Readers Question: As the FED is talking about tapering and at the same time keeping interest rate low. How can they both go together? Tapering will raise yield as bond prices go down in absence of any freak buying. And interest rate will chase yield this causes interest rate to climb up.

Fed Tapering means that the Federal Reserve will begin to stop buying bonds, and no longer continue to create money and buy bonds. This tapering could also be seen as a preliminary to reversing quantitative easing and selling the bonds that have been accumulated.

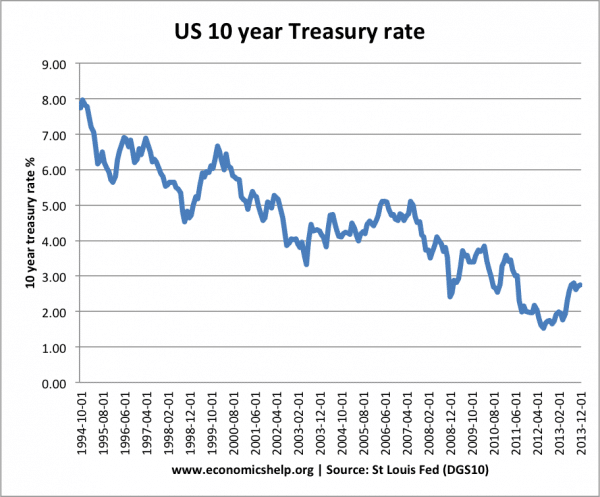

Even a suggestion they begin to taper did cause bond yields to rise. See: Why Fed Tapering causes bond yields to rise

Different interest rates

It is important to bear in mind there are different interest rates in the economy.

- Discount rate – set by Federal Reserve

- Federal Funds rate – short term interbank lending rate, influenced by open market operations of the Fed.

- Long term bond yields. – Effective interest rate on 10 year Treasury bonds.

Discount Rate

The Federal Reserve can change the discount rate (see: Federal Reserve discount rate). This is the rate that the Fed charges commercial banks to borrow directly from the Federal Reserve. This is a short-term interest rate because commercial banks borrow from the Federal Reserve to meet temporary shortfalls in their cash flow.

The Federal Reserve discount rate is currently 0.75% (link)

This Federal discount rate does influence other interest rates in the economy. If commercial banks find the discount rate has increased, then they are likely to increase their interest rates on loans to consumers. If commercial banks see the discount rate has increased, they tend to increase mortgage rates. Therefore, the Federal Reserve can influence other bank rates.

It is a similar situation in the UK. The Bank of England change the base rate. This base rate usually has a strong influence on other bank rates in the economy.

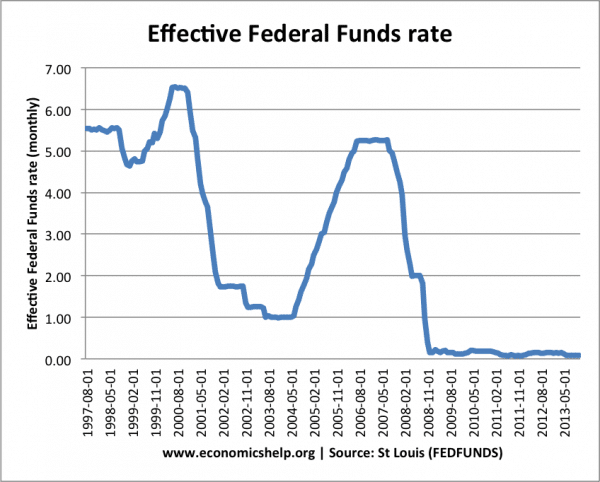

Effective federal funds rate

Another important interest rate in the economy is the effective Federal Funds Rate – see FEDFUNDS. This is the short-term inter bank lending rate. It is influenced by the Fed discount rate, but also the willingness of banks to lend to each other. It is also, influence by the Federal Reserve’s actions in open market operations. The FED has a target for the Federal Funds rate. When the Fed starts to sell bonds, you would expect this to depress the price of bonds and push up the Federal Funds Rate. With the Fed currently buying bonds, this has pushed up bond valued and decreased interest rates.

Long term bond yields

If the Federal Reserve change the discount rate, there is no direct effect on bond yields. Bond yields tend to be influenced by a variety of factors, such as:

- Economic growth

- Inflation

- Confidence

- Level of private sector saving

- Bond purchases by Central Bank

See: Factors affecting bond yields for more detail.

Therefore, when the Federal Reserve begin to taper, we can expect quite a significant rise in bond yields. However, rising bond yields doesn’t mean they have to increase the discount rate. They are separate.

How much will bond yields rise?

There is an interesting article here – how high can long term rates go?, which suggests that bond yields are closely related to nominal GDP growth. When the Fed begins tapering, we are likely to see long term bond yields (10 year) rise to around 3.5%. When the Fed return monetary policy to normal, bond yields could rise to 4.5% – this is what historical trends suggest. However, there will be other factors influencing bond yields as well as economic growth.

Why are long term bond yields rising faster than short term Federal Funds Rate?

Since August, the short term Federal Funds rate has remained at 0, whilst the long term bond yield has increased to 2.7%. This suggests banks are still awash with liquidity, but bond investors are more nervous about the prospect of future falling bond yields.

To answer the question – tapering, but keeping interest rates low.

The Fed can stop buying more bonds, but still keep the discount rate the same. The discount rate is not directly affected by bond purchases and bond sales.

However, when the Fed stops buying bonds, you would expect interest rates influenced by open market operations to rise.

This includes the short-term Federal Fund rate and long-term bond rates.

So far, expectations of bond tapering have caused a rise in long-term bond rates, but not the short-term Federal Funds rate.

Related

1 thought on “Tapering and the effect on interest rates”

Comments are closed.