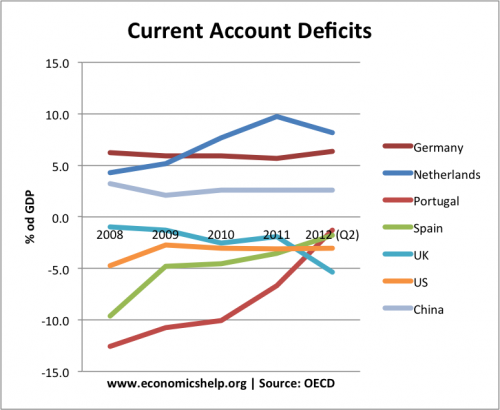

Readers Question: Can you tell what Portugal has done to reduce the Current Account GDP deficit so steeply?

The reduction in the Portuguese deficit is quite striking. In researching the answer to this question, I came up with a different post – The Portuguese Economic crisis

From what I can gather, essentially, the rapid reduction in the current account is due to a sharp fall in consumer spending on imports, combined with some growth in exports – helped by improvements in unit labour costs. However, bear in mind, I may have missed out a few other reasons due to lack of data.

Likely Reasons for Reduction in Current account deficit

1. Fall in consumer spending on imports.

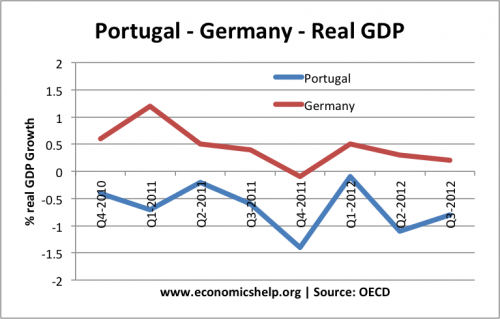

Portuguese economic growth compared to Germany

As mentioned in The Portuguese Economic crisis Portugal has seen the biggest fall in real GDP (apart from Greece) in the Eurozone. Portuguese consumers have seen a rapid fall in disposable income due to a combination of tax rises and public spending cuts. With lower income, Portugal is simply buying less imports – this improves the current account.

2. Increased Price Competitiveness

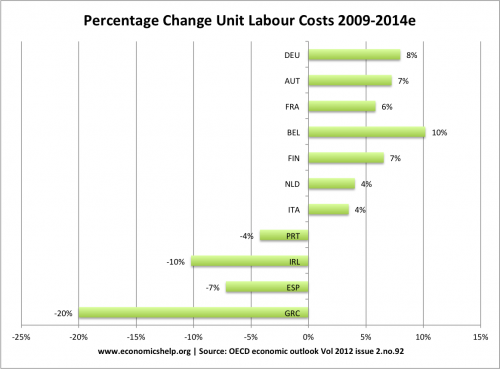

An important reason for the current account deficit in Portugal was the decline in competitiveness caused by rising unit labour costs.

Peter Praet, the ECB’s chief economist, stated that real effective exchange rates in Greece, Ireland, Italy, Portugal and Spain appreciated on average by 16% relative to Germany between 1999 and 2008, whereas the real effective exchange rate of the euro appreciated by only 3% over the same period. (link)

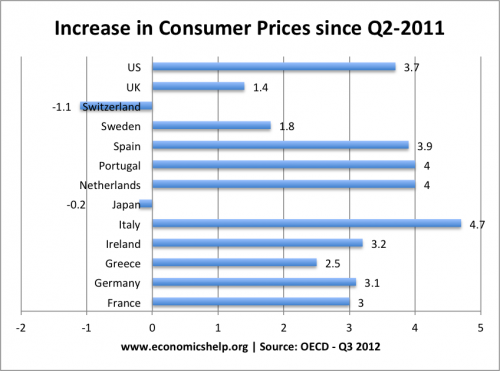

Usually, in a deep recession, you would expect to see a fall in prices as the recession puts downward pressure on producer and consumer prices. Essentially, Portugal is trying to restore balance of payments equilibrium through internal devaluation – reducing prices and costs – making exports relatively more competitive.

Using this measure of consumer prices, Portugal doesn’t stand out for having substantially lower prices. For export competitiveness, It may be more useful to check producer prices, but with relatively high inflation rates, this suggests lower prices alone do not explain the improvement in current account.

If we look at unit labour costs, the picture is more promising, with unit labour costs falling 5% in the past 12 months to Dec 2012 (austerity in Portugal at Telegraph) However, this fall in unit labour costs is mainly due to cuts in public sector wages due to the austerity measures. In the private manufacturing sector, wages continue to increase – suggesting there hasn’t been a fundamental re-adjustment.

Unit Labour Costs 2009-2012

This shows some readjustment within the Eurozone.

3. Rising Exports

Portugal has achieved some success in increasing exports. Between 2008 and 2010, exports have risen by 6%. In particular, Portugal has achieved success in exporting to China. Exports to China rose 45.8 percent in the first nine months of 2012, to almost US$1.2 billion, which was more than for the whole of 2011, according to Portugal’s ambassador to China.

In 2008, Portuguese exports to China were €50 million. By 2012, this had increased to around €230m (FT)

In the first quarter of 2012, Portugal say an 11.6% increase in exports and a 3.3% drop in imports. This narrowed the trade gap to €2.68bn, 38%t lower than the €4.35bn recorded a year earlier.. This (FT) article shows how Portugal has achieved success in innovation and focusing on higher value added exports (such as luxury/designer toilet paper – never knew there was such a thing!)

Conclusion

In conclusion, the reduction in the Portugal current account is good news. However, the reduction is due to both positive and negative factors. The negative factors involve the sharp drop in consumer spending as a result of the deep recession. Mass unemployment of 16% is a very high price to pay for a drop in the trade deficit.

On a more positive note, there are signs that Portuguese exports are showing signs of growth and capturing new markets. The improvement in unit labour costs is encouraging but may be masked by the fact public sector wages have been cut, so Portugal may still have a long way to go in restoring competitiveness and it is not clear that modest growth in exports can compensate for the dramatic drop in domestic demand.

Related

1 thought on “How Did Portugal Reduce Current Account Deficit?”

Comments are closed.