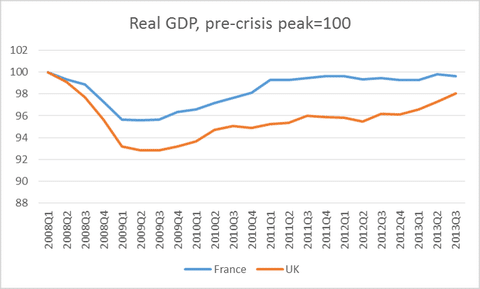

Useful post from Paul Krugman about a comparison between the French and UK recoveries.

It stems from comments by a Conservative cabinet minister that ‘the French economy is being run into the sand.’

For those who can’t get past the NY Times paywall, I’ll post the two graphs here.

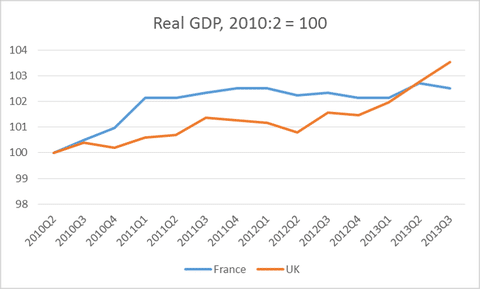

UK and France since 2010

The French economy is forecast to grow by just 1 per cent this year, according to OECD forecasts, compared to 2.4 per cent for the UK.

There are a few observations to be made.

- Quite often the bigger the decline in real GDP, the more scope there is for a strong recovery. If output falls 7%, it leaves more potential spare capacity. It can make the subsequent recovery appear more spectacular. Despite the depth of UK recession, the recovery has so far been relatively anaemic. For example, after Latvia GDP plunged 15%, they enjoyed a sharp recovery. But, you have to place the recovery in the context of how much GDP fell in the first place.

- It is difficult to evaluate the success of a policy, such as austerity, solely using quarterly GDP statistics. There are many factors affecting economic recovery. For example, in the UK monetary policy has played a key role in lessening the impact of the relatively small tightening of fiscal policy. France, tied by monetary union has had much less flexibility than the UK in monetary policy.

- The length of the UK recession was arguably needlessly long. Even five years after the crisis, we are still to see real GDP return to its pre-crisis peak.

- Despite the length of the recession and the unbalanced nature of the UK recovery, things are looking a lot more promising than on the continent. The UK economy does have several strengths (as well as weaknesses). See: UK economy in 2014.

- French government spending accounts for 56% of GDP, the second highest in the Eurozone. French business have been calling for cuts in social security costs to business and lower regulation. Recently, the French government planned to actually reduce the pension age to 60, whearas the UK have been planning to increase the pension age. Given the size of government spending and demographic changes, the French decision was bizarre to put it politely.

- French unemployment at 11% is y higher than UK unemployment of 7.1%. Part of this may be attributed to more flexible labour markets in the UK. There is a downside of flexible labour markets – zero hour contracts, part-time work, but employment rates in the UK have been increasing. Whearas high labour costs have discouraged employment in France.

Overall

At the present moment, the UK economy looks to be in a stronger position. Signs of UK growth are promising, especially signs of manufacturing growth in the north and improved confidence. Though it should be remembered the UK recovery is still weak, helped mainly by consumers spending and a fall in the savings ratio. The French economy by contrast is suffering the European-wide problem of stagnation and low growth.

France may well benefit from some free market reforms and lower government regulation. But, be wary of politicians exaggerating claims about the relative success of economies.

Related