A fixed exchange rate occurs when a country keeps the value of its currency at a certain level against another currency. Often countries join a semi-fixed exchange rate, where the currency can fluctuate within a small target level. For example, the European Exchange Rate Mechanism ERM was a semi-fixed exchange rate system.

Summary

- The idea of fixed exchange rates is that they reduce uncertainty over fluctuations in the currency; this gives greater confidence for firms to invest (especially exporters).

- However, critics argue that fixed exchange rates can be difficult to maintain – it may require high-interest rates and deflating the economy – just to keep the currency at its target. Also, currencies can be forced out of the fixed exchange rate – undermining its supposed benefits.

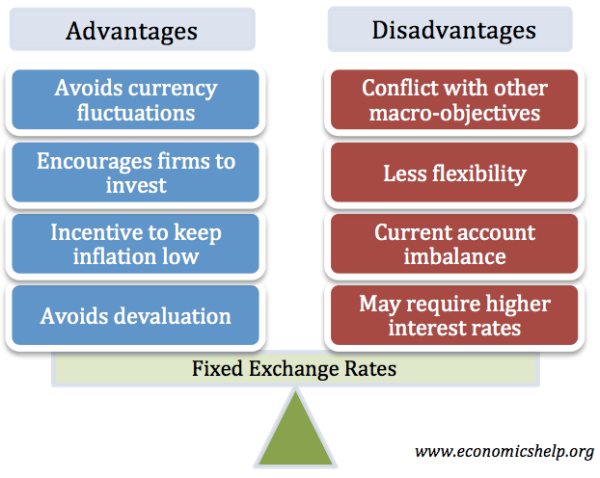

Advantages of fixed exchange rates

1. Avoid currency fluctuations. If the value of currencies fluctuates, significantly this can cause problems for firms engaged in trade.

- For example, if a firm is exporting, a rapid appreciation in Sterling would make its exports uncompetitive and therefore may go out of business.

- If a firm relies on imported raw materials, a devaluation would increase the costs of imports and would reduce profitability.

2. Stability encourages investment. The uncertainty of exchange rate fluctuations can reduce the incentive for firms to invest in export capacity. Some Japanese firms have said that the UK’s reluctance to join the Euro and provide a stable exchange rate makes the UK a less desirable place to invest. A fixed exchange rate provides greater certainty and encourages firms to invest.

3. Keep inflation low. Governments who allow their exchange rate to devalue may cause inflationary pressures to occur. Devaluation of a currency can cause inflation because AD increases, import prices increase and firms have less incentive to cut costs.

- AD increases (higher demand for exports), import prices increase, and firms have less incentive to cut costs.

- Import prices increase.

- Firms have less incentive to cut costs.

A fixed exchange rate, by contrast, means firms have an incentive to keep cutting costs to remain competitive.

It is hoped a fixed exchange rate will reduce inflationary expectations.

4. Current account. A rapid appreciation in the exchange rate will badly affect manufacturing firms who export; this may also cause a worsening of the current account.

Disadvantages of fixed exchange rates

1. Conflict with other macroeconomic objectives.

To maintain a fixed level of the exchange rate may conflict with other macroeconomic objectives.

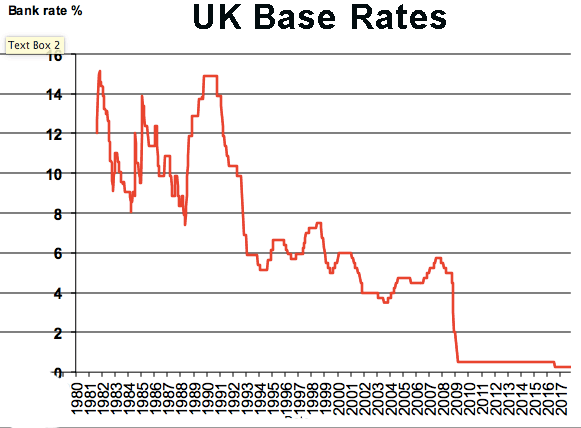

- If a currency is under pressure and falling – the most effective way to increase the value of a currency is to raise interest rates. This will increase hot money flows and also reduce inflationary pressures. However higher interest rates will cause lower aggregate demand (AD) and lower economic growth, If the economy is growing slowly this may cause a recession and rising unemployment.

2. Less flexibility. In a fixed exchange rate, it is difficult to respond to temporary shocks. For example, if the price of oil increases, a country which is a net oil importer will see a deterioration in the current account balance of payments. But in a fixed exchange rate, there is no ability to devalue and reduce current account deficit.

3. Join at the wrong rate. It is difficult to know the right rate to join at. If the rate is too high, it will make exports uncompetitive. If it is too low, it could cause inflation. In the late 1980s, the UK chancellor, Nigel Lawson tried to shadow the DM and keep Sterling low; this led to a rise in inflation. In 1990, the UK joined the ERM, but the rate proved too high and trying to keep the value of the Pound high led to high-interest rates and the recession of 1991/92.

4. Require higher interest rates.

If the currency is falling below the exchange rate floor, the government may be forced to put up interest rates – even if this is unsuitable for the economy. For example, in 1992, the government was trying to keep Pound Sterling in the ERM, but the value was falling. Therefore, the government increased interest rates to 15% – but this was very damaging – causing mortgage defaults and the recession of 1991/92

5. Current account imbalances. Fixed exchange rates can lead to current account imbalances. For example, an overvalued exchange rate could cause a current account deficit. See: problems of an overvalued exchange rate.

6. Difficulty in keeping the value of the currency – If a currency is falling below its band the government will have to intervene. It can do this by buying sterling but this is only a short-term measure. If membership of a fixed exchange rate is short-lived in defeats the purpose and rather than gradual changes in the exchange rate, there is added uncertainty and speculation about the exchange rate.

7. Encourage speculative attacks. Some argue a fixed exchange rate would encourage stability and therefore there is no point investors ‘speculating against the currency’ However, speculators know if the currency is fundamentally misvalued, then the government may have to leave exchange rate altogether.

Related

- Problems of Euro – problems of the single currency

- Factors which influence exchange rates

- Exchange rate mechanism (ERM) crisis 1992.

- Policy Trilemma – why fixed exchange rates are one out of possible three targets of monetary policy.