost-push inflation in areas such as energy and food in recent years. The falling prices of electrical goods and textiles have helped to increase UK living standards and have enabled a higher percentage of income to be spent on other goods and service

2. Higher price of raw materials. As well as contributing to lower goods inflation. You could argue China’s growth is contributing to rising prices of raw materials e.g. oil. The economic growth in China is pushing up demand and therefore price of oil, which is having an impact on Western inflation. China’s growing demand for oil and raw materials was a key factor in creating cost push inflation in the past few years. Therefore, even though the West has been in recession (2009-2013), we have also seen cost-push inflation. This cost-push inflation arguably exacerbated the recent recession. However, the rising price of oil is not just due to China, but also supply disruption in the Middle East and other factors. Also, the rising price of oil may encourage the developments of greater fuel efficiency and alternatives to oil which will benefit in the long run.

3. Relative decline in manufacturing sector. The UK’s manufacturing sector has been in relative decline since early 1980s. Chinese growth has in a way speeded up this process as British firms with higher labour costs become uncompetitive compared to Chinese firms. However, the manufacturing sector may have declined anyway and up to recently job losses in manufacturing sector have been absorbed into the service sector. Arguably, it is not a problem if we do have a relative decline in manufacturing. The theory of comparative advantage states that we should specialise in those industries, which we are best at.

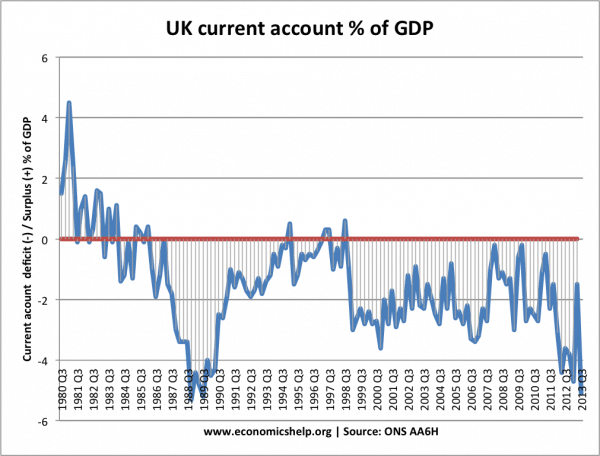

4. Current account deficit. The decline in UK manufacturing, and growth in imports from China / Asia has contributed to a long-term deterioration in the trade balance on the current account between the UK and China. Apart from a few short periods, the UK has experienced a current account deficit since the 1980s. Part of this is the changing comparative advantage between UK an China.

5. Service sector inflows. Trade between China and UK is not just a one way process. China is increasingly using its financial clout to buy British goods and services. A good example, is education. Many Chinese come to the UK to study. This counts as a credit on the financial part of the Balance of Payments. China has also bought UK assets such as UK government bonds. These capital flows have helped finance UK public sector debt.

Main challenges / problems for UK from growth of Chinese economy

- Decline in UK manufacturing as UK loses competitiveness; this is one factor behind the long term current account deficit.

- Growth of Chinese economy has increased pressure on raw materials, causing upward pressure on the prices of raw materials, such as oil, metal.

Benefit of Chinese economic strength

- Increased demand for exports of UK goods and services. As the Chinese economy grows, Chinese consumers may increasingly purchase British goods and services, which will help promote UK growth.

- UK consumers benefiting from lower prices from Chinese exports.

- It is inevitable that comparative advantage will always change. If China dominates labour intensive manufacturing, the UK should switch to other industries, where he can benefit from higher skilled / value added.

- Potential for increased inward investment from Chinese firms into the UK.

What should UK do about China?

I would say the UK doesn’t have to do anything specifically about China. However, as we are in an increasingly competitive world economy, there is greater importance to maintaining our productivity growth and improving in areas where we have a comparative advantage. I would argue, the UK would always struggle to compete in the production of labour intensive manufactured goods. The UK has to focus on areas where it has a comparative advantage. For example, the decision to restrict numbers of foreign students studying in UK means we lose out on potential foreign currency earnings.

One thing the UK should do, is to reduce its reliance on non-renewable raw materials, such as oil. If China and India continue to grow, then there will be a long term increase in oil prices. Therefore, there is a good case for encouraging renewable energy sources and not waiting for market forces to

Related

another piece of brilliant succinct analysis from this website –

better than the BBC or the Guardian