Readers Question. The fear of rising interest rate is spooking markets in USA. So is it because of tapering? – Less and less buying of securities. Or the rise of inflation is expected. Or is it the economy picking up?

Firstly, it is important to keep markets in perspective.

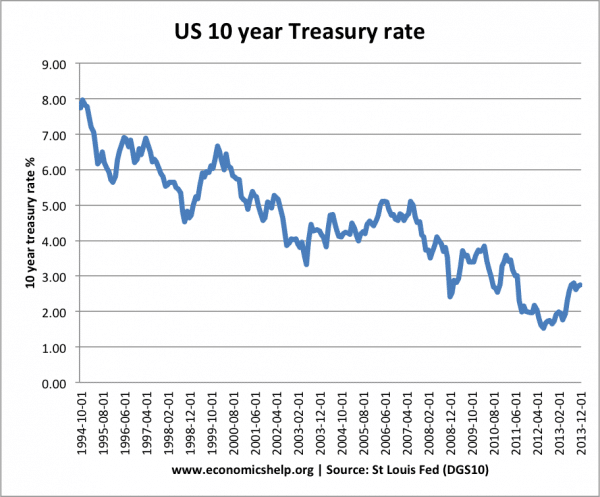

On Jan 24, the U.S. 10-year yield fell six basis points, or 0.06 percentage point, to 2.72 percent, after sliding to 2.70 percent, the lowest since Nov. 26.

Compared to ‘normal’ interest rates, US bond yields are still very low.

Definitely tapering has caused an increase in yields, and with further tapering, we can expect a further rise in bond yields. See tapering and effect on interest rates.

But, this rise in bond yields is also quite normal at this stage of the economic cycle.

However:

- Part of the increase in bond yields reflects an improved economic outlook, with US seeing better prospects for economic growth.

- Recently there has been greater concern about emerging markets. Signs of manufacturing decline in China have led to poor performance in Asian stock markets. Concerns about emerging markets have caused people to buy more US bonds – which is still seen as a relative safe haven, compared to many emerging markets.

- US debt is large, but I don’t think markets feel it is unmanageable. The US deficit has fallen significantly in the past two years. The deficit now stands close to 4%. Now that the possibility of political self-destruction has receded, the outlook for government debt management is reasonable.

- US inflation is still very low (1.5%) There is also little prospect of inflationary pressures on the horizon. There remains slack in the labour market putting downward pressure on wages. Global inflation is low and the US recovery is not exceeding supply constraints. All these factors will help keep inflation low.

Related