I only take a passing interest in American politics. I’m just grateful not to live in Ohio, where voters have been subject to hours and hours of political ad campaigns. According to a newsnight presenter, if the 150,000 ads were all lined up, they would last for four consecutive days. (although I’m sure that would constitute cruel and unusual punishment. I think I’d talk after the first six hours). I’ve never seen an American political ad, but I doubt they explain the nuances of balance sheet recessions, liquidity traps and the optimal way to reduce debt to GDP ratios without con straining economic recovery.

But, despite economics being somewhat in the background, the re-election of Obama could be seen as a political confirmation that:

The recession was the result of the financial excesses in the lead up to 2008 – and not really the present administration.

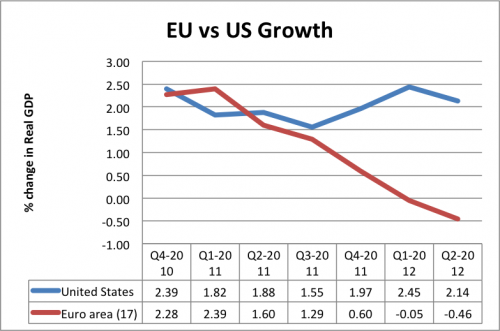

Overcoming this unique balance sheet recession was always going to be difficult and long process. The US has performed moderately – but much better than many of its fellow countries. To some extent Obama deserves credit for allowing a recovery – even if it could have been stronger.

In a country which loves the laissez faire ideal like no others, it’s interesting to still see solid support for the idea that government intervention can actually make markets work more efficiently. Obama supported the rescue of the automobile industry with government money. Romney opposed the use of federal funds. The bailout was a success, so it’s only fair Obama did well in the ‘rust belt’ north. Even the hurricane Sandy is a reminder that for real crisis, government rescue funds can play an invaluable role. Recent years have been a reminder that the highest ideal of government is not just to reduce taxes on the rich.

Inequality. Often elections show little difference between candidates on policy. But, the US election was a clear choice between a businessman who favoured tax cuts for the rich, and Obama who is less keen to favour the wealthy. I’ve no doubt that under Romney, America’s inequality would have continued to increase. To some extent, this election is a rejection of Reagan’s trickle down economics and the Religion of tax cuts. There is a chance that even rich investors may start to pay the same rates of taxes as everyone else. (see: Tax the Rich)

What next for US Economy?

The US economy faces many difficulties. Unemployment is still too high, recovery is still moderate given the amount of spare capacity. There is much talk of the US fiscal cliff – (which is more of a political problem than economic problem). But, unless the US embark on some self-destruct mechanism, there is no reason why the US can’t support a steady and sustained economic recovery. With strong economic growth, the US will be in an ideal position to see a fall in unemployment and reduce the debt to GDP ratio. Strong growth and an electoral mandate may also enable a rolling out of greater welfare reform. This might involve evaluating welfare entitlement and limiting the growth of long-term public spending. But, it should definitely mean a real universal health care system and end the paradox of the richest country in the world being unable to offer this most basic public service to all. It wouldn’t happen under Romney, but it could happen under Obama.

Economic recovery will bring its own problems, notably the finance sector still remains largely unreformed. This is still no guarantee that the mistakes of the 2000s will not be repeated sometime in the future. It will not be easy, but there will be no better opportunity to prevent the excesses and craziness which led to the last financial crisis.

At least there was no concerns about elections been thrown by electoral fraud.

Related