A look at the pros and cons of Scottish independence from an economic perspective.

It is said you can’t put a price on freedom and cultural identity. But, when it comes to independence, economics seems to be one of the biggest factors to sway voters in Scotland. When asked in a poll, only 21% favour Scottish Independence if it leaves them £500 a year worse off. Only 24% favour retaining union with Britain if it leaves them worse off. (Economist)

Benefits of Scottish Independence

- Oil and Gas Reserves in the North Sea are potentially a lucrative source of tax revenue and this has become more profitable with higher oil prices. According to the Scottish government, Scotland represents 8.4 per cent of the UK’s total population, but they generate 9.4 per cent of its annual revenues in tax — equivalent to £1,000 extra per person. (link) However, with dwindling reserves, income from oil and gas may dry up in future years.

- Independence may give freedom to set low corporation tax rate and attract business from overseas.

- Reform of tax and welfare system. Crawford Beveridge, chairman of the Scottish Fiscal Commission, claims that smaller countries, such as Ireland and New Zealand have considerable success in collecting tax. He argues an independent Scotland could scrap 1,000 tax exemptions and make the tax system simpler and encourage greater work incentives. “The UK tax system is complex and costly, and does not fully reflect the unique characteristics and needs of Scotland. There is considerable room for improvement in its design and operation.”

- Some argue that independence might increase self-confidence of the country, attracting more business and tourism. It may enable Scotland to have a stronger brand loyalty for its traditional exports like whisky and tartan kilts.

Costs of Scottish Independence

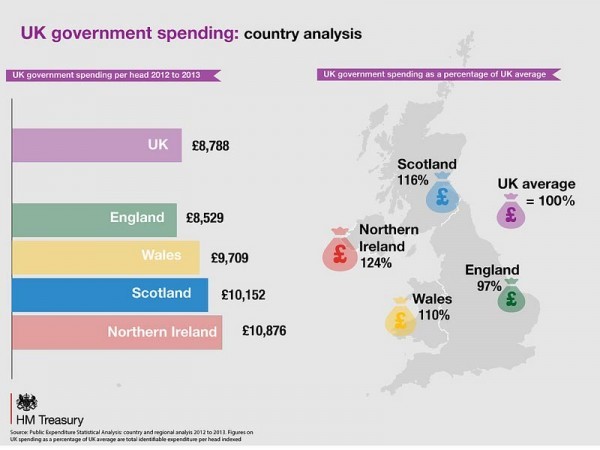

- Would lose ‘subsidy’ from Westminster. Scottish people get around £10,212 spent on them every year by the UK government, compared with around £8,588 — £1,624 less — for people in England. Independence may make it more difficult to maintain this spending. Independence may end some of the generous subsidies in Scotland for university education, trains and health care. However, this Scottish ‘subsidy’ is controversial as oil and gas revenues help give a Scotland bigger (£1,000) per capita tax revenue (New Statesman)

- Debt Levels. After independence, UK debt levels would be share on a per capita or per GDP level. This would leave Scotland with a national debt of £80bn and growing. Although debt would be split according to the respective GDP, the recent experience of smaller countries on the Eurozone periphery mean that Scotland may struggle to meet debt payments

- Higher administration costs for business who now have to do two sets of accounts for operations in Scotland and England.

- Lower reserves for crisis. After the credit crisis, the UK government had to bail out the Royal Bank of Scotland and HBOS with close to £70bn. A small independent Scotland would have struggled to raise this finance. It would have led to a similar situation to Ireland, where the bank bailout led to a government bailout.

Problems of Joining the Euro.

An independent Scotland would want to join the EU; but other countries like Spain may raise objections because they fear their own independence movements (e.g. Catalonia in Spain) Also if Scotland wish to join the EU, it is likely to involve joining the Euro. Whearas once, joining the Euro seemed to be very attractive, there is now a great reluctance given the problems faced by peripheral Eurozone economies like Greece and Portugal. See: Problems of Euro for more details.

- Higher bond yields. In the Euro, there is in theory no lender of last resort (though ECB have reluctantly started to buy bonds). But, it may prove the case that markets would become more reluctant to be buying Scottish bonds, if they fear greater liquidity problems. Debt levels would be much more closely scrutinised and this could lead to higher interest payments. (See: EU bond yields)

- Debt Spiral. The big concern is that if the Scottish economy struggled, there is a greater danger of ending up like Greece, Spain and Portugal with rising bond yields and greater pressure for fiscal austerity, leading to a negative debt spiral.

- The irony is that joining the Euro could severely curtail the fiscal freedom on an independent Scotland. It may find there is no room for Keynesian expansion in recessions or generous welfare payments.

- Exchange Rates could be wrong. In a fixed exchange rate of the Euro, Scottish exports could become uncompetitive, as has happened in many European periphery countries..

- Inconvenience of currency exchange with England

Those supporting Scottish independence argue they will try to maintain the Pound Sterling. If this is retained, it would make independence a smoother transition. However, if Scotland joins the EU as a new nation it may be expected to have the Euro.

Problems of being in a single currency with England (Pound)

If Scotland is able to negotiate continued use of the Pound Sterling. It will effectively be entering into a Single Currency with the rest of the UK. This will involve a common monetary policy. Interest rates will still be set by the Bank of England. In that case, an independent Scotland will stay face UK monetary policy.

The experience of the Euro, shows monetary union requires a high degree of economic and fiscal union to be successful. If the Scottish economy diverges from the English economy after independence, it may face a monetary policy which is unsuitable for the Scottish economy. It could also find its exchange rate becoming uncompetitive.

However, it is worth pointing out one difference between UK monetary union and the Euro. – There will be greater geographical mobility between England and Scotland than say between Germany and Greece. But, Scottish independence will give little freedom in terms of monetary policy.

What Would Stay the Same?

If Scotland was able to retain the UK’s opt-out from the Euro, many things could stay fairly similar. Presumably, there would be no new trade or custom barriers. For many people, things would go on as they were before.

How Would UK be Affected?

The UK could lose 80% of its oil and gas revenues. It would have less energy security. This would leave a gap in public finances, but it is a relatively small % and has been declining anyway. The UK may also become a relatively smaller player in the EU.

External links

p.s. (I should declare a vested interest as prominent supporter of the Yorkshire Independence Movement. I’ll be writing on the economic benefits of re-opening Yorkshire coal mines and developing the ferret export market in the near future…)

Please take a look at my blog http://thinkaboutecon.blogspot.co.uk/

rar rar rar rar rar rar rar rar rar rar rar rar rar

Joseph Stieglitz,

Mark Blythe,

Richard Murphy.

These are respectable economists talking about real economic models. This writer is just pulling facts out of thin air.