Readers Question: Given the widely varying fiscal policies of countries, both left and right, how come their growth rates over the long term are so close?

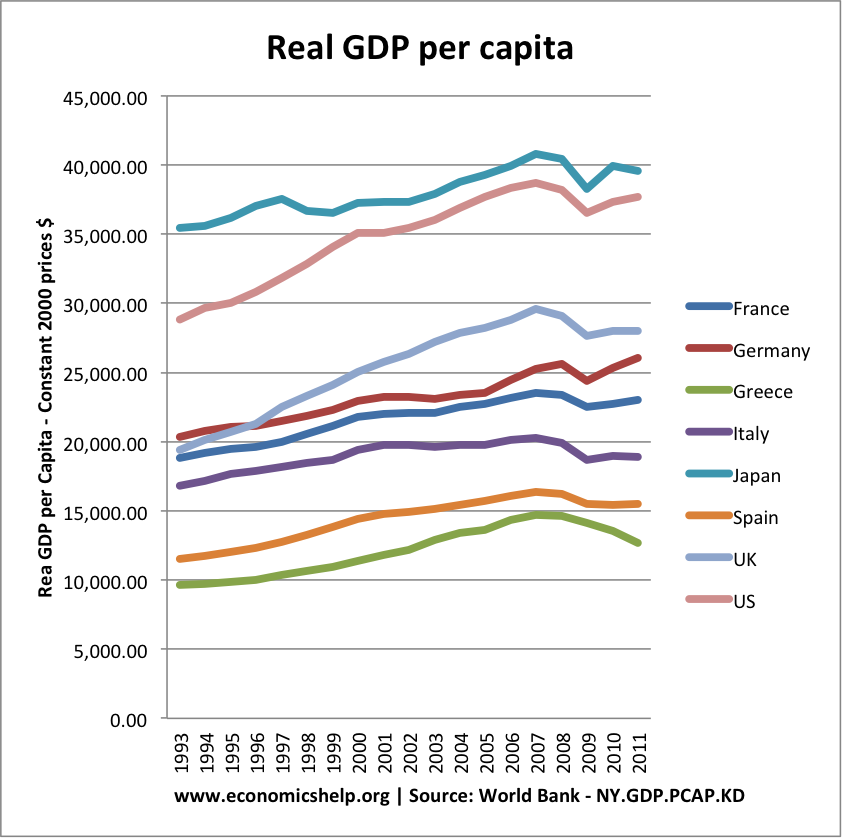

source: World Bank

To some extent growth rates are close; though it also depends which data and countries you use. However, from a very broad perspective, growth rates do share similar patterns and growth rates.

Why there are Similarities in Economic Growth Rates?

To some extent there are similarities in economic growth rates, especially amongst countries at a similar stage of economic development, and who are geographically close. There are a few reasons for these similar trends in economic growth rates.

- Technological developments. In the long term, a key factor in determining economic growth is the development and implementation of new technologies. Steam technology helped countries to industrialise; the assembly line enabled efficiency savings from the 1920s. In the post-war period, all major industrial countries have benefited from similar improvements in technology – micro-computers, increased mechanisation, the internet and better transport. These technological improvements are generally available to every country, so they can all benefit from the same productivity growth. Also, the creation of new technology doesn’t really depend on government policy.

- Globalisation and multinationals. The world is increasingly globalised; big multinationals have operations in all major economies. If they improve their productivity and invest, it tends to be felt on a global scale, not just in a particular country.

- Global shocks. All major economies are subject to the same global shocks. For example, in the 1970s, a rise in oil prices hit all the main oil-importing economies. The global credit crunch of 2008, had a similar effect in pushing most major economies into recession.

Therefore, especially in the long run, economies are sharing similar developments, such as technology, improvements in education and the growing role of multinationals. These kind of factors are not really directly influenced by government policy. Whether the government is socialist or conservative – the internet has enabled cost savings which will give the potential for improvements in productivity and efficiency for all economies in the world.

Why are there differences in economic growth rates?

If we look a bit closer at economic growth rates, we can still see there are significant differences in actual economic growth rates – especially in the short run.

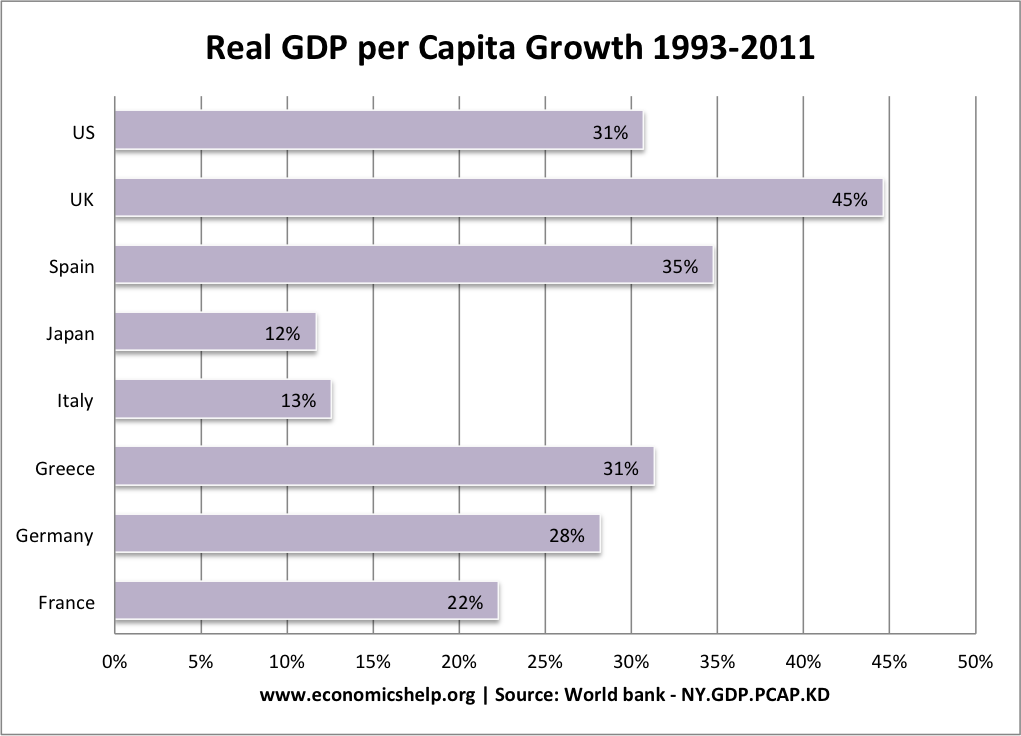

source: World Bank – constant 2000 prices

| 1993 | 2011 | % change 1993-2011 | ||

| France | 18,822.70 | 23,016.85 | 22% | |

| Germany | 20,344.22 | 26,080.52 | 28% | |

| Greece | 9,635.29 | 12,653.44 | 31% | |

| Italy | 16,817.60 | 18,935.05 | 13% | |

| Japan | 35,439.02 | 39,578.07 | 12% | |

| Spain | 11,510.72 | 15,511.93 | 35% | |

| UK | 19,384.83 | 28,032.79 | 45% | |

| US | 28,834.56 | 37,691.03 | 31% | |

If we look at the percentage change in real GDP per capita over this 20 year period, we see that actually there is quite a bit of variance. People may be surprised to learn that the UK had the fastest economic growth during this period. If we had stopped the data in 2008, the fastest-growing economy was Greece (which might not fit in with people’s preconceptions)

BTW: The World Bank data just happened to start in 1993 – just after the UK had emerged from a deep recession of 1991/92 – if we had taken data from 1990, it would have looked much less flattering to the UK.

Reasons for different growth rates

1. Demand management

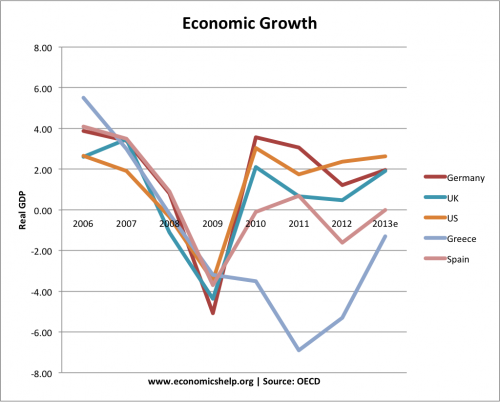

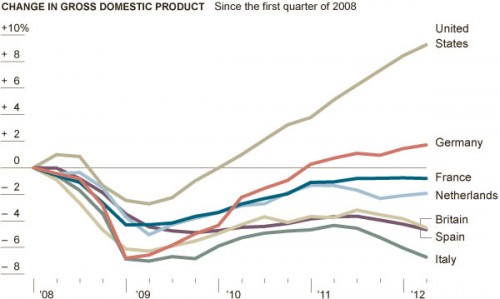

In the short term, demand management does matter. If you look at economic growth rates since 2009, there is a big divergence in explaining economic recovery. Countries which have pursued the deepest deflationary policies – tax increases and spending cuts – have seen the biggest fall in aggregate demand and lower economic growth. Countries which have seen the strongest economic recovery have generally pursued policies which have helped, in some way, to boost short-run economic growth.

source: OECD –

(BTW: I think the forecast for Spanish and Greek growth is over-optimistic.)

But, it does show that if you deflate an economy – e.g. through an overvalued fixed exchange rate – plus deep austerity policies; in this case growth will be much lower. The US has seen one of the stronger relative recoveries since the credit crunch. This has been helped by a very moderate fiscal expansion and monetary easing – the US has seen much more support for the economy than in the Eurozone.

Another way of looking at economic recovery

Differences in Long Term Economic growth rates?

In the post war period, there was one of the longest sustained periods of global economic growth on record. All developed economies benefited from the post-war boom. All economies benefited from similar technological improvements, increased mechanisation and growth in world trade. However, although all economies showed the same upward trend, some still benefited much more. Germany and Japan clearly outpaced the UK economy.

“If we take the six largest OECD countries, then in 1950 only the United States had a higher level of National Income per head. However, during the 1960s Britain was overtaken by both France and Germany. Then in the 1970s she was passed by Japan. In the late 1980s Britain was still slightly ahead of Italy, although the latter had narrowed the gap significantly over the post-war period.” (Britain’s post war decline)

To some extent this was due to post-war reconstruction – their economies were so battered after the end of the war, it was easier to increase the % of GDP. But, that doesn’t explain the out-performance of the UK in the 1960s and 1970s. Economists will suggest that Japan and Germany had a better long-term economic performance in the post war period because of structural factors such as:

- Low inflation environment – avoiding boom and bust economic cycles, the UK was more prone to having.

- Better industrial relations. In the post-war period, UK industrial relations were poor, leading to low productivity growth and time lost to strikes. In Germany, trades unions were better incorporated into the economy.

- Greater sense of dynamism and enthusiasm for industrial expansion. There was a different mentality amongst workers and entrepreneurs – the UK lacked the same incentive to improve the economy, perhaps found in other economies.

- Greater stagnation in UK economy – difficulty in diversifying the economy away from old traditional manufacturing industries.

To what extent does government policy influence economic growth?

It needs to be remembered many of the factors influencing economic growth are not within the government’s control. For example, some of the factors explaining the relative post-war decline of the UK were due to developments within industry and society. A different government policy may have modified these developments, but can government policy give the population the same hunger for economic growth, that was more evident in defeated countries such as Germany and Japan?

Related