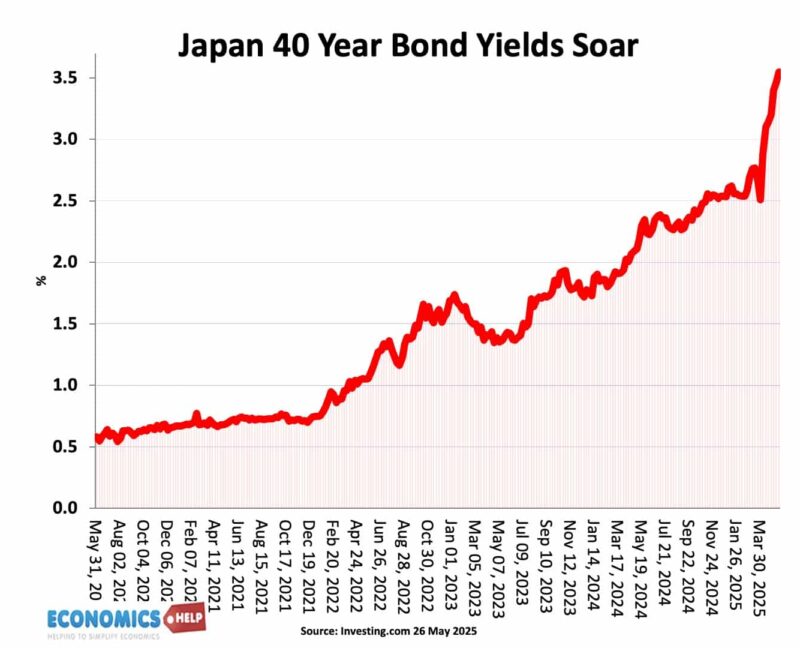

For decades, Japan had artificially low interest rates, but since 2022, bond yields have risen, and the pace of increase is getting steeper.

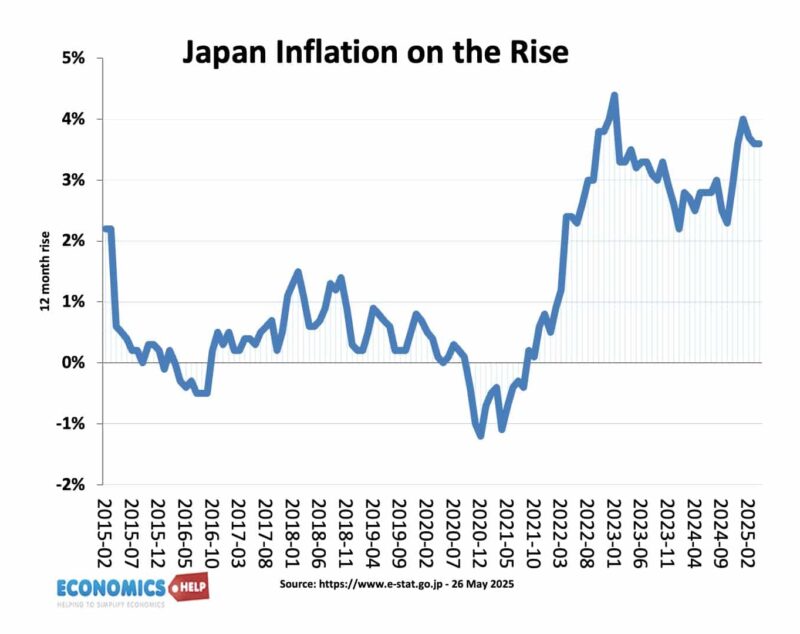

And when you have debt at 270% of GDP, this is a big deal. Japan has a double crisis – rising debt and a collapse in the working population. With inflation going up and the economy going into recession, it is no surprise that markets have become more reluctant to take on long-term Japanese debt.

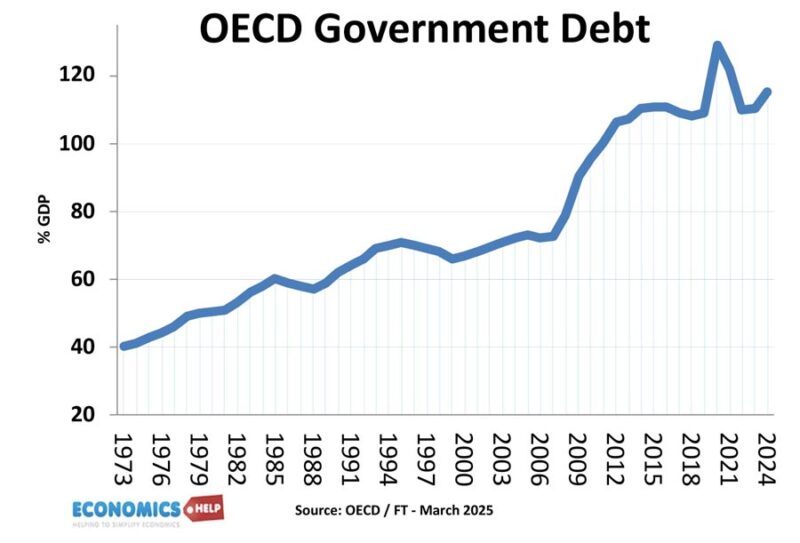

But Japan is not the only country, government debt has been rising across the world from 40% in 1973 to over 110% today.

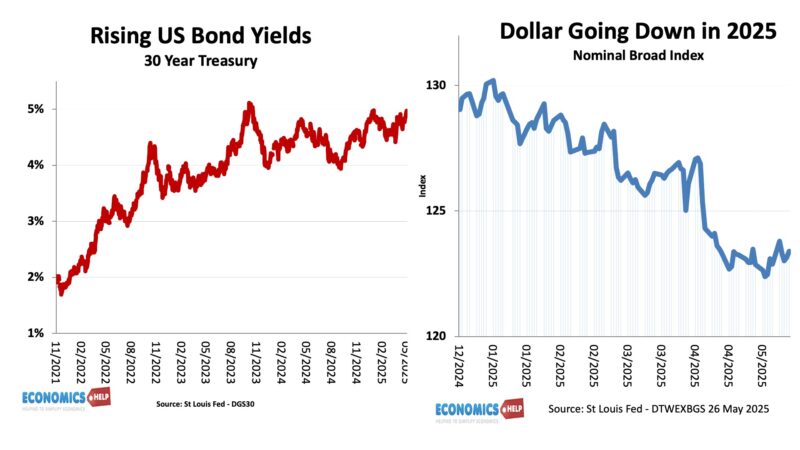

The world’s largest economy, the United States is having its own bond market meltdown, a worrying combination of surging debt, a falling dollar and markets losing confidence in the United States. For years, we lived in a world where there was basically zero risk premium for US debt, but that is changing and nearly every advanced country has seen higher bond yields in the past 30 days, what happens next? Adam Tooze, who wrote a definitive history of the 2008 financial crisis argues, “this scenario is more serious than 2008”

Japan

For decades, Japan had a problem with deflation. They tried fiscal stimulus, monetary stimulus, but nothing really worked. But recently, inflation has finally returned, but there’s no celebration because they have ended up with more inflation than they wanted and an unexpected shrinking of the economy. When inflation is close to zero, markets are relatively happy with low bond yields, but as inflation rises, investors need higher bond yields, otherwise inflation will reduce the real value of their investment. The other reason is that the Bank of Japan is reversing quantitative easing. In the 2000s, the government created huge quantities of money to buy its own debt. In fact, the government of Japan owns over 52% of its own debt, but the Bank of Japan is now struggling to sell this back onto the market. Markets are concerned about inflation, low growth, and demographic change.

Does it matter if bond yields rise?

Well firstly, as bond yields rise, the government need to pay more debt interest payments. Secondly, when bond yields rise sharply, it means holders of bonds see a fall in the value of the assets. A rise in 40-year bond yields from 1 to 4% means that someone who bought a Japanese 40-year bond in 2022, could lose 69% of their value. Remember when UK bond yields soared in the UK in September 2022, pension funds went into meltdown because they never anticipated such quick losses. In fact, the Truss era is a cautionary tale of the power of the bond market to bring down a government, or at least change economic policy.

It’s not end of world – yet

Now, before we get carried away with the idea the Japanese bond market is in meltdown, there are some points.

- Firstly, the Japanese government have gross liabilities of 270% of GDP, but they also have government assets of 192% of GDP. Net public liabilities are only 78% of GDP.

- Secondly, Japan could end quantitative tightening and if necessary, go back to money creation. As any good Modern Monetary Theorist will tell you, if you borrow in your own currency, you can’t go illiquid; you can always create as much money as you need to meet government debt. However, whilst this was an easy gig in the deflation period of the past two decades, now that inflation has returned, a big increase in the money supply is more problematic. the Bank of Japan won’t want to embark on monetary stimulus with inflation above target.

- Thirdly, Japanese government pension funds, have put huge quantities into the US bond market. In fact, Japan are the largest foreign holder of US bonds, with $1.13 trillion as of March 2025. They could always sell US treasuries and bring the money back to buying Japanese bonds. But, with Trump threatening a trade war with Japan. A massive Japanese sale of US bonds might not help them get the best trade deal…

US Bond Market

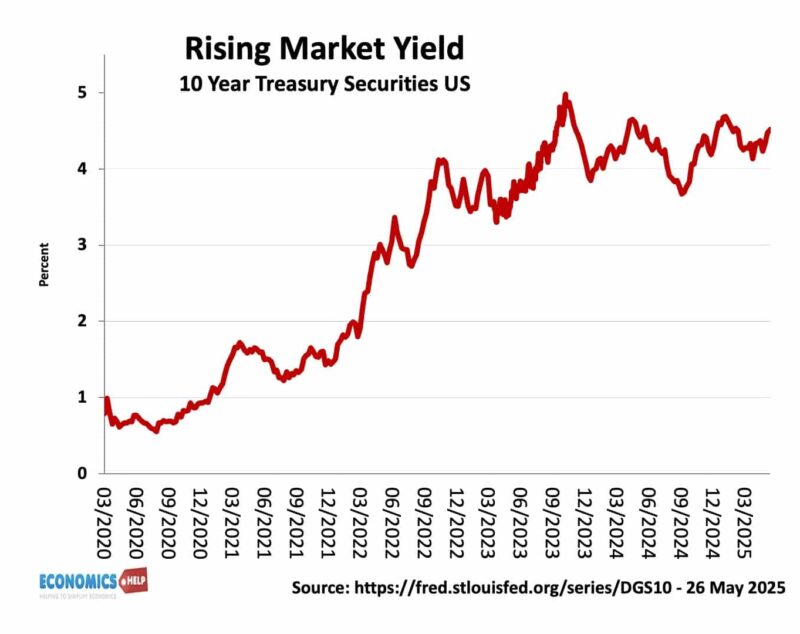

But that brings us on to the US bond market, which is arguably a much bigger problem. Japan is not alone in selling US treasuries. China and other countries have been quietly off-loading US bonds. The US has long relied on foreigners to buy its debt, it helped make US debt relatively cheaper to service. But the share of foreign holdings has fallen from 42% to 30%. And since the start of the year with all the tariff turmoil, foreign selling has continued and this is pushing up bond yields. The rise in US bonds primarily reflects a surge in uncertainty about the US economy.

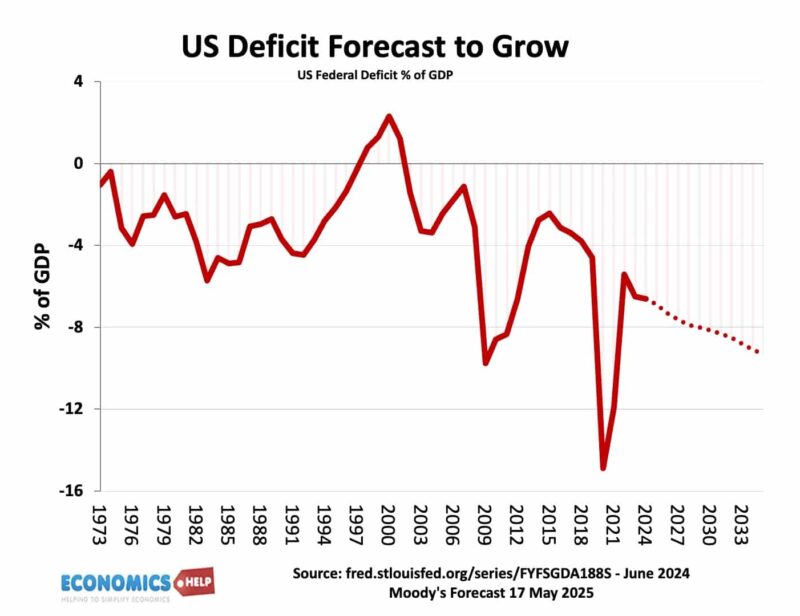

In particular, a ballooning budget deficit. Moody’s recently downgraded US debt on the grounds the budget deficit will rise to 9% of GDP by 2030, an eye-watering figure for peacetime. For the first time in generations, there is a genuine uncertainty about the reliability of US bonds. And the danger is that as bond yields rise it creates a vicious cycle. Bond yields rise, causing higher debt interest payments, causing higher debt, causing bond yields to rise. US debt interest payments totalled £881bn in 2024 – more than medicaid or national defence and it could take 22% of tax revenues by 2035. But, there is an added complication for the US, the dollar is sliding and is expected to continue to slide. The devaluation of the dollar means foreign holders of US bonds will lose out even more and this will only encourage them to sell US bonds. And as bond yields rise, it puts more downward pressure on the dollar.

Austerity or money printing?

When bond yields rise rapidly, the government can be faced with a difficult choice. Painful austerity, which leads to lower economic growth or resort to quantitative easing and create money which can cause inflation.

Now, if you borrow in a recession, this can help boost the growth rate and higher growth can help pay back debt. The problem the US, and many other countries, is that debt is rising, just as rates of economic growth are falling. This creates the dynamic that interest rates are becoming higher than growth rates. This is when debt becomes a problem,m meaning the burden of debt interest rises. It can be difficult to deal with this. Just ask Greece and Italy.

The problem is that the US tariff war, threatens the worst of both worlds, higher prices and lower economic growth. Independent studies suggest that the new tax cuts in recent US budget will do very little to boost economic growth and will be outweighed by the negative effects of tariffs.

Quick questions

Weren’t bond yields much higher in the late 1970s? Yes. That was a reflection of very high inflation of the 1970s rather than debt insolvency. In those days, debt as a share of GDP was much lower, and even with these bond yields, some investors lost out because inflation was higher than the bond yield they bought.

Is the US going bankrupt? On current economic policy, US debt is set to soar to over 180% of GDP, and the recent proposed tax cuts, will supercharge this. But, it is important to point out, this trajectory could easily be changed by not cutting taxes for the wealthy, collecting missing tax revenue or many other solutions. The US is a wealthy country, which could easily keep debt stable, with minimal pain, but it does requires the political will and markets are concerned this is not there.

Since the US borrows in $ is it not in a privileged position? To some extent, yes. Many emerging economies get into debt difficulties by borrowing in foreign currency, e.g. Argentina borrowed in $, so when its currency fell, it couldn’t pay back the dollar debt. This led to several defaults and as a consequence more expensive to borrow in the future. The US can always print dollars to pay off its debt. But, this would have cost of inflation and devalue the dollar further. It would make countries in the future less willing to buy US debt in the future.

What else could go wrong? The surge in US bond yields and higher interest rates could really cause problems in US housing market. US House prices are overvalued, really expensive, many households have very small margins, higher rates could cause big fall in house prices, which almost always cause recessions.

Shouldn’t the Fed just cut rates to reduce bond yields? It’s a tricky dilemma. Lower interest rates would help reduce bond yields, but inflation is still a bit above target, and consumers have high inflation expectations, so interest rate cuts could worsen inflation, which will go up because of tariffs. Also, the rise in bond yields is primarily due to uncertainty and rising deficits, so it’s not guaranteed cutting interest rates would stabilise bond yields, especially if markets think it will increase inflation and there is no plan to reduce the deficit.

Is it all going to end in meltdown? No, don’t forget Greece had debt of 250% of GDP in 2019, and looked like a hopeless basket case. But, since then, the economy has had something of a turnaround, and debt has fallen. If Greece can turn around a collapsing economy, the US can easily avoid dire predictions.

Related

Sources

https://www.ft.com/content/c2dd8918-d6c1-4c60-b0d8-4959e287b11a

https://www.dw.com/en/japans-economy-shrinks-more-than-expected/a-72561544

https://www.stlouisfed.org/on-the-economy/2025/apr/what-is-behind-japan-high-government-debt

https://www.ft.com/content/fdad7e0b-aa23-4b7b-8f1a-fc1d48468631