Some thought provoking analysis from NIESR. Firstly, they define recession and depression in an interesting way.

- Recession – a period of time where output is falling.

- Depression – The period of time where output is below it’s peak.

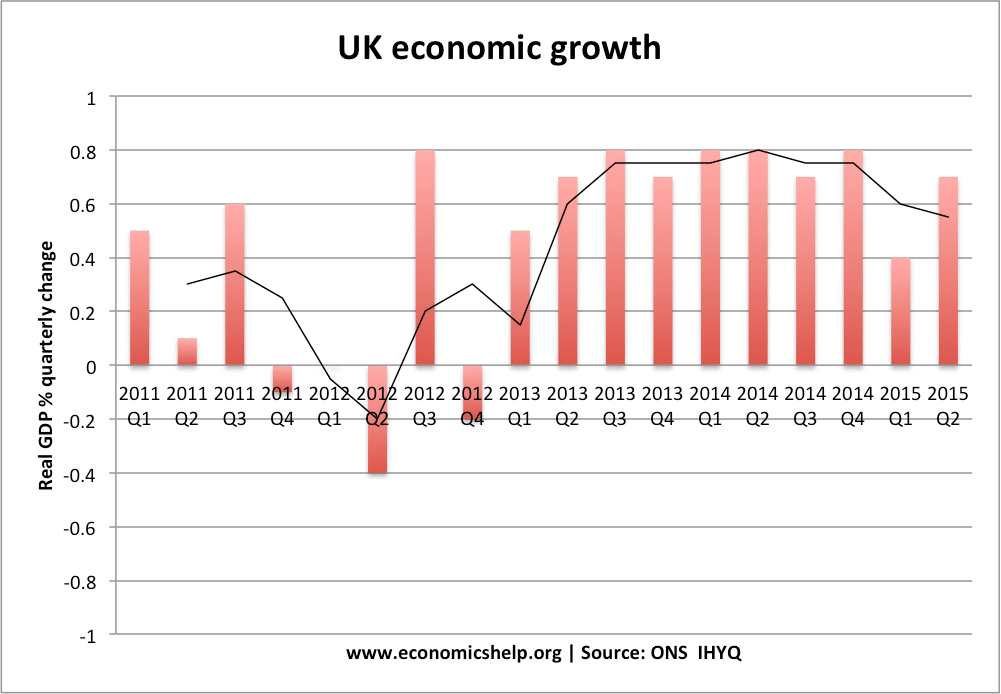

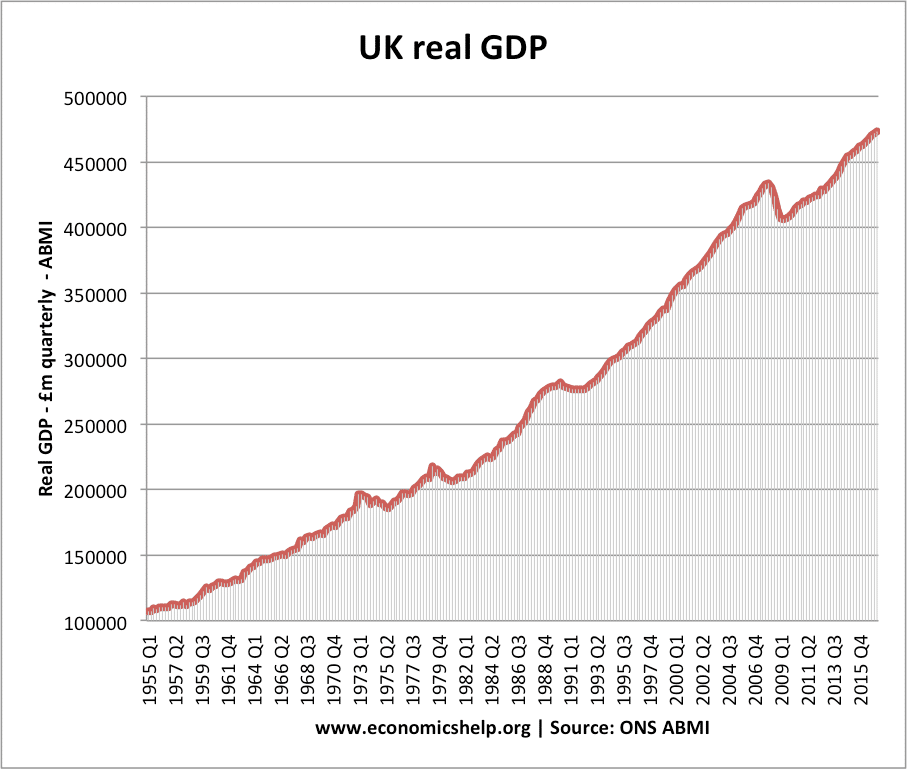

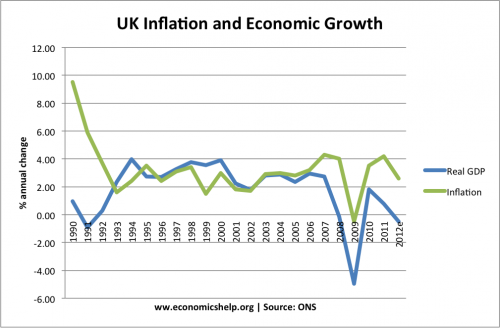

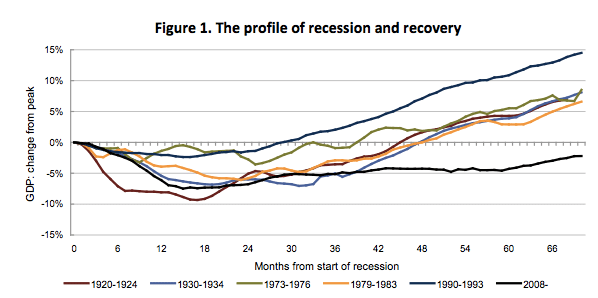

The UK economy is now growing, at a decent pace (0.8% in Q3). However, output is still significantly below the old 2008 peak. This means that the recession is over. But, with output still below the 2008 peak, the prolonged period of depression is still not over, according to this definition.

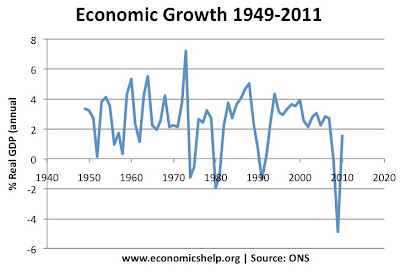

Also, if we compare this ongoing economic downturn (2008-2013) with other periods of serious economic stagnation, the UK economy is performing worse now than even the 1920s or 1930s.

The NIERS don’t expect the 2008 GDP peak to be regained until 2015. Meaning, we will have a 7 year period of stagnating real GDP. An unprecedented length of economic stagnation. See also: more on comparison of different recessions

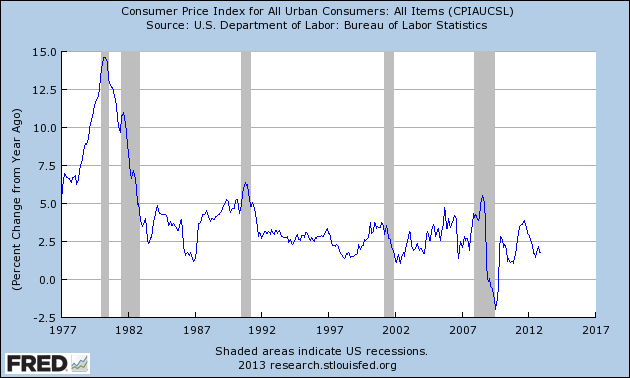

But, it doesn’t feel like a depression?

There are no commonly agreed definitions of what constitutes a depression. Most definitions tend to emphasise a significant fall in real GDP or a prolonged fall in GDP for a period of over 3 years. For example, if real GDP falls by over 10%, that would be classed as a depression. A depression also implies a very high rate of unemployment (perhaps greater than 15%).

The UK unemployment rate is relatively low by the standards of other recessions (helped by falling productivity and flexible labour markets) Therefore, with economic growth, and ‘reasonably’ low unemployment, it feels a different climate to the great depression of the 1930s.

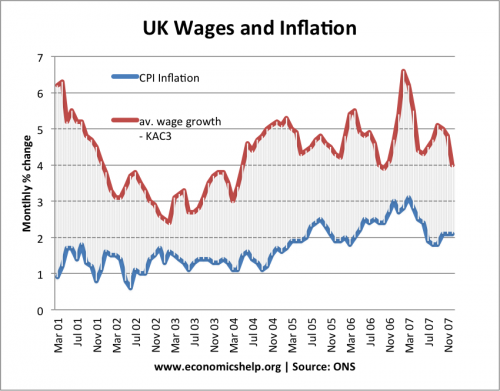

On the other hand, although unemployment could be much higher, there has been a widespread fall in living standards, which is unprecedented in the post war period. Figures show UK living standards have dropped to their lowest in a decade after average real incomes fell a further 3 per cent last year.